-

US indices finished yesterday's trading higher. S&P 500 gained 1.48%, Nasdaq rallied 2.56% and Dow Jones added 0.69%. Russell 2000 jumped 1.89%

-

Upbeat moods could have been spotted during the Asian trading hours as well. Nikkei gained 2.3%, S&P/ASX 200 added 0.7% and Kospi rallied almost 4%. Indices from China traded lower

-

DAX futures point to a higher opening of the European session

-

Donald Trump condemned recent riots and said he is now focused on smooth and orderly transition of power

-

Media reports suggest that Biden is considering $2,000 stimulus checks and $3 trillion tax and infrastructure stimulus bill

-

Mike Pence is said to be against removing Trump from the office via 25th Amendment

-

United Kingdom will required Covid-19 tests for all incoming travelers

-

Second coronavirus vaccine developed by China is said to have 78% efficacy

-

Fed's Evans said that he believes US central bank will hold rates near zero until 2024

-

Japanese household spending increased 1.1% YoY in November

-

Bitcoin jumped above $40,000 late yesterday but has given back part of the gains since. Major cryptocurrency trades slightly above $38,000 mark at press time

-

Agricultural commodities gain along with oil. Precious metal lag

-

AUD and NZD are top performing major currencies while CHF and JPY lag the most

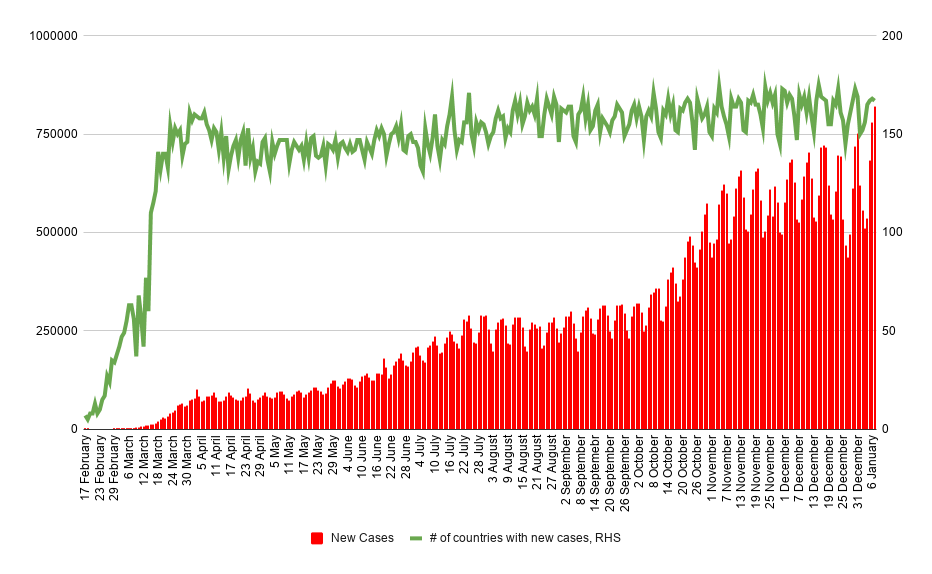

820 thousand new coronavirus cases were reported yesterday. Total death toll has exceeded 1.9 million. Source: worldometers, XTB

820 thousand new coronavirus cases were reported yesterday. Total death toll has exceeded 1.9 million. Source: worldometers, XTB

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?