- Philadelphia Federal Reserve index spiked to a nearly 50-year high

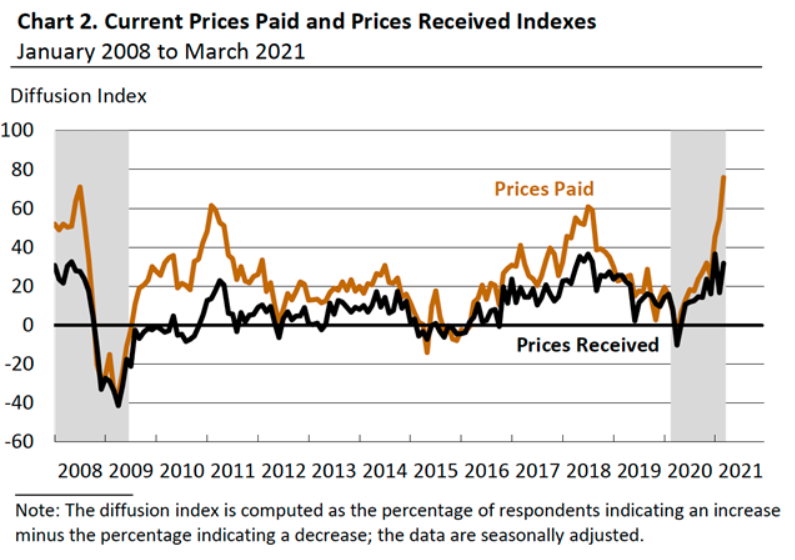

- The firms continued to report price pressures from purchased inputs

The US manufacturing sector is showing fresh signs of strength at the end of the first quarter as the Philly Fed index surged to 51.8 in March from 23.1 in February, beating analysts expectations of 23. Today's reading is the highest since 1973.

The Philly Fed Business Sentiment Indicator rose sharply in March. Source: Bloomberg via ZeroHedge

The Philly Fed Business Sentiment Indicator rose sharply in March. Source: Bloomberg via ZeroHedge

Looking in more detail, all categories have increased except for inventories as the companies showed more widespread optimism about growth over the next six months. New orders and shipments at factories in the region that covers eastern Pennsylvania, southern New Jersey and Delaware soared. General activity and employment indexes also increased. Nearly 59% of the firms reported increases in current activity this month (up from 35% last month), while only 7% reported decreases (down from 11%). The index signals that overall manufacturing activity in the region continued to expand in March for the tenth consecutive month, after a strong rebound in June driven by the reopening of activity. "The firms' responses indicated widespread growth in the region's manufacturing sector this month," the Philly Fed said. However today's report also showed more signs of inflation pressure as a measure of prices paid advanced to the highest in more than four decades.

The prices paid index rose sharply from 54.4 to 75.9, its highest reading since March 1980. Source: philadelphiafed.org

The prices paid index rose sharply from 54.4 to 75.9, its highest reading since March 1980. Source: philadelphiafed.org

As one can see, subsequent indicators show that inflation in the US is accelerating significantly and more investors are getting nervous, even despite the assurances from Fed Chair Powell, who claims that it is a transitional phenomenon. However, if this trend continues, it may negatively affect corporate profits or the end customer will experience significant inflation.

What does newest NFP report tells us?

US OPEN: Investors exercise caution in the face of uncertainty.

BREAKING: University of Michigan sentiment slightly better than expected!

BREAKING: Employment in Canada better than expected! 🍁📈