- Robust sales increase overshadowed by a $16B one-time charge and rising AI spending

- Excluding this effect, Meta said net income would have been $18.6B with EPS of $7.25

- Meta shares fell about 8% in after-hours trading.

- Robust sales increase overshadowed by a $16B one-time charge and rising AI spending

- Excluding this effect, Meta said net income would have been $18.6B with EPS of $7.25

- Meta shares fell about 8% in after-hours trading.

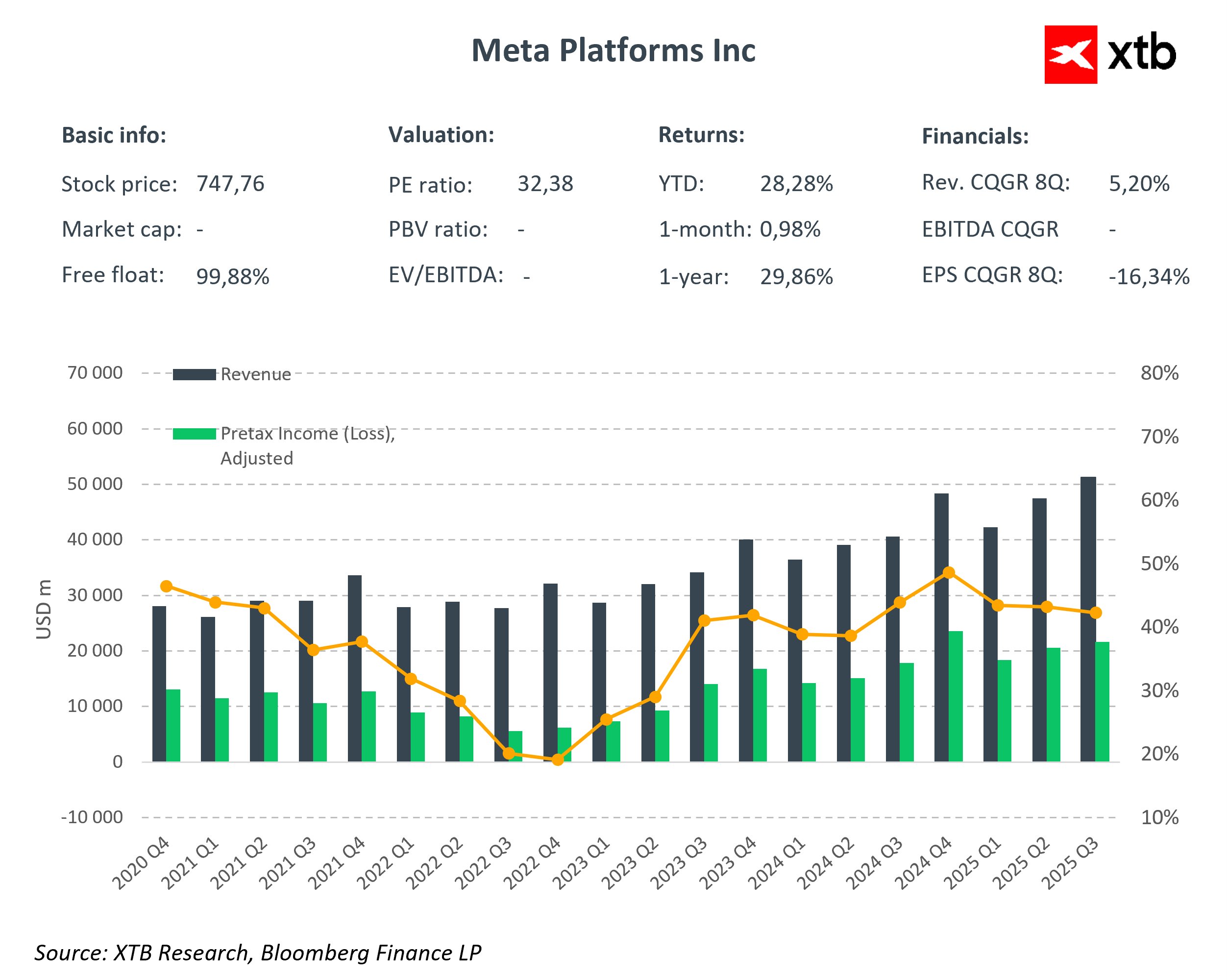

Meta Platforms (META.US) reported impressive Q3 revenue growth, driven by strong advertising demand and higher user engagement fueled by AI-powered tools across Facebook, Instagram, and WhatsApp. Revenue rose 26% y/y to $51.2B, well above market expectations. However, results were overshadowed by a one-time, non-cash tax charge of $15.9B related to the implementation of the U.S. “One Big Beautiful Bill” act, which lifted the company’s effective tax rate to 87% and significantly reduced its reported profit.

Excluding this effect, Meta said net income would have been $18.6B with EPS of $7.25, showing a clear improvement year-over-year. The company noted that the tax change reduces future U.S. tax obligations, though it temporarily depressed current-quarter results.

Key financial results (Q3 2025):

- Revenue: $51.24B (+26% y/y) — above consensus of $49.36B

- EPS: $1.05 vs. expected $6.68 — impacted by $15.9B one-time tax charge

- Operating income: $20.54B (+18% y/y)

- Operating margin: 40% (vs. 43% a year earlier)

- Net income: $2.71B (−83% y/y, due to tax impact)

- Ad impressions: +14% y/y; average ad price: +10% y/y

- Daily active users (Meta family of apps): 3.54B (+8% y/y)

- Capital expenditures (CapEx): $19.37B

- Free cash flow (FCF): $10.6B

AI ambitions drive spending

Capital expenditures rose to $19.4B, reflecting accelerated investment in data centers and artificial intelligence infrastructure. CEO Mark Zuckerberg said Meta Superintelligence Labs have a “bright future” and reaffirmed the company’s long-term goal of building advanced AI systems and next-generation smart glasses.

Meta raised its full-year 2025 CapEx guidance to $70–72B (from $66–72B), citing growing demand for computing power. For 2026, spending is expected to be “significantly higher”, mainly due to data infrastructure expansion, AI chip purchases, and increased technical hiring.

Outlook and market reaction

For Q4 2025, Meta projects revenue between $56–59B, in line with the market consensus of $57.3B.

CFO Susan Li warned that operating and capital expenses will rise significantly in 2026 as Meta expands its AI infrastructure and boosts technical staff compensation.

Despite solid business fundamentals, the combination of the one-time tax expense and rising spending dampened investor sentiment. Meta shares fell about 8% in after-hours trading.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records