- SK Hynix reports that all HBM memory sales for 2026 are sold out, indicating an acceleration of the supercycle in the semiconductor sector.

- As one of the leading HBM producers, Micron is benefiting from rising demand driven by AI and data center growth, with its HBM3e chips already deployed in solutions from Nvidia.

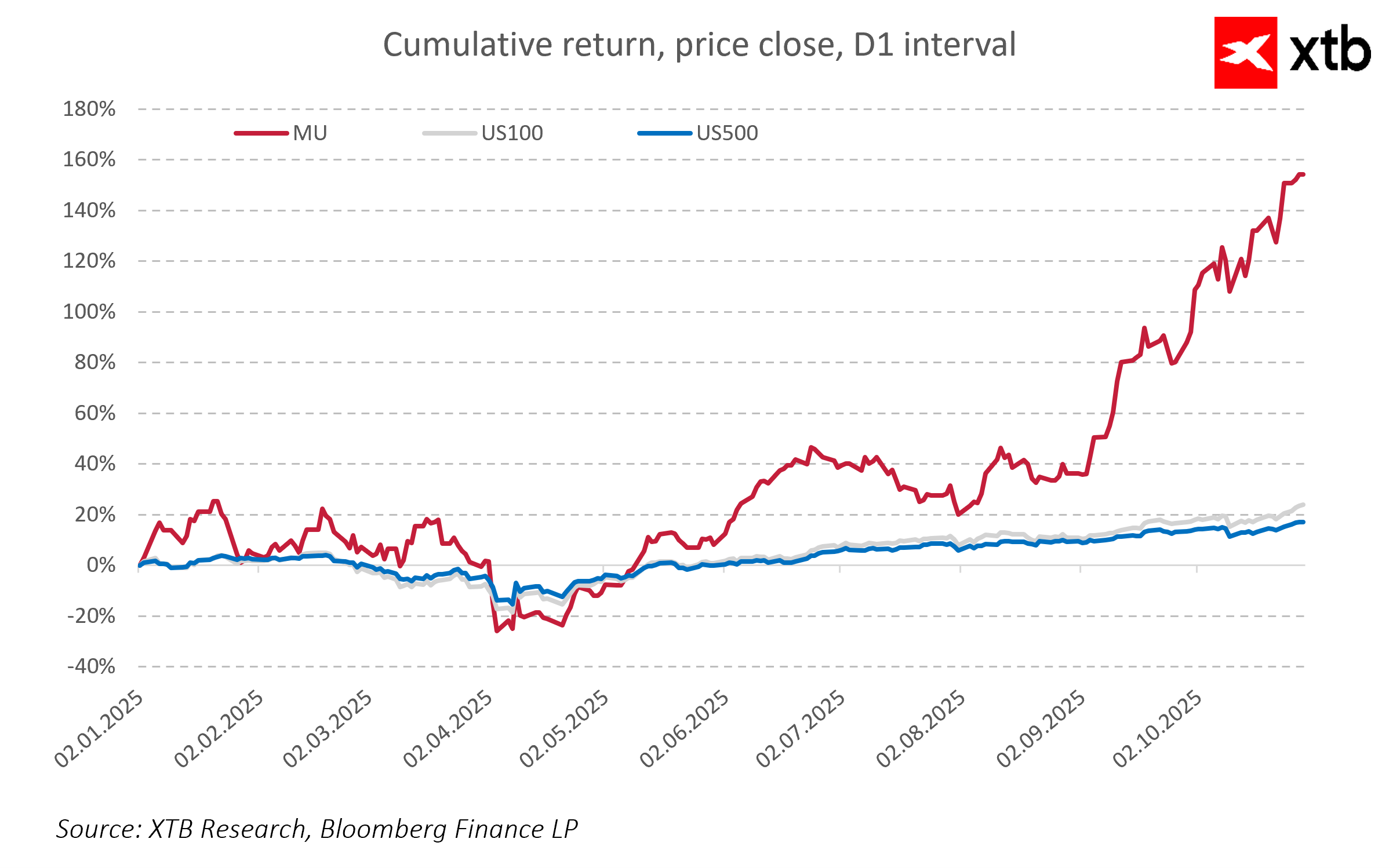

- Since the beginning of the year, Micron’s shares have outperformed the S&P 500, reflecting investor optimism about the company’s prospects while monitoring technological and global risks.

- SK Hynix reports that all HBM memory sales for 2026 are sold out, indicating an acceleration of the supercycle in the semiconductor sector.

- As one of the leading HBM producers, Micron is benefiting from rising demand driven by AI and data center growth, with its HBM3e chips already deployed in solutions from Nvidia.

- Since the beginning of the year, Micron’s shares have outperformed the S&P 500, reflecting investor optimism about the company’s prospects while monitoring technological and global risks.

Micron Technology and its competitor SK Hynix are currently in the spotlight for investors due to a strong upward trend in the semiconductor memory market, particularly in the High Bandwidth Memory (HBM) segment. SK Hynix reports that total memory chip sales for 2026 are already sold out, and forecasts point to a so-called supercycle, a prolonged period of exceptionally high demand driven by the rapid development of artificial intelligence infrastructure and data centers.

Long-term forecasts for the HBM market are very promising. SK Hynix estimates a compound annual growth rate of 30 percent through 2030, which could result in a market value of up to $150 billion, significantly exceeding Micron’s earlier projections. The company is one of the three leading HBM producers worldwide, and its HBM3e chips are already being used in graphics solutions from major players, including Nvidia.

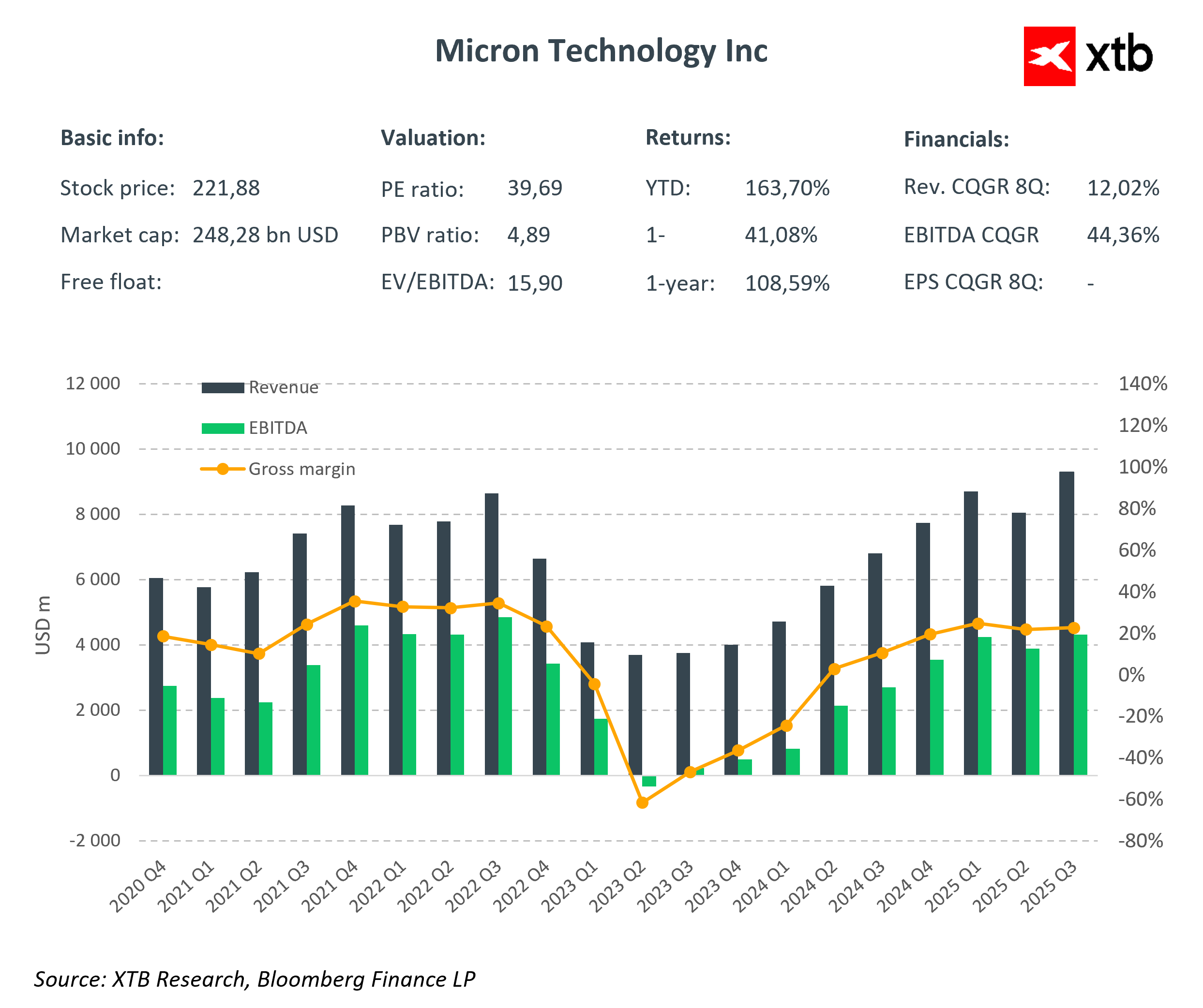

The current market environment favors high-bandwidth memory producers, as the growth of AI, Big Data, and advanced applications significantly increases demand. Limited supply and high entry barriers work to the advantage of market leaders, allowing them to increase market share and maintain a competitive edge. Since the beginning of the year, Micron’s stock has risen significantly more than the S&P 500, further highlighting investor optimism about the company’s prospects.

At the same time, it is important to be mindful of risks related to maintaining technological leadership, competitive pressure, and global economic policies, including relations with China and export regulations.

Micron faces a substantial growth opportunity thanks to the AI boom and record demand for advanced HBM memory. This creates a solid foundation for further growth in the company’s financial results and stock market value.

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending