-

US indices finished yesterday's trading higher. S&P 500 gained 0.8%, Dow Jones moved 0.30% higher and Nasdaq rallied 1.90%. Russell 2000 gained 0.21%

-

Stocks from Asia-Pacific traded slightly higher on Tuesday. Nikkei gained 0.2% while S&P/ASX 200 and Kospi added around 0.05% each. Stock exchanges in China and Hong Kong and Taiwan were closed for holiday

-

DAX futures point to a flat opening of the European cash session today

-

US Treasury said that it will block any attempts by Russia to settle its USD-denominated debt with reserves it holds in US financial institutions

-

World Bank expects Chinese economy to grow 5% in 2022, lower than official Chinese estimate of 5.5%

-

BoJ Governor Kuroda said that policy will become less effective once Japanese 10-year yield jumps above 0.25%. BoJ plans to continue to buy unlimited amounts of government bonds in near-term

-

The Reserve Bank of Australia left the interest rate unchanged at a meeting today. However, RBA no longer stressed "patience" in its policy statement

-

Japanese household spending increased 1.1% YoY in February (exp. +2.7% YoY)

-

Brent and WTI trade around 0.8% higher each today

-

In spite of USD weakness, precious metals trade mixed - gold and platinum drop slightly while silver and palladium gain

-

AUD and NZD are the best performing major currencies while USD and EUR lag the most

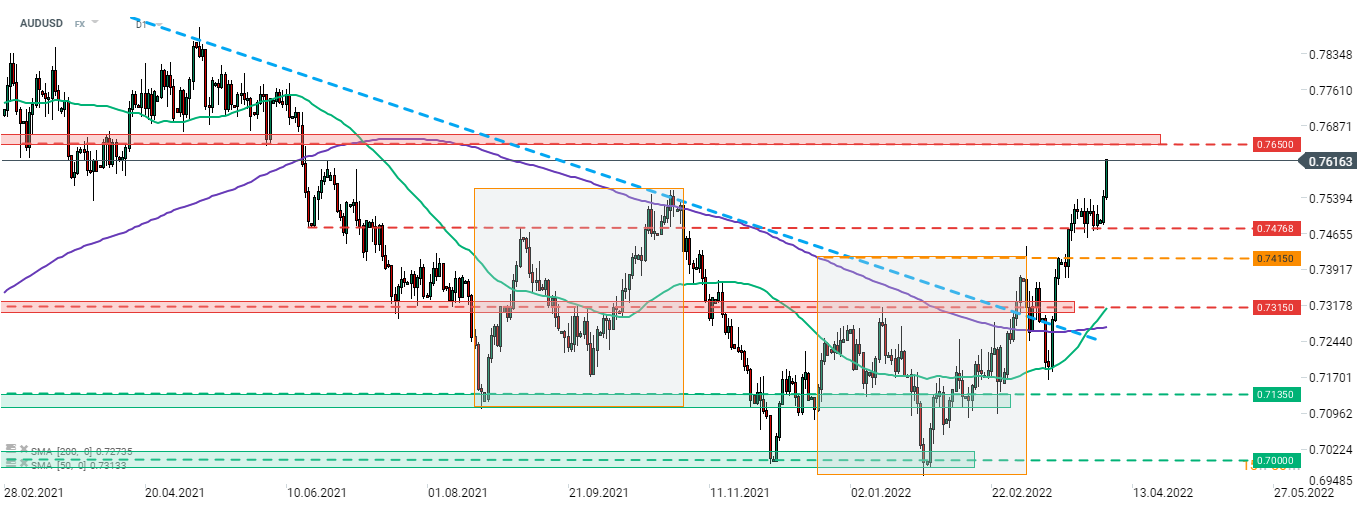

AUDUSD rallied today after mention of patience was removed from RBA statement. This suggests that RBA may decide to hike rates at one of the coming meetings. AUDUSD reached the highest level since June 2021 following the decision and is looking towards resistance zone ranging above 0.7650. Source: xStation5

AUDUSD rallied today after mention of patience was removed from RBA statement. This suggests that RBA may decide to hike rates at one of the coming meetings. AUDUSD reached the highest level since June 2021 following the decision and is looking towards resistance zone ranging above 0.7650. Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%