In times of market turbulence, it is natural for investors to seek safe assets where they can hold their capital until trends and sentiment calm down and become clear.

Recently, investors have felt a shortage of safe assets. The unstable U.S. policy shakes confidence in the dollar and American bonds. Precious metals have experienced rare volatility, and Bitcoin has lost over 30% of its value in just the last two months.

Some point to the superiority of investing in real estate during times of economic and market unrest. This view is often lacking fundamental justification, but it is not the biggest problem. Market inertia, capital requirements, and freezing significant sums are not for everyone.

However, what if there is a way to invest in real estate through the capital market that allows to reap most its benefits without having to worry about most of its risks or downsides? Such possibilities are offered by so-called REITs. However, not all REITs are equal; the key to sucess today is the market segment. Office properties suffer from poor returns and debt due to oversupply. Residential properties, contrary to popular belief, are very susceptible to economic cycles, and widespread speculative bubbles maintained by local laws expose investors to the risk of large corrections.

A segment of the real estate market that is largely free from these problems is the unassuming but extremely lucrative industrial real estate market. The days when companies owned infrastructure and buildings are over. Today, companies need to be agile and adaptable; they cannot be permanently tied to a piece of land. Hence, the increasingly well-developed market of industrial REITs.

The advantages of such instruments and this sector are:

- Significantly higher occupancy rates. Industrial REITs are much more efficient in organizing tenants.

- Smaller price fluctuations; industrial properties are more specialized and of better quality.

- Greater opportunities for rent increases; large economic entities are in a better position than consumers whose wages do not keep up with price increases.

- Less sensitivity to regulations; lack of social pressure and significant distance from densely populated areas reduce pressure on the government to regulate the industry.

- Contracts are usually signed for many years in advance, creating a stable cash flow.

Who are the market leaders, what are the prospects for such entities, and what is their business model?

One of the most promising choices in this segment is STAG Industrial.

- The company boasts an occupancy rate of over 95%.

- The customer retention rate is as high as 75%.

- The lease increase rate is over 20%.

- Unprecedented diversification; the largest client (Amazon) accounts for only 2.8% of revenues.

- Revenue growth year-over-year of 9%.

- 14 years of dividend growth, with a coverage ratio of 60%.

- Recent debt upgrade by Moody’s.

- The company pays dividends not annually or quarterly but monthly.

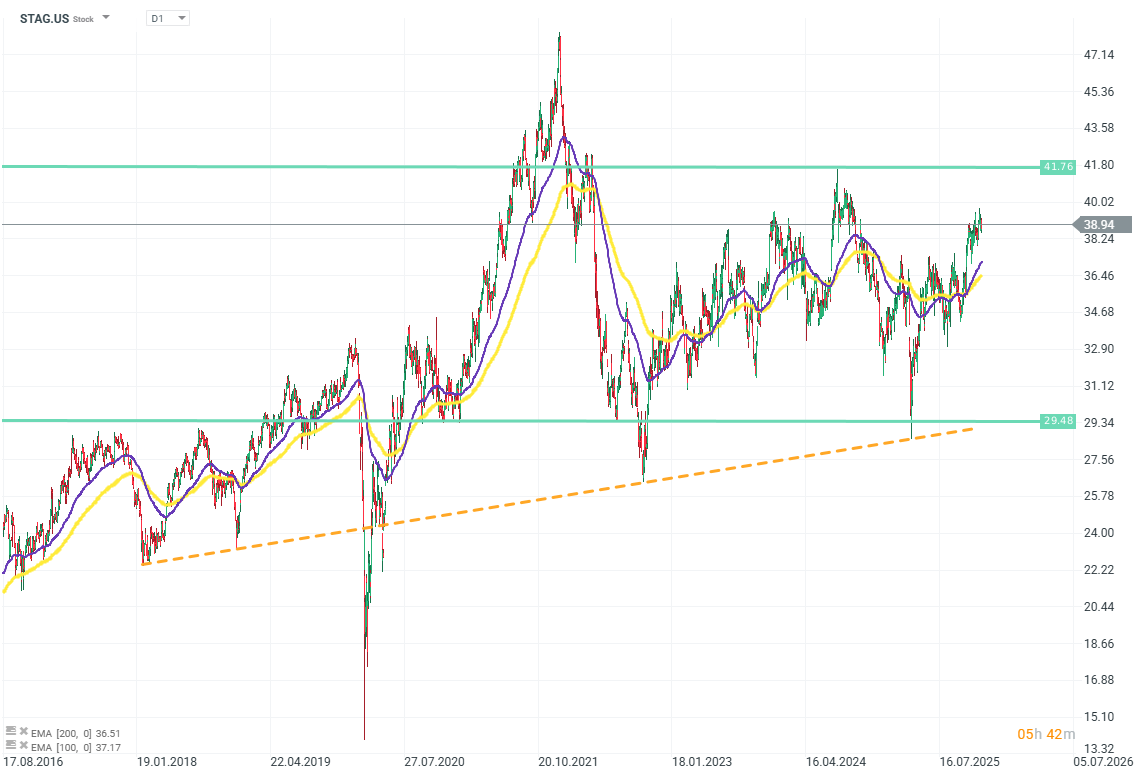

STAG Industrial (STAG.US - D1)

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China