Meta Platforms (META.US) stock fell over 6.0% on Tuesday as European Data Protection Board has raised concerns over social media giant targeted ad sales across its Facebook and Instagram platforms, according to WSJ.

EU officials ruled against Meta's practice of offering users the chance to 'opt-in' to agreements that allow it to create targeted ads based on their online activity. This may have a negative impact on a company's financial performance, as ad revenue is its main source of income.

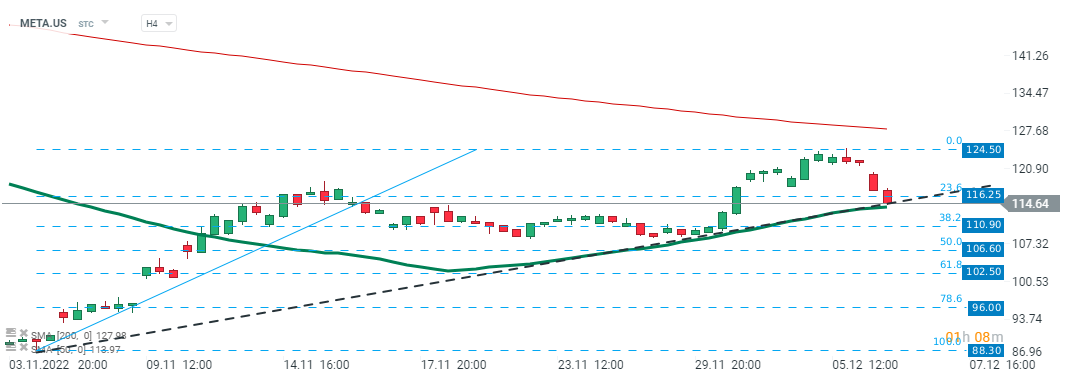

Meta Platforms (META.US) stock fell sharply on Tuesday and is currently testing major support at $116.25, which coincides with the upward trendline, 50 SMA (green line) and 23.6% Fibonacci retracement of the last upward wave. Should break lower occur, the remaining retracements may be considered as support level. On the other hand, if buyers manage to halt declines here, then another upward impulse towards recent high at $124.50 may be launched. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡