Meta Platforms (META.US) is trading over 3% higher in premarket today after confirming earlier reports on massive lay-offs. Shares of the company gained recently on the news saying that it is preparing to cut "thousands of jobs". These media reports were confirmed today with the announcement from the company and it has sent shares higher in premarket.

Meta said that it will cut 11 thousand employees, accounting for around 13% of its total workforce. Company reasoned its decision saying that revenue outlook is lower than expected at the beginning of 2022 and cost cuts are needed. On top of that, Meta said that it will extend its hiring freeze beyond this year and through the first quarter of 2023. Meta Platforms is another tech company that begins big layoffs. Apart from tech companies, banks are also reducing employment in a sign that deterioration in economic outlook is progressing.

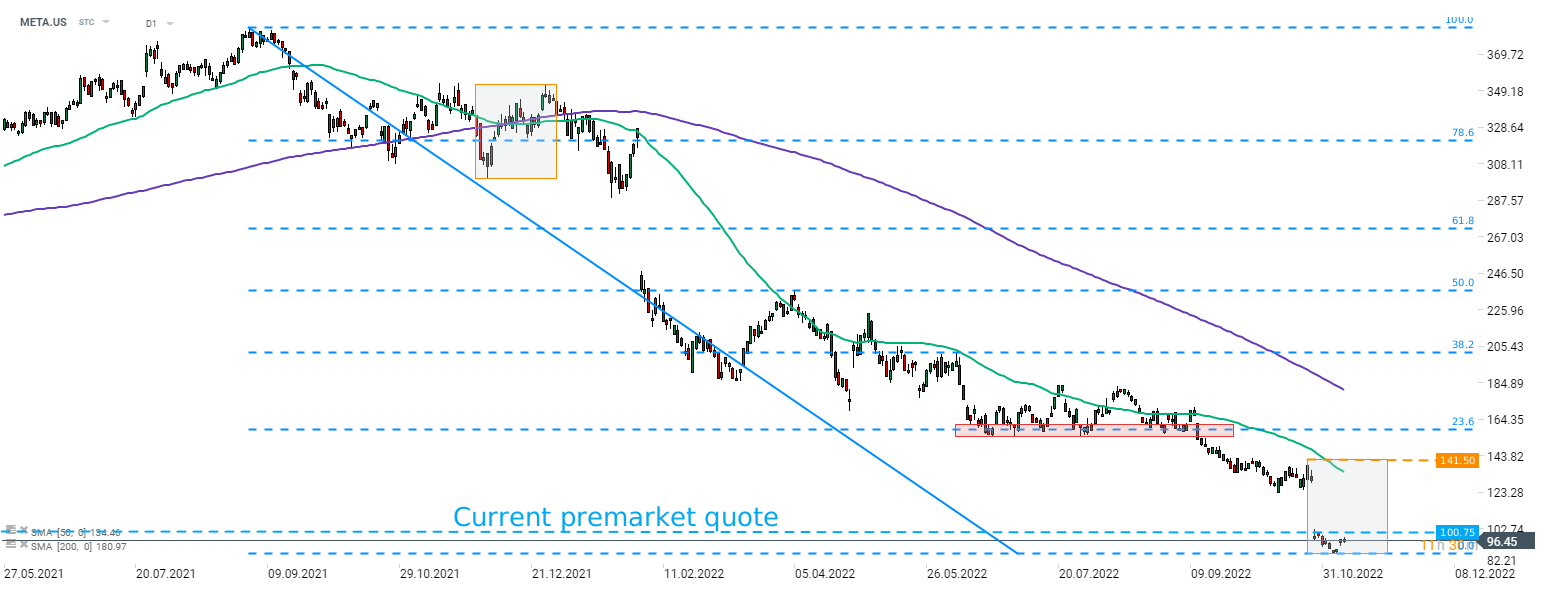

Shares of Meta Platforms (META.US) trade over 3% higher in premarket and are set to open above $100.00 - the highest level since the day after Q3 2022 earnings release. However, this jump is barely visible on the chart of the company, following an over-70% YTD drop. From a technical point of view a break above the upper limit of the Overbalance structure at $141.50 would be needed for the outlook to get more bullish. However, it would require a 40~% rally from current price levels.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street