- In spite of a higher opening, US indices finished yesterday's trading lower. S&P 500 dropped 0.39%, Dow Jones moved 0.19% lower and Nasdaq slumped 0.58%. Small-cap Russell 2000 traded around 0.2% down

- Indices from Asia-Pacific traded lower, following a downbeat session on Wall Street. Nikkei slumps 1.8%, Nifty 50 and S&P/ASX 200 drop 0.1% each and Kospi trades 0.2% lower. Indices from China trade little changed

- DAX futures point to a lower opening of the European cash session today

- According to unconfirmed media reports, SpaceX is considering offering shares at around $95 per share, valuing the company at $175 billion

- According to China Securities Journal, there is space for interest rate and reserve requirement ratio cuts in China

- Bank of America expects Bank of Canada to deliver the first rate cut in June 2024

- BoJ Governor Ueda warned that Japan's situation will become more challenging in 2024 and that it is important for wages to keep rising and support consumption

- Chinese exports increased 0.5% YoY in November (exp. -1.1% YoY) while import were 0.6% YoY lower (exp. 3.3% YoY). Trade balance for November came in at $68.39 billion (exp. $58 billion)

- Australian trade balance for October came in at A$7.13 billion, slightly below expected A$7.48 surplus

- Cryptocurrencies resumed climb after a brief pause yesterday. Bitcoin trades 0.4% higher, Ethereum gains 1.4% and Dogecoin adds 1%

- Energy commodities trade mixed - oil gains 0.6% while US natural gas prices drop 1%

- Precious metals gain in spite of USD strengthening - gold and platinum trade 0.1% higher while palladium rallies 0.7%. Silver is a laggard with 0.2% drop at press time

- JPY and USD are the best performing major currencies, while NZD and AUD lag the most

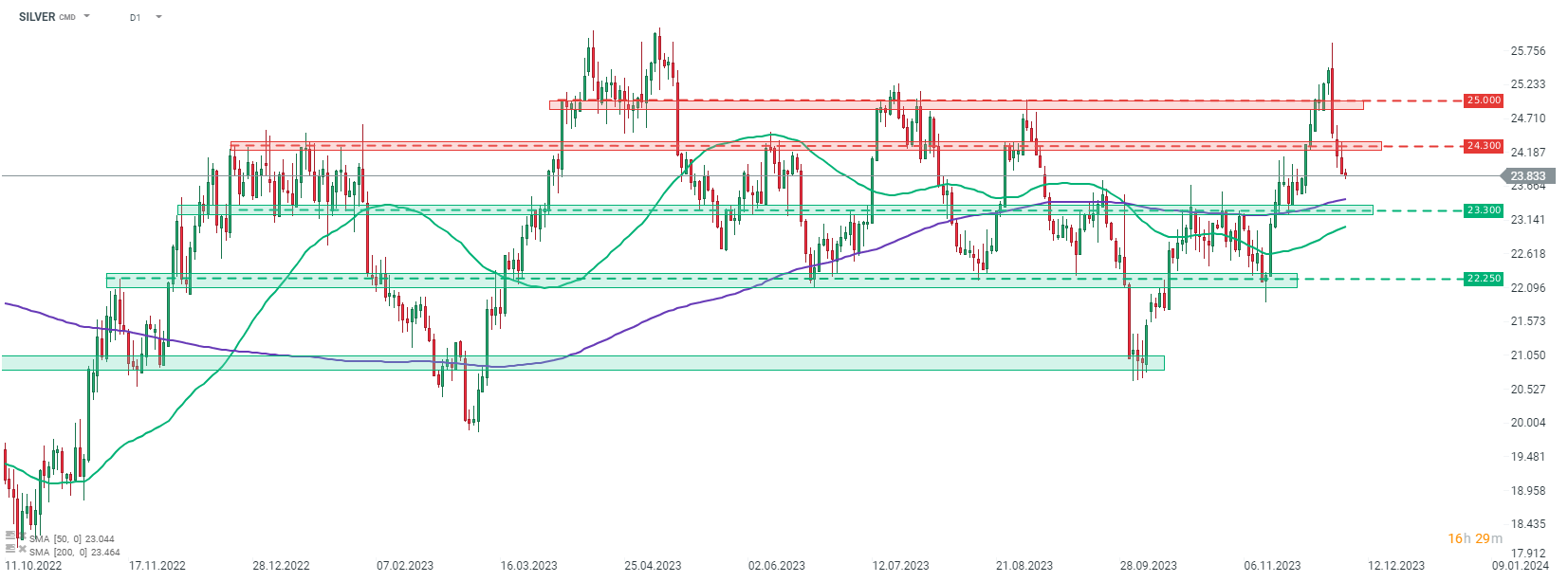

Silver continues to pull back. Price has already dropped 8% from an intraday-high reached near $25.90 per ounce on Monday. Source: xStation5

Silver continues to pull back. Price has already dropped 8% from an intraday-high reached near $25.90 per ounce on Monday. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉