After the yield on the benchmark 10-year Treasury bill fell, sending the dollar lower, SILVER and GOLD rose following two sessions of decline. A weaker dollar could allow these precious metals to start a new upward trend after remaining under pressure. In this analysis, we will focus on three intervals to find out the perspective of the SILVER, since this precious metal could outperform GOLD.

Weekly interval :

A stronger dollar during the second half of March led SILVER prices to reach a two months low. Prices found support on the weekly cloud at 23,50$ while RSI bounced off the 50 level (yellow circle). Since then prices kept rising and the next weekly resistance level can be found on the Kijun-line (blue line) at 26$. This resistance is also reinforced by the Tenkan-line (red line) and could be a key level to break. If bulls manage to take prices higher, the door will be open to the next resistance at 27$.

SILVER, W1 interval, source : xStation 5

Daily interval :

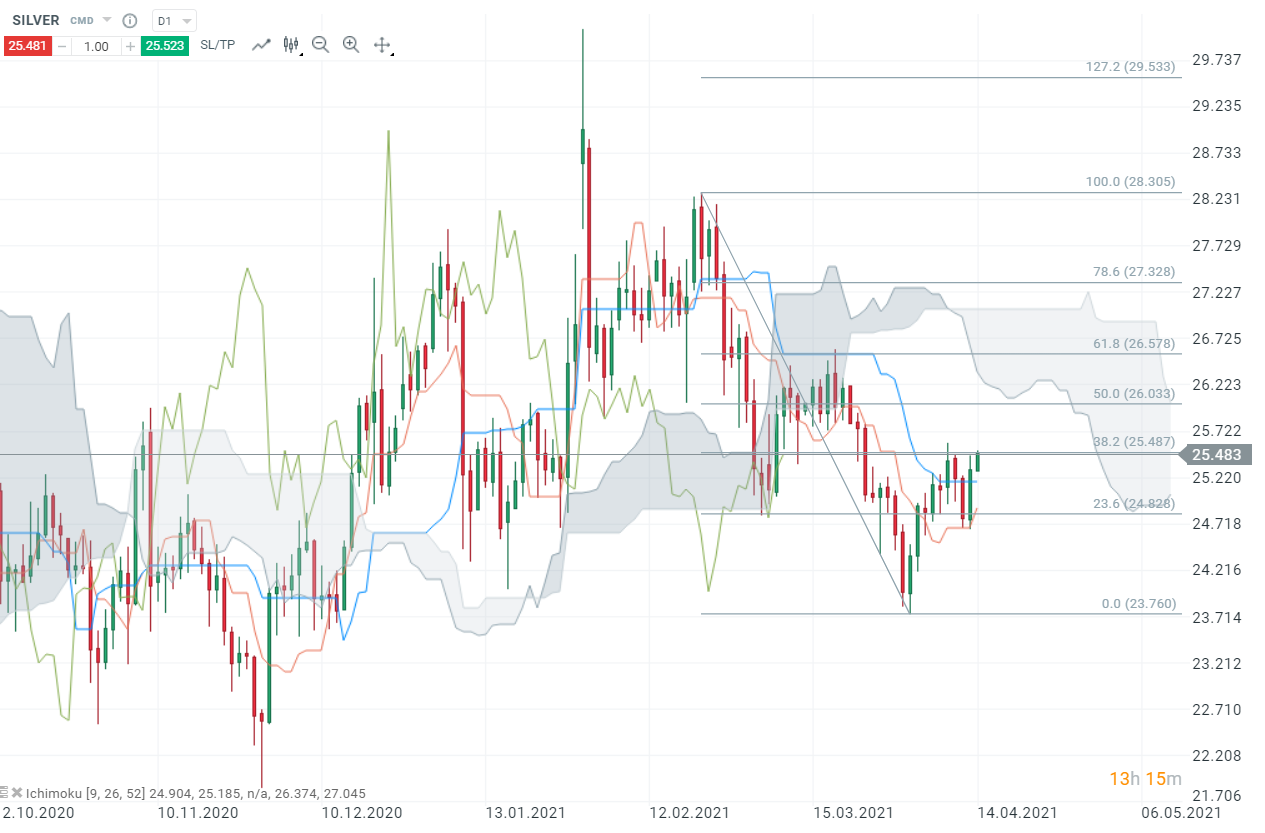

On a daily basis, after a decline, prices found support on the Tenkan-line (red line) and the 23,6% retracement. Prices are currently trying to break above the 38,2% retracement. Breaking above this level may announce an upward move through the daily Ichimoku cloud to the 61,8% retracement. Keep in mind that the cloud acts as a support or resistance and may halt the upward move. Breaking the upper limit of the cloud reinforced by the 78,6% retracement at 27,30$ would be a strong bullish signal.

SILVER, D1 interval, source : xStation 5

H4 interval :

On the H4 interval, one may notice as the Ichimoku cloud worked as a support, allowing prices to rise to the next 28,2 % retracement. If the aforementioned level is broken, price could rise to next 50% retracement at 26$, near the lower limit of the daily Ichimoku cloud and weekly Tenkan-line. If any declines occur, the next support will be the H4 cloud at 25,20$. A key support can be found at 24,50 and breaking this level would be a bearish Ichimoku signal.

SILVER, H4 interval, source : xStation 5

Réda Aboutika, XTB France

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉