Investors were offered some interesting data today, especially from the United States. US jobs data showed even more worrying signs, suggesting that the condition of the US labor market is deteriorating. On the other hand, German data released today showed industrial production increasing more-than-expected.

US - more worrying signs from jobs market

Recently released data from the US jobs market showed some worrying signs. While ISM employment subindices began to deteriorate some time ago already, now deterioration can also be seen in 'hard data'. Data released on Tuesday showed JOLTS dropping below 10 million for the first time in almost 2 years while yesterday's ADP print missed expectations and came in below 3-, 6- and 12-month averages.

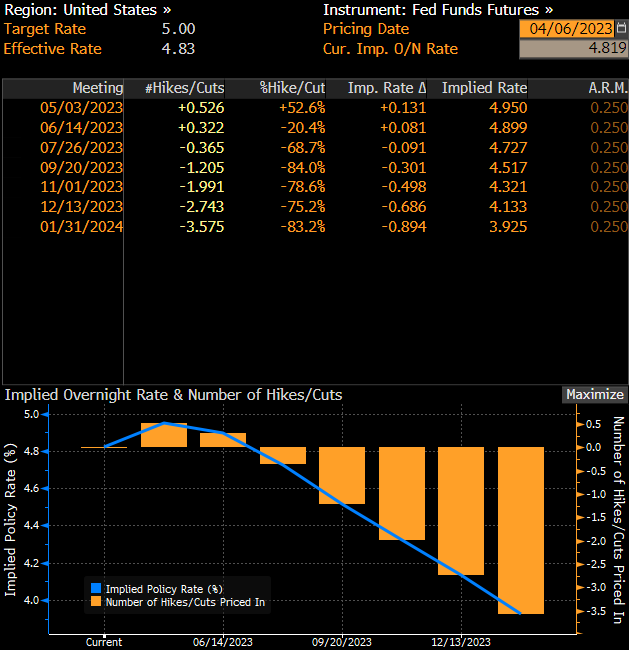

More bad news was offered today with Challenger report showing higher-than-expected planned lay-offs (increase of almost 320% YoY!) while jobless claims climbed to the highest level since early-December 2022. A streak of worrying jobs data makes tomorrow's NFP reading even more important as it hints that employment drop may be looming in the United States. Weaker data from jobs market pushed market odds for Fed hikes lower and now money markets see around-50% chance of a 25 basis point rate hike at May 3, 2023 meeting.

Markets see around-50% chance of 25 bp Fed rate hike in May. Source: Bloomberg

Europe - German industrial production increases

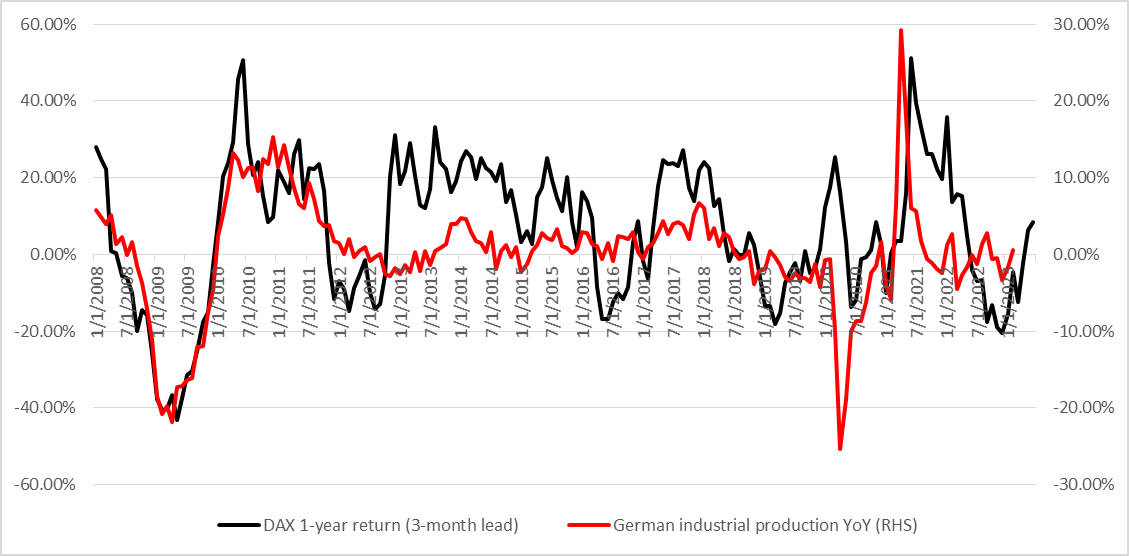

German industrial production data for February was the only noteworthy print from Europe today. Data turned out to be a positive surprise with German industrial output increasing 2.0% MoM in February (exp. 0.1% MoM). A point to note is that work day adjusted annual data climbed above 0.0% for the first time since September 2022 and reached 0.6% YoY. A point to note is that higher output in February was seen almost all across the economy.

Annual German industrial production climbs into positive territory for the first time since September 2022. Source: Bloomberg, XTB

Annual German industrial production climbs into positive territory for the first time since September 2022. Source: Bloomberg, XTB

BREAKING: US trade balance data showed the smallest trade deficit YTD 📌

Economic calendar: Nvidia and Fed Minutes in the spotlight

Morning Wrap (19.11.2025)

Daily summary: Wall Street tries to rebound 📈Amazon and Microsoft under pressure of Rotschild & Co Redburn