-

US indices finished yesterday's trading higher. S&P 500 gained 0.21% while Dow Jones added 0.61%. Nasdaq dropped 0.17%. Russell 2000 finished trading 0.07% higher.

-

Pessimism dominated during the Asian trading hours. Nikkei dropped 0.4%, S&P/ASX200 moved 0.5% lower while Kospi declined 0.4%. Indices from China traded mixed

-

DAX futures point to a higher opening of the European session

-

Japanese authorities are considering a new stimulus package

-

Chinese manufacturing PMI (Caixin/Markit) dropped from 52.0 to 51.3 pts in June

-

Japanese Tankan index for the manufacturing sector jumped from 5 to 14 in Q2 2021 (exp. 16). Services index moved from -1 to 1 (exp. 3)

-

South Korean exports increased 39.7% YoY in June (exp. 33.6%) while imports were 40.7% YoY higher (exp. 33% YoY). Semiconductor exports increased 34.4% YoY

-

Australia trade balance reached A$9.68 billion in May (exp. A$10 billion)

-

Bitcoin trades near $34,000 mark

-

Gold and silver gain while platinum and palladium drop. Oil trades slightly higher with industrial metals decline

-

JPY and USD are the best performing major currencies while AUD and EUR lag the most

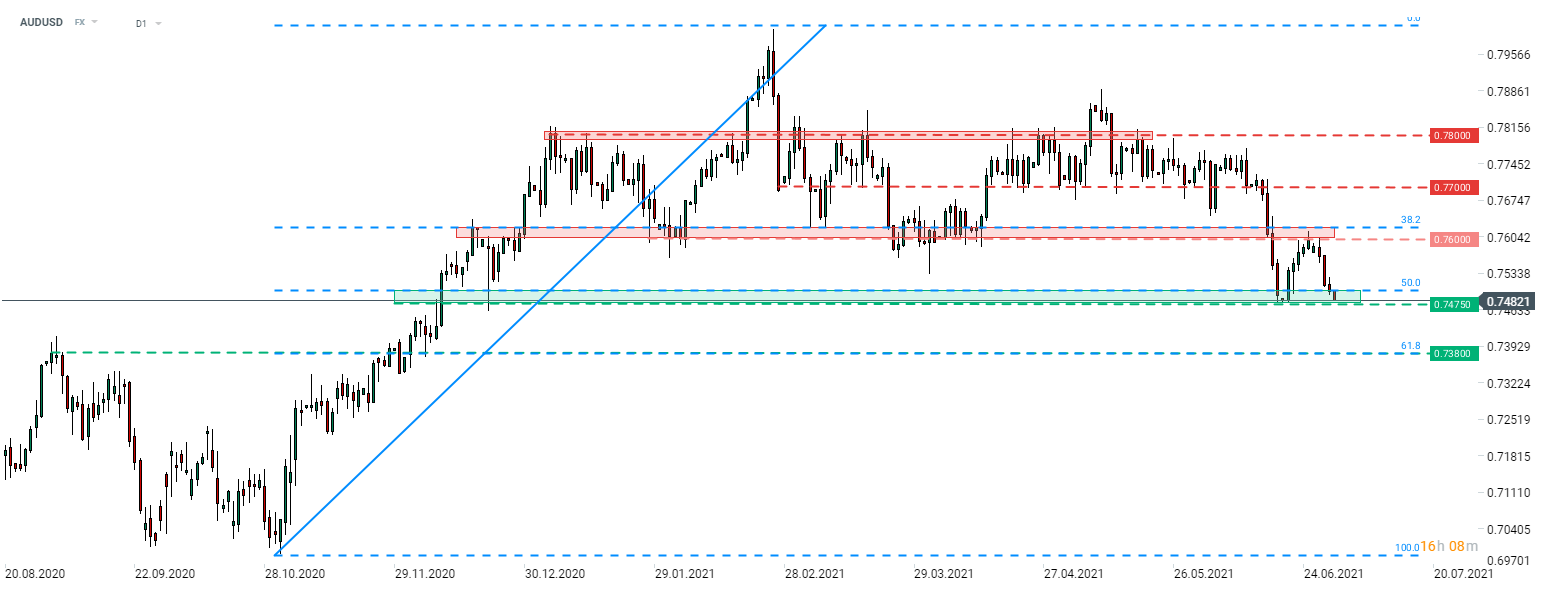

AUDUSD is one of the worst performing major FX pairs today. Price is retesting a support zone ranging between 0.7475 mark and 50% retracement of the upward move impulse launched in late-2020. Breaking below this hurdle could pave the way for a test of the next support - 0.7380 area at 61.8% retracement. Source: xStation5

AUDUSD is one of the worst performing major FX pairs today. Price is retesting a support zone ranging between 0.7475 mark and 50% retracement of the upward move impulse launched in late-2020. Breaking below this hurdle could pave the way for a test of the next support - 0.7380 area at 61.8% retracement. Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Three markets to watch next week (27.02.2026)