Lyft (LYFT.US) stock fell over 3.0% on Monday after UBS downgraded the ride-hailing company to neutral from buy as its driver survey pointed that drivers prefer its biggest competitor Uber.

UBS analysts are concerned whether Lyft will be able to match the revenue growth of its competition in an environment of slowing economic growth and a weaker active-rider environment.

According to FactSet, from 40 analysts who cover the company, 58% (23) are bullish, one is bearish and 40% are neutral. In comparison, from 45 analysts which cover UBER, 91% (41) are bullish, while the other four are neutral.

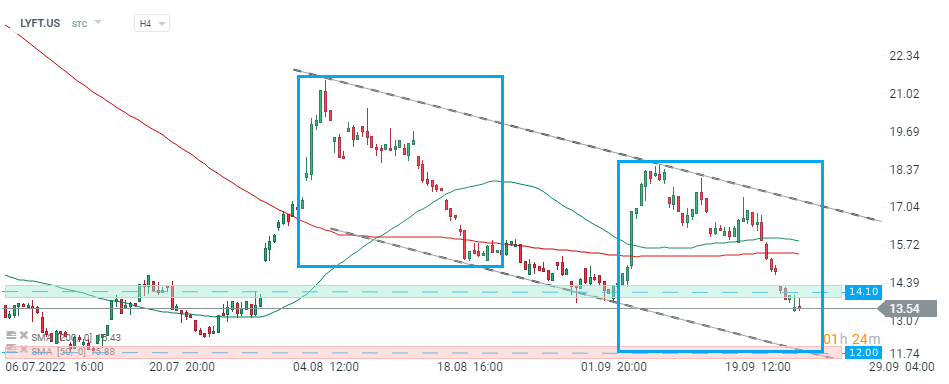

Lyft (LYFT.US) stock price plunged over 36.0% from August 2022 high and today broke below major support at $14.10 which is marked with previous price reactions. If current sentiment prevails, sellers may focus on the next support at $12.00 where the lower limit of the descending channel and July lows are located. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales