The ISM report was the most anticipated data release today and it brought the mix that is not exactly ideal.

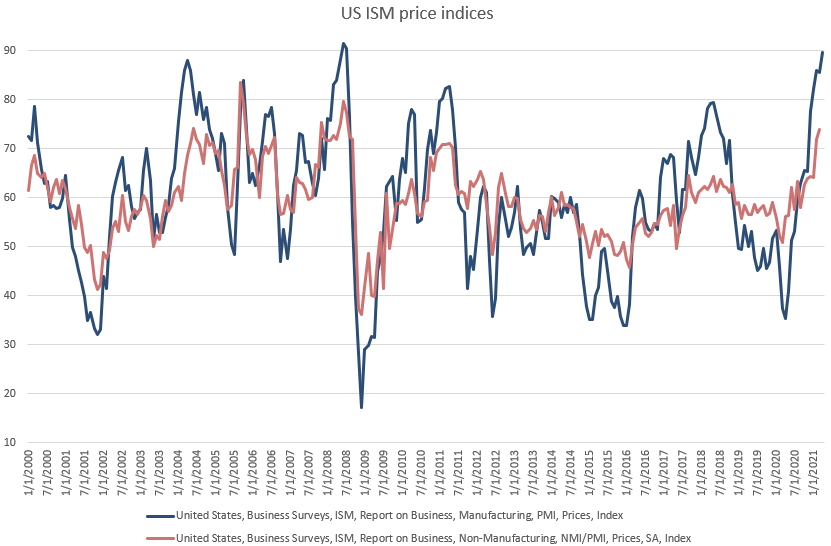

The headline number slowed from 64.7 in March to 60.7 in April on the back of slower growth of orders, production and employment. To be sure, this is still very high reading, representing booming manufacturing but supply constraints are more and more clear. We can see that in inventories subindex dropping below 50 (to 46.5) and customer’s inventories dropping to a very low level of 28.4! This obviously goes along with price pressures and the prices subindex soared to 89.6 pts.

Source: Macrobond, XTB Research

Source: Macrobond, XTB Research

The price component was higher only 3 times in its history:

- In the middle of 2008 when OIL was at $147

- 2 times in the 70’s – and we know how it ended

The mix shows that supply side of the economy is already constraining growth and with strong consumer demand might also lead to inflationary pressures.

Ironically bonds… soared on the news fueling price recovery on Gold and Silver and driving US500 close to 4200 points.

Strange reaction on the bond market propels Gold higher. This is another test of $1800 after a failed attempt in April.

Strange reaction on the bond market propels Gold higher. This is another test of $1800 after a failed attempt in April.

Fed's Bostic and Hammack comment the US monetary policy 🔍Divided Fed?

Scott Bessent sums up the US trade deal with China🗽What will change?

CHN.cash under pressure despite positive Trump remarks 🚩

Fed members comment on US economy 🗽US dollar gains