Economy and Currencies

-

Eurozone: Q4 2025 GDP grew 0.3% q/q and 1.3% y/y, matching preliminary data and market expectations. The foreign trade balance rose for the first time in three months to €11.6 billion (forecast: €11.7 billion; seasonally adjusted).

-

Poland: Consumer inflation (CPI) fell less than expected, moving from 2.4% to 2.2% (forecast: 1.9%). The slowdown was primarily driven by cheaper fuel and transport, while upward pressure came from excise goods (tobacco, alcohol). The reading remains below the NBP's target midpoint of 2.5% (+/- 1 pp).

-

US Dollar: The Dollar Index is gaining for the third consecutive day (USDIDX: +0.15%), still supported by the strong NFP report despite anticipation of the upcoming CPI report (forecast: 2.5%, previous: 2.7%). A tight labor market and solid business activity data suggest a risk of "sticky" inflation; dollar gains may reflect positioning for a potential upside surprise.

-

FX Moves: The Australian dollar (AUDUSD: -0.5%) and yen (USDJPY: +0.5%) are seeing the largest corrections. EURUSD has retreated 0.1% to 1.186, while USDPLN is gaining 0.1% to 3.553.

Indices

-

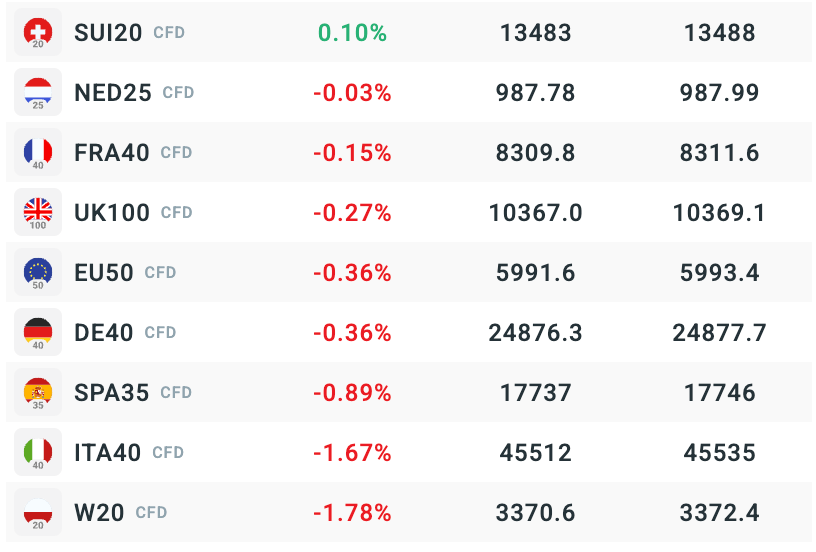

Market Sentiment: European index futures are trading mostly in the red, extending losses from yesterday's Wall Street sell-off (EU50 & DE40: -0.35%).

-

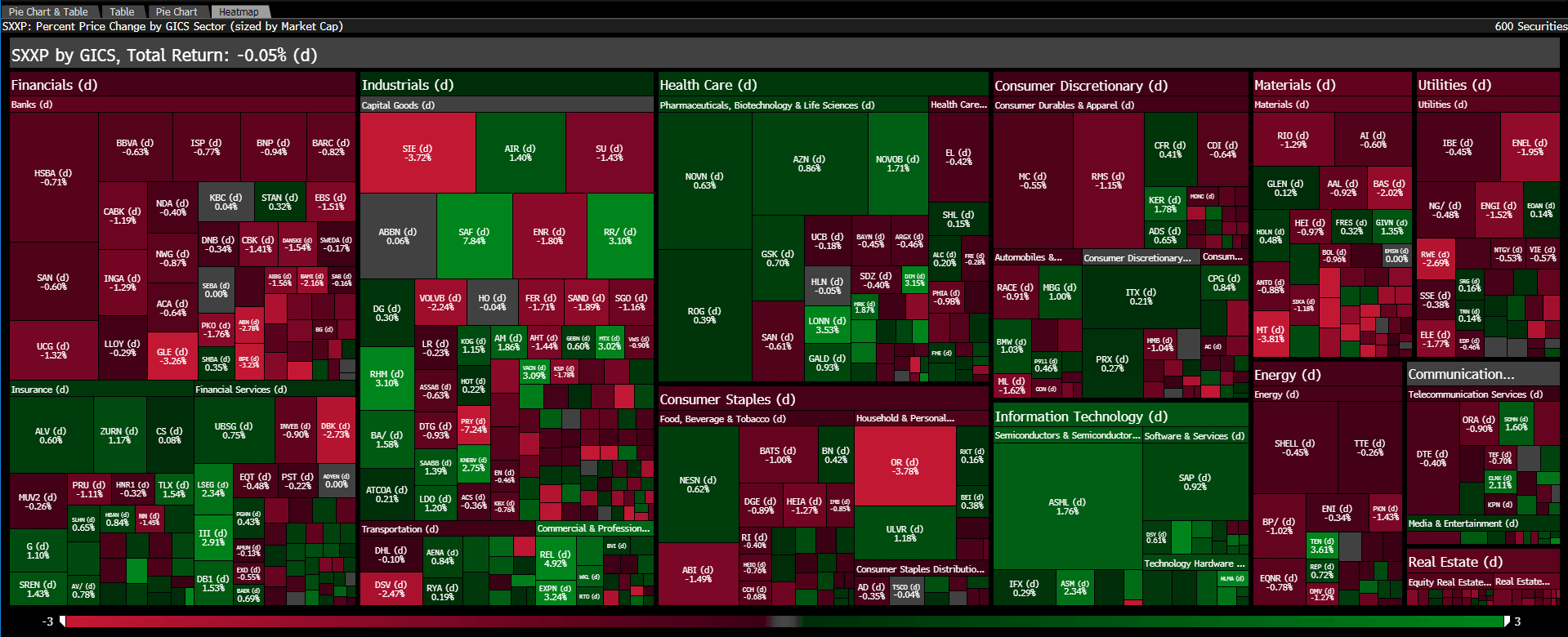

Sectors: declines are concentrated in financials, materials, energy and utilities. These are being partially offset by gains in major pharmaceutical, industrial and technology firms.

-

W20 (Poland): Leading losses at -1.8%.

-

SUI20 (Switzerland): The lone "green" exception at +0.1%.

The changes in stock index futures. Source: xStation5

Individual Stock Highlights

-

Siemens (-3.7%): Undergoing a sharp correction, completely erasing gains made after yesterday's initial positive reception of its financial results.

-

L’Oreal (-3.6%): Sliding after Q4 results showed marginal sales growth in China (0.6% vs. 5.6% forecast). Strong demand in North America and Europe (6% total growth) was not enough to satisfy investors.

-

Safran (+8.5%): Soaring after H2 2025 revenue hit €16.6 billion (+16% y/y). While EPS was softer, Free Cash Flow (€2.1 billion) significantly beat consensus. The market reacted positively to significantly raised 2028 targets.

-

Capgemini (+4.4%): Beat its 2025 revenue target (€22.47 billion) with strong Q4 growth (+10.6%) fueled by the WNS acquisition. AI-driven solutions remain the primary engine of growth, with a major restructuring planned to pivot fully toward AI services.

Today's performance of stocks and sectors of Stoxx 600 index. Source: Bloomberg Finance LP

Today's performance of stocks and sectors of Stoxx 600 index. Source: Bloomberg Finance LP

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

Stock of the Week: Broadcom Driven by AI Sets Records

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺