-

The session in the Asia-Pacific region proceeded in a good mood after a strong rebound on Wall Street. Stocks led by technology companies gained.

-

Leading the gains was Vietnam's VN30 Index (VIET30), which gained more than 3.30%. Other indexes including Japan's JAP225 and indexes from China were also trading on the upside.

-

The British Pound and the US Dollar are among the weaker currencies in the first part of the day. USDJPY fell from levels of 151.5 to 150.5, but still remains above the psychological barrier of 150.

-

Bonds in Asia-Pacific countries, including Japan and South Korea rebounded, with yields losing after the Fed conference. New Zealand's 10-year bond yields lost the most, falling from levels of 5.50% to 5.25%.

-

Jerome Powell's less hawkish stance than expected led to a rise in stock and bond prices. The market now believes that the Fed may be nearing the end of its interest rate hikes.

-

Australia's trade balance came in lower than forecast at AUD 6786 million, with exports down 1% and imports up 8%.

-

South Korea's year-on-year consumer price index (CPI) was 3.8%, higher than forecast (3.6%). The monthly CPI was 0.3%, slightly above the 0.2% forecast.

-

China's Foreign Ministry said on Monday after a visit by Foreign Minister Wang Yi to Washington that the two countries would hold "consultations on arms control and non-proliferation" in the coming days, as well as separate talks on maritime affairs and other issues.

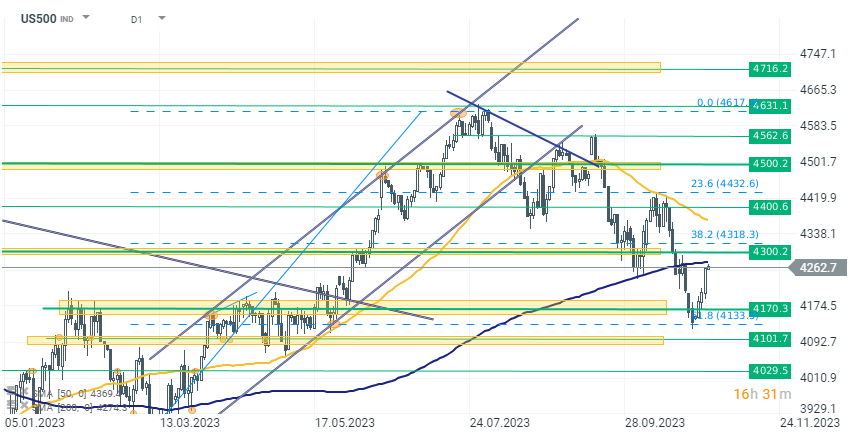

The US500 contracts closed yesterday 1.60% higher, heading towards the next resistance zone at 4300 points. The index price at the 61.8% Fibonacci retracement level was defended, and the rebound accelerated after yesterday's Fed decision. Source: xStation 5

The US500 contracts closed yesterday 1.60% higher, heading towards the next resistance zone at 4300 points. The index price at the 61.8% Fibonacci retracement level was defended, and the rebound accelerated after yesterday's Fed decision. Source: xStation 5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)