- US indices extended the upward streak for another day and finished yesterday's trading with big gains. S&P 500 gained 1.89%, Dow Jones moved 1.70% higher and Nasdaq jumped 1.78%. Russell 2000 gained around 2.5%

- Gains, especially on tech indices, were trimmed slightly after Apple reported results after close of the Wall Street session

- Apple traded over 3% lower in the after-hours trading after the company reported Q3 EPS at $1.46 (exp. $1.39) and revenue at $89.50 billion (exp. $89.35 billion). iPhone sales were higher than expected while sales of Mac and accessories missed expectations

- Apple reported the fourth revenue drop in a row, marking the longest losing streak since 2001

- Indices from Asia-Pacific traded higher today - S&P/ASX 200 and Kospi gained 1.1%, Nifty 50 traded 0.6% higher and indices from China added 0.7-2.4%. Stock exchanges in Japan were closed due to a holiday

- DAX futures point to a higher opening of the European cash session today

- Moves on the FX market during the Asia-Pacific session were limited as traders are awaiting key jobs data later today

- ECB Schnabel said that with current monetary policy stance she expects inflation to return to target by 2025

- Chinese Caixin manufacturing PMI ticked higher in October, from 50.2 to 50.4 (exp. 51.2)

- Major cryptocurrencies trade mixed - Bitcoin drops 0.7%, Dogecoin trades 0.1% lower while Ethereum gains 0.3% and Litecoin adds 0.1%

- Energy commodities are trading higher today - oil gains 0.2-0.3% while US natural gas prices jump 0.7%

- Precious metals benefit from USD weakening - gold adds 0.1%, platinum gains 0.3% while silver drops 0.1%

- NZD and EUR are the best performing major currencies while USD and CAD lag the most

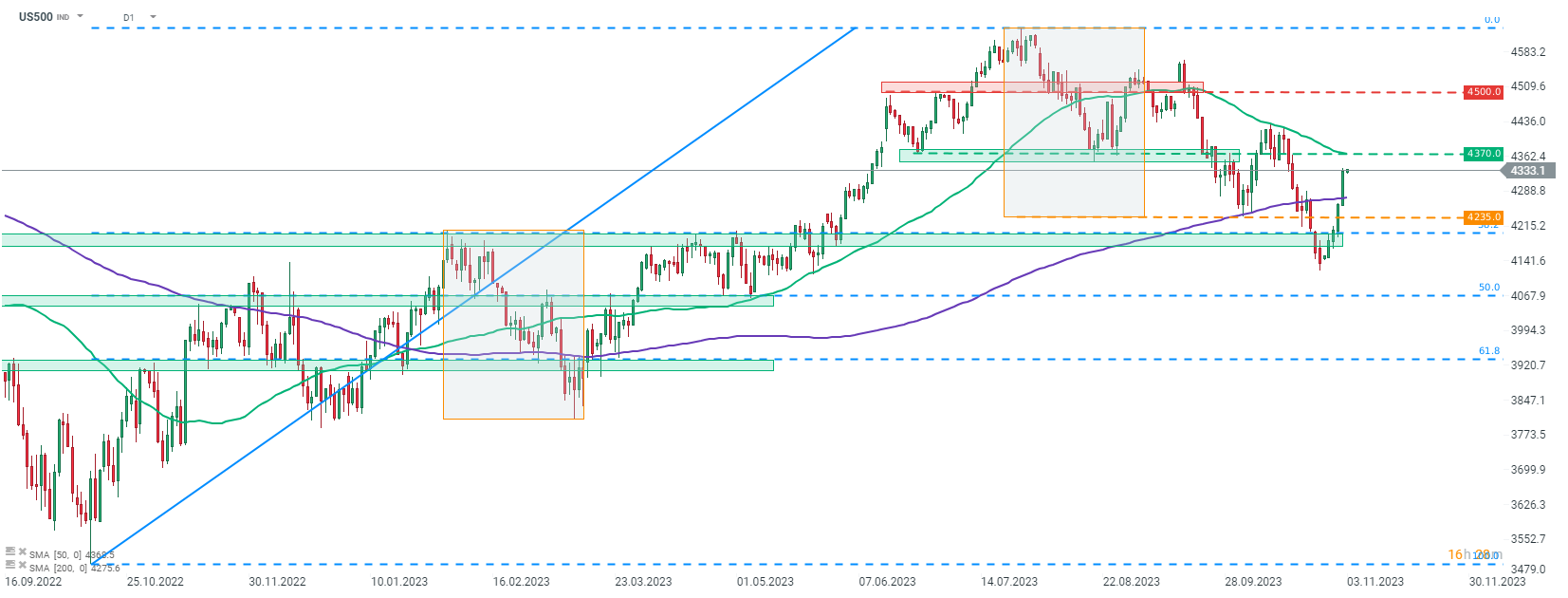

US indices extended an upbeat streak yesterday with US500 now trading around 5% higher week-to-date. Index trades at 2-week highs. Source: xStation5

US indices extended an upbeat streak yesterday with US500 now trading around 5% higher week-to-date. Index trades at 2-week highs. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments