-

US indices finished yesterday's trading lower as tech sector slumped. S&P 500 dropped 1.04%, Dow Jones declined 0.10%, Nasdaq slumped 2.55% and Russell 2000 closed 2.59% lower

-

Stocks in Asia followed into footsteps of their US peers and moved lower. Nikkei plunged over 3%, S&P/ASX 200 moved 1% lower while Kospi dropped 1.6%. Indices from China traded lower as well

-

DAX futures point to a lower opening of the European session

-

US regulator authorized Pfizer vaccine for use in 12-15 age group

-

Fed's Kaplan repeated that it is better to begin taper discussion sooner rather than later

-

Politico reports that Republican Senators could accept higher infrastructure spending than previously announced $568 billion Republican bill

-

Japanese household spending increased 6.2% YoY in March (exp. +1.5% YoY)

-

New Zealand's retail card spending increased 4% MoM in April

-

Chinese CPI inflation accelerated from 0.4% to 0.9% YoY in April (exp. 1% YoY). PPI inflation accelerated from 4.4% to 6.8% YoY (exp. 6.6% YoY)

-

South Korean exports jumped 81.2% YoY during the first 10 days of May while imports were 51.5% YoY higher. Semiconductor exports increased 51.9% YoY

-

Precious metals trade slightly higher. Oil and agricultural goods pull back. Industrial metals advance

-

EUR and CAD are the best performing major currencies while CHF, JPY and USD lag the most

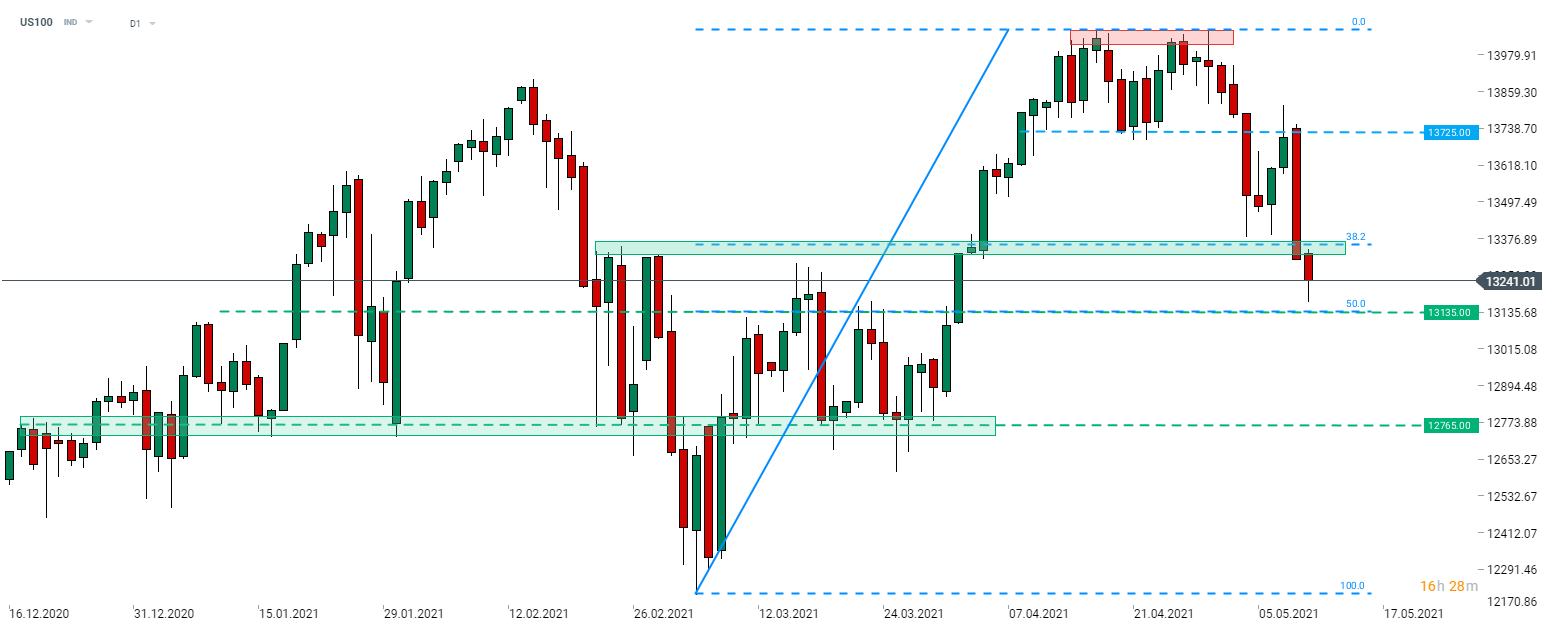

US100 plunged yesterday as tech shares sold off. Index dropped over 2.5% yesterday and the downward move is being continued today. US100 broke below the support zone at 38.2% retracement and trades at the lowest level since the beginning of April. Source: xStation5

US100 plunged yesterday as tech shares sold off. Index dropped over 2.5% yesterday and the downward move is being continued today. US100 broke below the support zone at 38.2% retracement and trades at the lowest level since the beginning of April. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments