-

US futures trade little changed compared to Friday's closing prices. US trades return to the markets today following a long weekend

-

Stocks in Asia are trading mixed. Nikkei and most Chinese indices trade higher while S&P/ASX 200 and Kospi drop

-

DAX futures point to a slightly lower opening of the European cash session

-

The Reserve Bank of Australia left rates unchanged at today's meeting. RBA extended bond purchases until at least February 2022 amid slowdown in economic recovery. However, Bank remains committed to begin tapering soon

-

Fumio Kishida, one of the key politicians in the Japanese Liberal-Democratic Party, said that he will support more fiscal stimulus if he becomes prime minister. Kishida also said that he wants Bank of Japan to maintain its inflation goal as well as monetary stimulus

-

Chinese exports increased 25.6% YoY in August (exp. 17% YoY) while imports were 33.1% YoY higher (exp. 27% YoY)

-

Japanese household spending increased 0.7% YoY in July (exp. 3% YoY)

-

Bitcoin trades near $52,500

-

Precious metals drop. However, palladium is an exception gaining around 0.2% at press time

-

Industrial metals trade lower while oil gains slightly

-

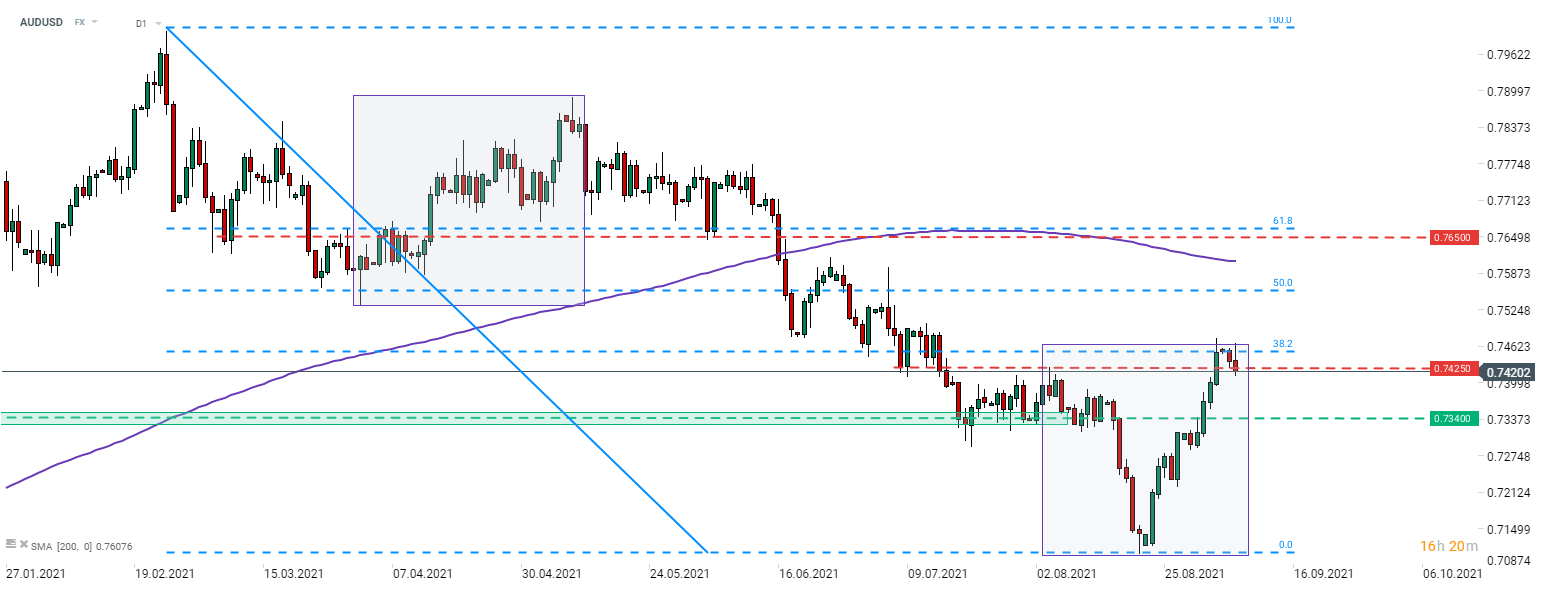

EUR and CHF are the best performing major currencies while NZD and AUD lag the most

The Australian dollar weakened after the RBA noted slowing recovery and decided to extend bond purchases. AUDUSD failed to break above the upper limit of the Overbalance structure earlier this week and today's pullback fits into the technical landscape. Source: xStation5

The Australian dollar weakened after the RBA noted slowing recovery and decided to extend bond purchases. AUDUSD failed to break above the upper limit of the Overbalance structure earlier this week and today's pullback fits into the technical landscape. Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%