-

The first Asian session of a new week turned out to be mixed. S&P/ASX 200 dropped 0.1%, Kospi moved over 1% lower and indices from China gained. Japanese stock market was shut for holiday

-

US and European index futures trade flat compared to Friday's cash close

-

A local Omicron outbreak was detected in Tianjin,China - city that is gateway to Beijing

-

Goldman Sachs expects the Federal Reserve to deliver 4 rate hikes in 2022. Meanwhile, IMF warned to quick pace of Fed rate hikes could have negative impact on asset prices and may weaken demand in the US

-

ECB's Schnabel said that action aimed at helping climate pose an upward risk to inflation in medium-term

-

Output on Tengiz oilfield, the largest in Kazakhstan, has been gradually restored over the weekend after it was disrupted by protests in the country.

-

China will host oil ministers from Saudi Arabia, Kuwait, Oman and Bahrain this week. China asked for talks as it grown concerned about supply security amid violent protests in Kazakhstan

-

Australian building approvals increased 3.6% MoM in November (exp. +0.2% MoM)

-

Major cryptocurrencies traded sideways over the weekend. Ethereum tested $3,000 area but failed to break below while Bitcoin dropped to as low as $40,500 before recovering slightly

-

Precious metals trade lower, industrial metals gain and oil trades flat at the beginning of a new week

-

GBP and AUD are the best performing major currencies while CHF and EUR lag the most

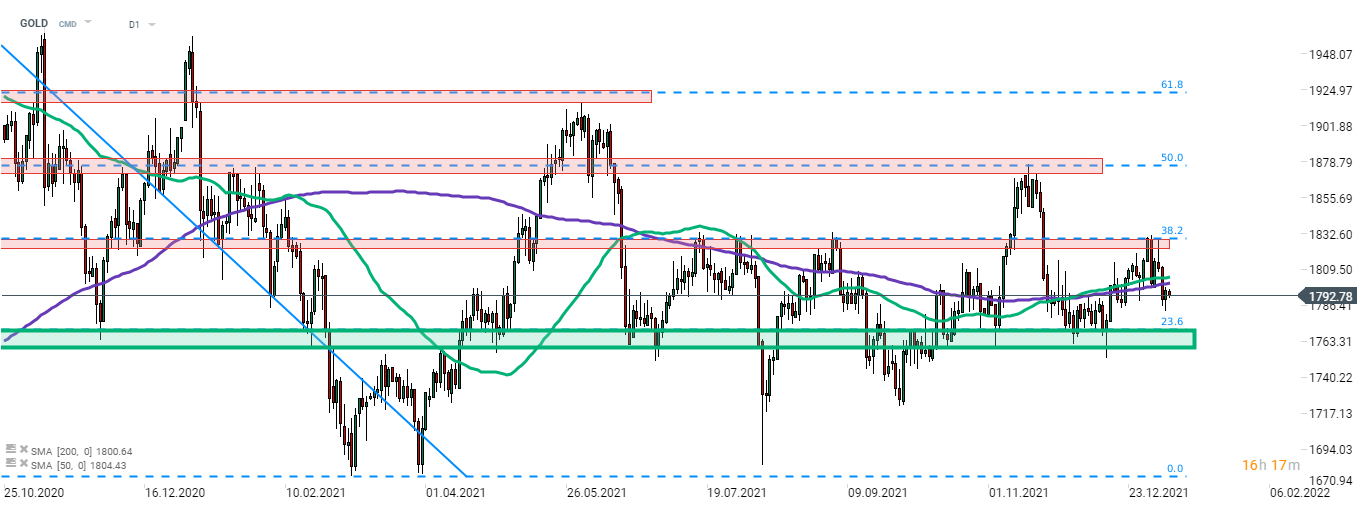

Precious metals trade slightly lower at the beginning of a new week. GOLD continues pullback started last week after a failed attempt of breaking above the resistance zone marked with 38.2% retracement of the downward move launched in August 2020. The nearest support to watch can be found at the 23.6% retracement ($1,770 area). Source: xStation5

Precious metals trade slightly lower at the beginning of a new week. GOLD continues pullback started last week after a failed attempt of breaking above the resistance zone marked with 38.2% retracement of the downward move launched in August 2020. The nearest support to watch can be found at the 23.6% retracement ($1,770 area). Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉