Microchip Technology has strengthened its partnership with Taiwan Semiconductor Manufacturing Company (TSMC) by integrating a specialized 40 nanometer manufacturing process at Japan Advanced Semiconductor Manufacturing (JASM), a subsidiary majorly owned by TSMC in Kumamoto Prefecture, Japan. This move is aimed at enhancing Microchip's supply chain resilience. The company sees this deal as a way to boost internal manufacturing capabilities, expand geographical diversity, and create more redundancy in various stages of semiconductor production.

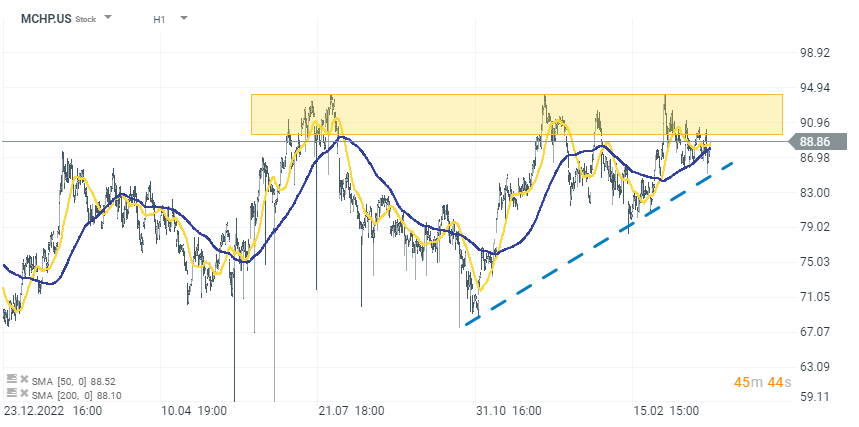

Microchip Technology (MCHP.US) shares gain 1.30% today, reaching $88.80 per share. The stock has rebounded from the lower support line of the trend and is heading towards the resistance zone between $90-$94.

Source: xStation 5

Shares of Taiwan Semiconductor Manufacturing Company (TSMC.US) are up 2.46% today and are also near the resistance zone between $140-$145 per share.

Source: xStation 5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals