- Indices from Asia-Pacific launched new week's trading higher. Nikkei and S&P/ASX 200 gained 0.5%, Kospi trades 0.6% higher and Nifty 50 trades flat. Indices from China trade 1.0-2.5% higher

- Strong gains in China were driven by property sector stocks. This comes after a weekend reports saying that Chinese developer Country Garden won approval to extend payments on onshore bonds

- European index futures point to a slightly higher opening of the cash session on the Old Continent today

- Liquidity on the markets may be thinner today, especially in the afternoon, as traders from the United States and Canada will be off to celebrate Labour Day holiday

- Money markets are pricing in less than a 10% chance of a 25 bp rate hike at September FOMC meeting, following NFP report that show a spike in unemployment rate

- ECB's Wunsch said that underlying inflation continues to be persistent and that more rate hikes will be needed

- Morgan Stanley is no longer expecting ECB to hike rates at its September meeting and instead thinks that ECB rate hike cycle is over already

- Moody's lowered its Chinese GDP growth forecast for 2024 from 4.5 to 4.0%. Forecast for 2023 was left unchanged at 5.0%

- Australian business inventories dropped 1.9% QoQ in Q2 2023

- Cryptocurrencies are trading higher today - Bitcoin gains trades flat, Ethereum gains 0.1%, Dogecoin adds 0.4% and Ripple jumps 1%

- Energy commodities pull back - oil drops 0.3-0.4% while US natural gas prices drop 2.5%

- Precious metals gains - gold, platinum and silver trades 0.3% higher while palladium rallies 0.9%

- AUD and GBP are the best performing major currencies while USD and JPY lag the most

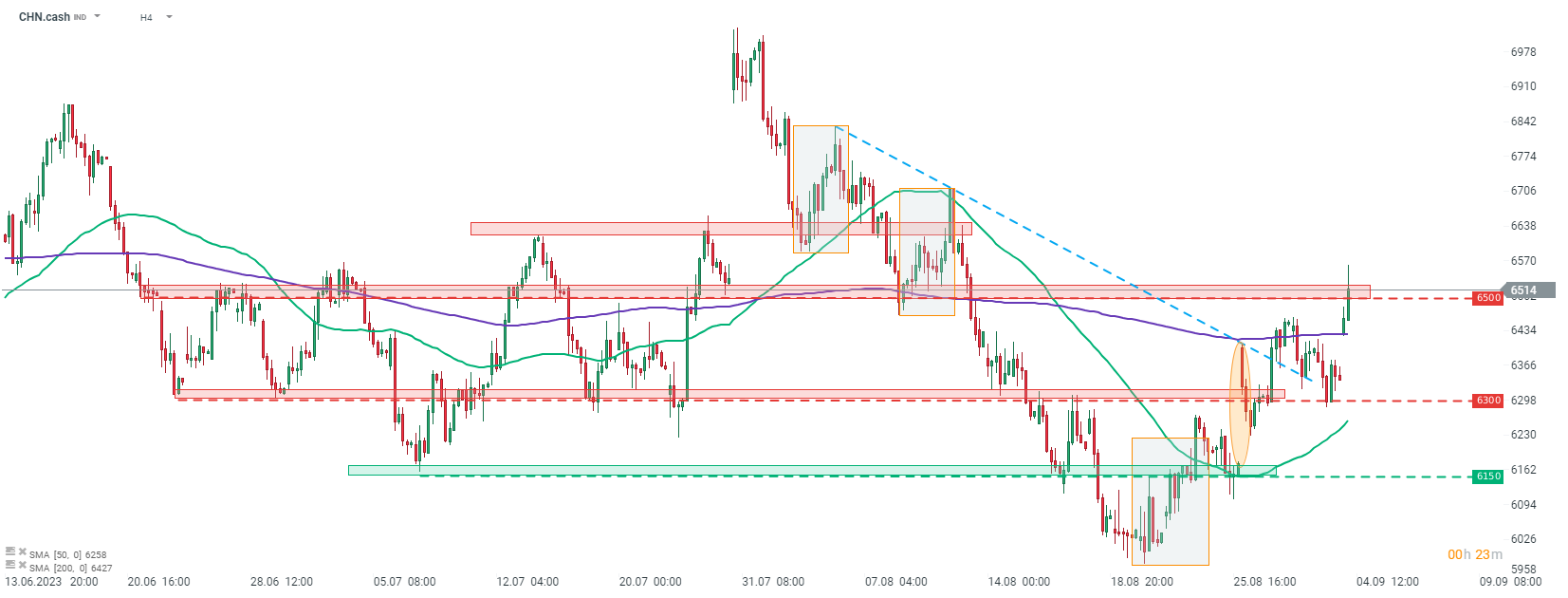

CHN.cash is trading over 2.5% higher today, as sentiment towards the Chinese property sector improved. The index is currently testing a 6,500 pts resistance zone. Source: xStation5

CHN.cash is trading over 2.5% higher today, as sentiment towards the Chinese property sector improved. The index is currently testing a 6,500 pts resistance zone. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!