- What’s behind the strong earnings?

- Does investment banking indicate the direction of the markets?

- What are the dangers of excessive capital concentration?

- What’s behind the strong earnings?

- Does investment banking indicate the direction of the markets?

- What are the dangers of excessive capital concentration?

BlackRock, a well-known and sometimes controversial giant in the investment and asset-management industry, has published its results. Beating already optimistic investor expectations has pushed the company’s valuation close to all-time highs.

BlackRock’s 2025 earnings, however, are more than just a successful year-end for the world’s largest asset manager. They provide a reference point for understanding how the centre of gravity in financial markets and the economy is shifting: where growth is concentrating, what is driving strong performance, and why an increasing part of the economy is starting to operate according to the logic of wealthy clients rather than the mass market.

BlackRock ended the year with assets under management exceeding $14 trillion. EPS for Q4 2025 exceeded investor expectations by 5%, coming in at $13.16, while revenue reached a round $7 billion versus expectations of $6.75 billion.

What might superficially be a cause for concern is a year-on-year, decline in net revenue of more than 30%. This is, however, a signal of growth rather than deteriorating operational metrics. The company is benefiting from the ongoing M&A boom and has itself acquired a number of platforms and investment firms, which improves its growth outlook but puts short-term pressure on profitability.

BLK.US (D1)

Source: xStation5

What matters most, however, is not the numbers themselves but their composition. Record fund inflows, rapid growth in the wealth-management market, and the expansion of offerings aimed at affluent individual clients show that a business model based on scale, data, and access to capital is gaining an advantage that is effectively impossible to compete with.

Particularly noteworthy is the shift in growth toward higher-margin products. Private credit funds, trading infrastructure, and active strategies sold in fund form allow BlackRock to partly escape the long-standing pressure to cut fees in passive management.

Investment banking beats commercial banking

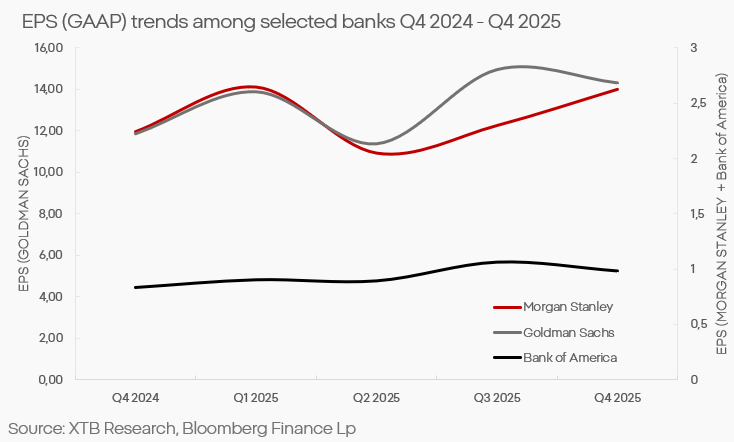

Where can we see the systemic turn in the economy and markets mentioned above? Both Goldman Sachs and Morgan Stanley have shown relative resilience in recent quarters, and in some areas, a clear rebound. Investment banking, asset management, and services for affluent private clients have performed better than traditional deposit-and-loan banking.

The contrast with commercial banks is striking. Margins that not long ago benefited from high interest rates are starting to shrink. At the same time, credit risk is rising markedly among customers with lower financial capacity. These factors mean that banks built around the mass-market customer are lagging behind.

Investment banks operate in a different world. Their revenues depend more on market activity, advisory services, securities issuance, and wealth management. Wealthy clients and institutions benefit from the “wealth effect”: asset valuations inflate, corporate margins rise, and lower interest rates enable ever larger and increasingly risky investments.

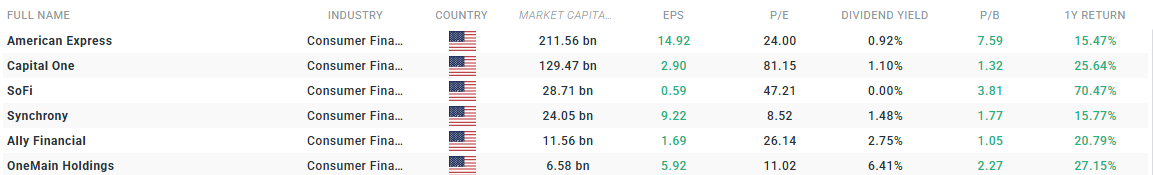

Top 6 (Market cap) Capital Markets Companies, average return ~34% Source: xStation5

Top 6 (Market cap) Consumer Finance Companies, average return ~28% Source: xStation5

The sector divergence in results is a consequence of an increasingly extreme shift and concentration of resources in the economy. A growing share of financial assets is held by a narrow group of entities and households. This group is now generating not only the vast majority of investment demand but increasingly consumer demand as well—something also visible in the results of companies outside the financial sector.

The race for affluent customers

A textbook example is airlines. For years, they competed on price and volume; now they are increasingly shifting their business model toward maximizing revenue per passenger. Premium segments, loyalty programs, and the sale of ancillary services now determine the profitability of entire fleets.

Not all sectors, however, can adapt to this logic. Commercial real estate depends on real economic activity and demand from businesses. Office-building owners are stuck in a macroeconomic trap of remote work, unprecedented employment cuts, and offshoring. The commercial real-estate sector remains a millstone for many smaller banks, which will only deepen the gap between players in the industry.

Low-margin retail also has little room to “select” customers or raise prices without losing volume. Despite the inflation surge—which the sector used to increase not only profits but also margins—those margins proved temporary. Today many companies in this sector are finding it increasingly difficult to deliver results.

It is precisely in these sectors that the dissonance between good macroeconomic data and weaker conditions in the real economy shows up fastest. Financial indices rise while a large part of business operates under stagnation or recession conditions.

Capital concentration and systemic risk

Structural capital accumulation leads to concentration that increasingly distorts macroeconomic data. Growth in financial assets and in the profits of institutions serving wealthy clients does not have to translate into broad-based economic growth; more often than not, it produces the opposite tendency. At the same time, concentrating investment decisions in the hands of a few global players raises systemic risks to unacceptable levels. This is especially important given the growing role of “private” markets, which control an ever larger share of global assets, have a much more aggressive risk profile, and at the same time lack regulatory oversight.

A two-speed market

The results of BlackRock and the investment banks are now a barometer of the financial system’s condition and show the direction in which the market and the economy are heading. The affluent part of society and institutional investors have concentrated capital to a degree that motivates them to seek increasingly exotic assets, increases risk tolerance, and distorts the perception of risk.

Companies unwilling or unable to pivot toward high-margin services for affluent customers suffer from declining demand and investment, creating a self-reinforcing spiral. At the same time, distorted data on consumption and demand in the economy feed models lacking nuance and cause monetary policymakers to operate with an ever greater disconnect from real economic conditions—amplifying risk.

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning