-

US indices plunged yesterday amid a spike in energy commodity prices. S&P 500 dropped 2.95%, Dow Jones moved 2.37% lower and Nasdaq plunged 3.62%. Russell 2000 moved almost 2.5% lower

-

Stocks in Asia dropped as well. Nikkei moved 1.7% lower, S&P/ASX 200 dropped 0.8% and Kospi declined 1.1%. Indices from China traded 0.8-2.2% lower

-

DAX futures point to a lower opening of the European cash session today

-

Nickel prices on the London Metal Exchange approached $100,000. As Russia is one of key suppliers of the metal, current price gains are driven by concerns over availability of this supply

-

Third round of Russia-Ukraine talks achieved little progress. Both sides agreed to hold more talks in the near future

-

European Union will unveil plan to cut Russian natural gas imports by over 60% within a year

-

A bipartisan group of US politicians proposed a bill to ban imports of Russian oil

-

Goldman Sachs boosted its 2022 oil price forecast and now expects crude prices to average $135 per barrel this year

-

Venezuelan President Maduro said that talks with the United States on oil were polite and constructive

-

ExxonMobil and Chevron began boosting oil production in Permian Basin

-

Oil trades slightly higher while natural gas prices are flat on the day

-

Precious metals gain with palladium jumping 6% and platinum adding 2.5%

-

USD and EUR are the best performing major currencies while AUD and NZD lag the most

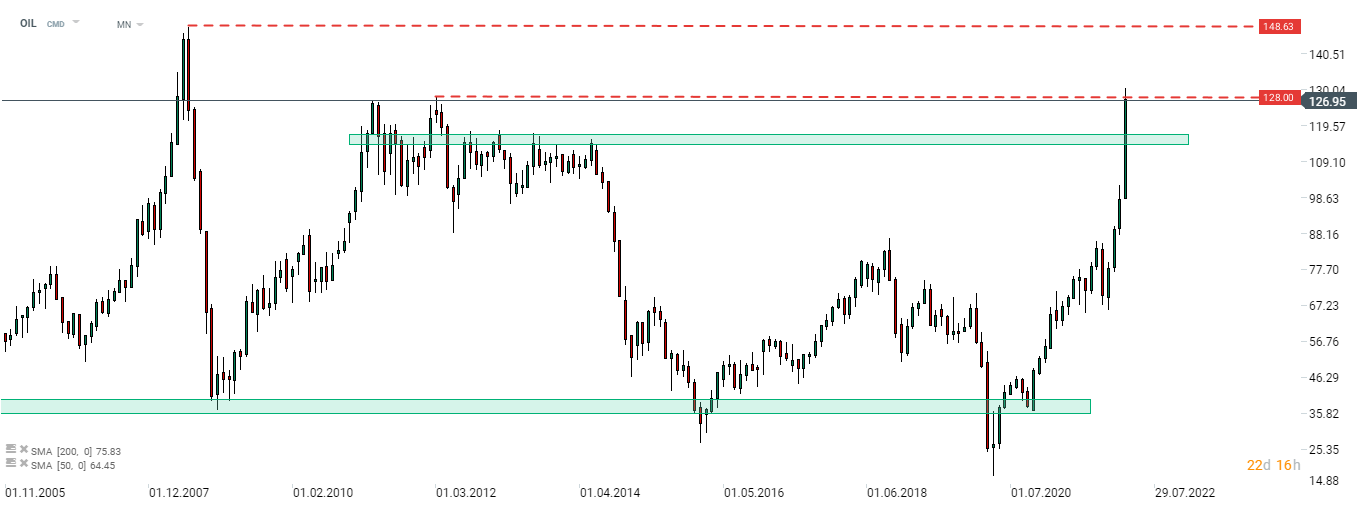

Oil erased part of yesterday's gains and pulled back below local highs from 2012 in the $128.00 area. Source: xStation5

Oil erased part of yesterday's gains and pulled back below local highs from 2012 in the $128.00 area. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉