-

US indices finished yesterday's trading significantly lower following a hawkish testimony from Fed Chair Powell. Powell hinted that Fed is ready to accelerate rate hikes if situation requires it

-

Some banks and institutions are now seeing chance of Fed hiking rates to 6% and holding them there for a longer period of time

-

2y-10y and 2y-30y yield curves are the most inverted in over 4 decades with both spreads exceeding -100 bps

-

S&P 500 dropped 1.53%, Dow Jones moved 1.72% lower and Nasdaq declined 1.25%. Small-cap Russell 2000 traded 1.11% lower

-

Indices from Asia-Pacific traded mostly lower today. S&P/ASX 200 dropped 0.8%, Kospi plunged 1.3%, Nifty 50 dipped 0.5% and indices from China traded 0.3-2.3% lower. Nikkei was outperformer and managed to finished 0.5% higher

-

DAX futures point to a slightly lower opening of the European cash session today

-

RBA Governor Lowe said that rate hike cycle may be paused at the next meeting if incoming data warrants it

-

OPEC Secretary General Al Ghais said that Russian oil production remains resilient

-

According to poll conducted by Reuters, majority of economists surveyed expect Bank of Japan to end yield curve control this year

-

According to Washington Post, US is preparing to lift Covid-19 travel testing restrictions for arrivals from China

-

API report pointed to a 3.83 million barrel drop in US oil inventories (exp. -0.5 mb)

-

Cryptocurrencies are pulling back today. Bitcoin and Dogecoin drop around 0.5% each while Ethereum trades flat

-

Energy commodities trade higher - oil gains 0.4-0.5% while US natural gas prices climb 0.5%

-

Precious metals trade mixed - silver drops 0.1%, gold trades flat and platinum adds 0.5%

-

AUD and USD are the best performing major currencies while JPY and CHF lag the most

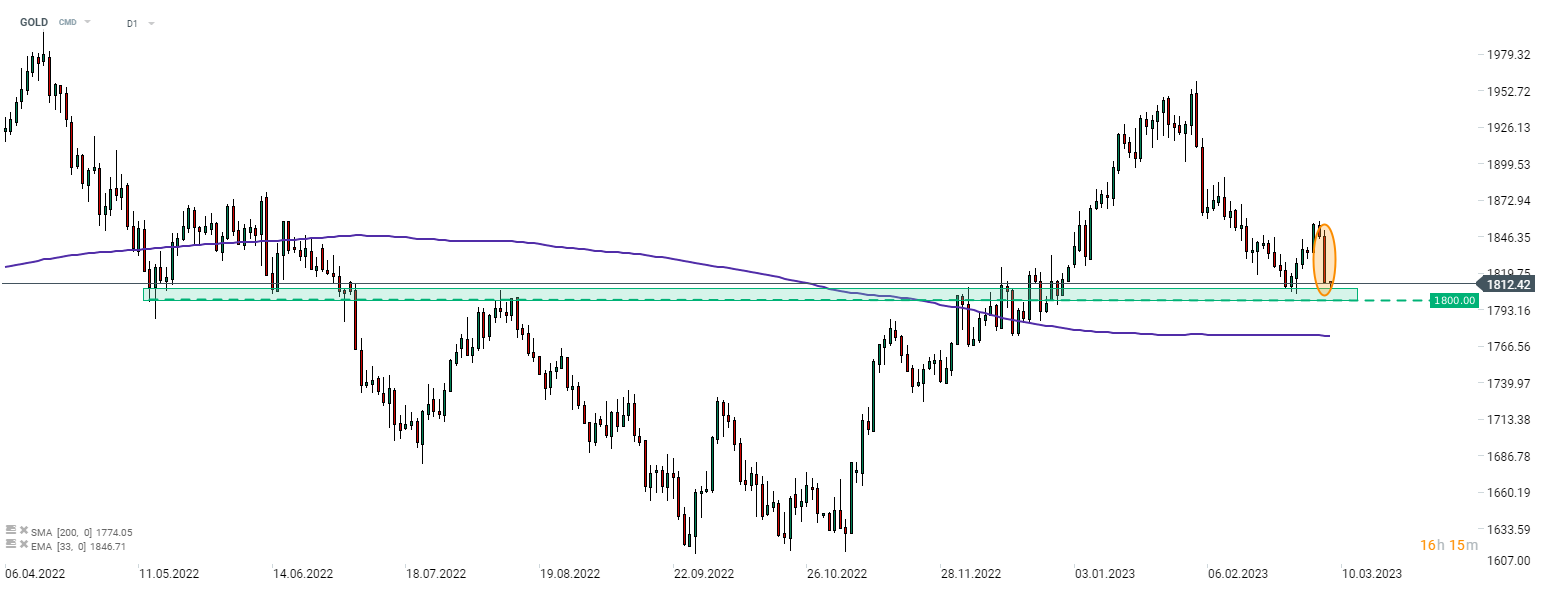

GOLD took a hit yesterday on hawkish Powell testimony and plunged around 2%. Precious metal erased most of the gains made over the previous week and is once again trading near the support zone ranging above $1,800 mark. Source: xStation5

GOLD took a hit yesterday on hawkish Powell testimony and plunged around 2%. Precious metal erased most of the gains made over the previous week and is once again trading near the support zone ranging above $1,800 mark. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30