-

US indices again finished trading at new record levels. S&P 500 gained 0.09%, Dow Jones moved 0.29% higher and Nasdaq added 0.07%. Russell 2000 added 0.23%

-

Asian session today was mixed and moves overall were small. Nikkei dropped 0.75%, S&P/ASX 200 declined 0.24%, Kospi gained 0.08% and indices from China traded 0.2-0.4% higher

-

DAX futures point to a slightly lower opening of the European session

-

Reuters reported that troubled Chinese developer Kaisa asked for external help to pay off workers, investors and suppliers. According to Wall Street Journal, Evergrande had to sell its tech holdings to boost liquidity

-

According to Bloomberg, Fed member Lael Brainard was interviewed by President Joe Biden as one of possible candidates for Fed Chairman post

-

Mastercard will launch cryptocurrency payment cards in Asia

-

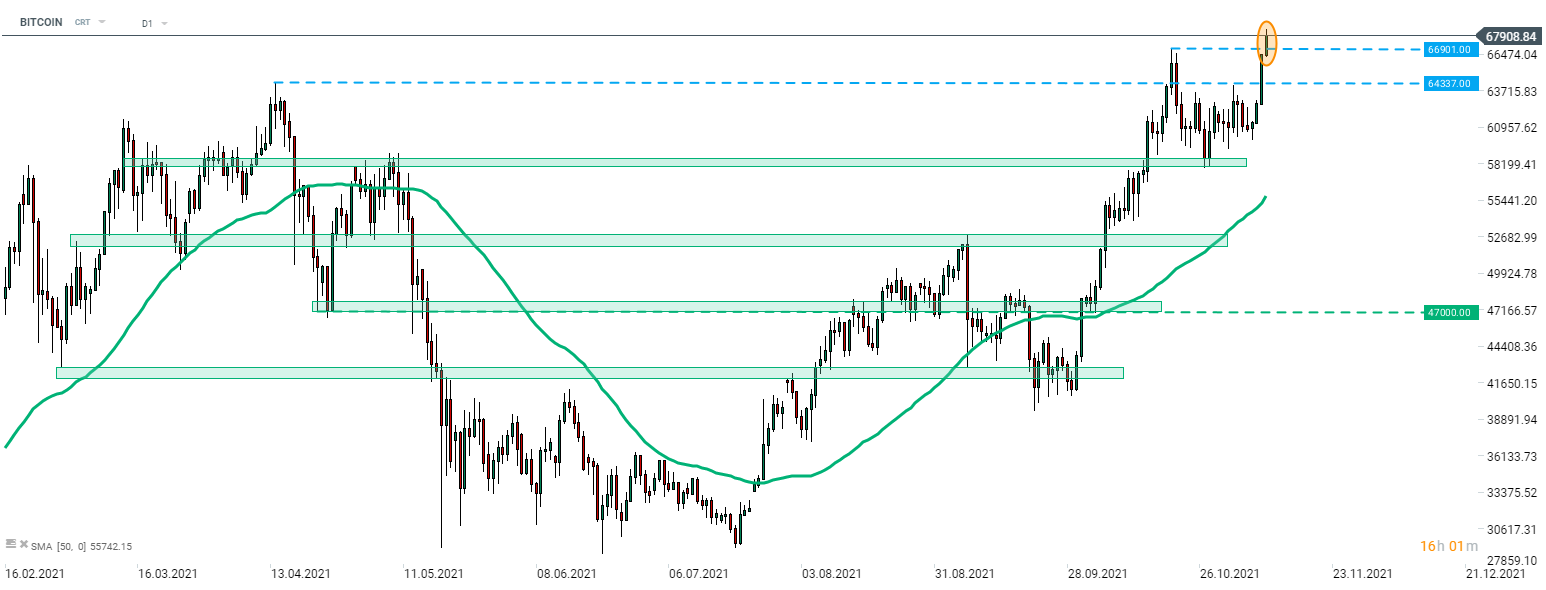

Bitcoin reached a new record high moving near $68,400. Ethereum also reach fresh all-time highs near $4,830

-

Precious metals and industrial metals pull back. Oil gains slightly.

-

CHF and JPY are the best performing major currencies while NZD and AUD are top laggards

BITCOIN extended a strong upward move started during the week. Cryptocurrency reached a fresh all-time high in the $68,400 area but has given back part of the gains since. Source: xStation5

BITCOIN extended a strong upward move started during the week. Cryptocurrency reached a fresh all-time high in the $68,400 area but has given back part of the gains since. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf