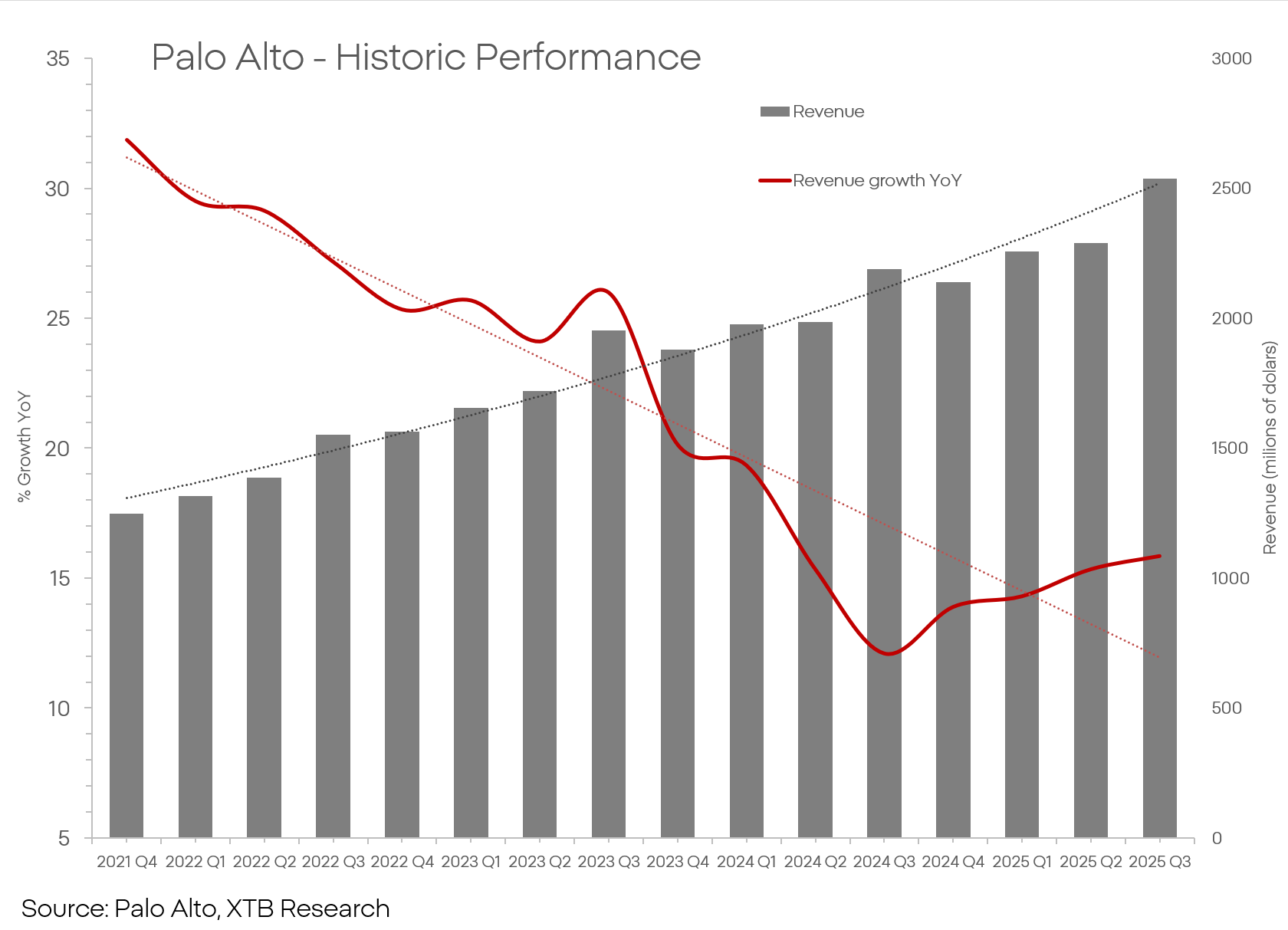

At first glance, the financial report doesn't reveal any reasons for concern or disappointment.

- Revenue: $2.47 billion compared to the expected $2.46 billion. Year-over-year growth of 16%.

- EPS at $0.93 compared to the expected $0.89. Year-over-year growth of 19%.

- Increase in order portfolio to $15.5 billion, with $5.85 billion being recurring revenue from "Next Gen Security" solutions - in this segment, growth was 24% and 29% year-over-year, respectively.

- Revenue growth is not at the expense of profits, with free cash flow increasing to $1.7 billion with an FCF margin of 19%.

Forecasts are meant to reassure investors about promising future results:

Revenue for the next quarter is expected to be between $2.47-2.50 billion, and revenue for the entire fiscal year is expected to exceed $10.5 billion with EPS between 3.8-3.9 - both figures above consensus expectations. By 2028, the operating margin is expected to exceed 40%.

At the same time, the company announced another major acquisition — this time it's Chronosphere, aimed at improving Palo Alto's offerings and capabilities regarding oversight and AI. This acquisition will cost $3.35 billion.

In light of this information, which of them caused the stock price to drop?

Primarily, it's not the numbers but the trends that speak here — specifically its slope. It's about the growth rate which, although impressive, is declining when compared to historical data. The growth is still incredibly impressive, but with a P/E ratio exceeding 140, impressive is not enough.

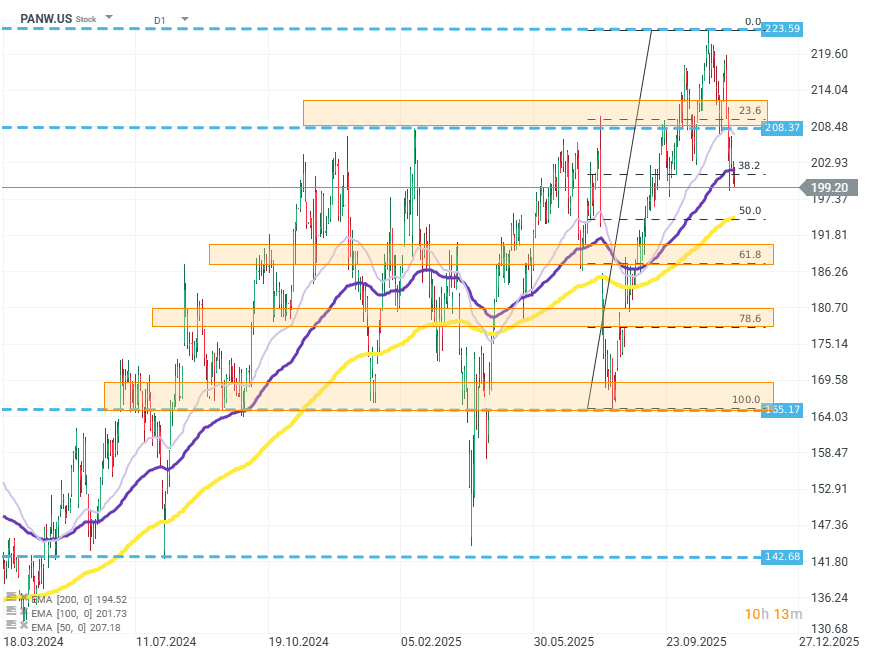

PANW.US (D1)

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment