-

US indices finished yesterday's trading mixed. S&P 500 gained 0.25%, Dow Jones moved 0.26% lower and Nasdaq added 0.98%. Russell 2000 finished flat

-

Indices from Asia-Pacific traded mostly higher today. Nikkei gains 0.4%, indices from China traded up to 3% higher while Kospi and S&P/ASX 200 finished flat

-

DAX futures point to a slightly higher opening of the European cash session

-

Biden administration will review Trump-era tariffs on China and may drop them in order to lower inflation

-

Fed's Barkin said that central bank will have to decide whether to put the brakes on once Fed rate reaches neutral level. Fed's Mester thinks that rate hikes beyond neutral level will be needed. Fed's Waller thinks that rates can be raised without increasing unemployment

-

US Senate approved Lisa Cook nomination for Fed Board of Governors

-

Chinese CPI inflation accelerated from 1.5 to 2.1% YoY in April (exp. 1.8% YoY). PPI inflation decelerated from 8.3 to 8.0% YoY (exp. 7.7% YoY)

-

South Korean exports increased 8.9% YoY in the first 10 days of May. Semiconductor exports were 10.8% YoY higher

-

API report pointed to a 1.62 million barrel build in US oil inventories (exp. -1.2 mb)

-

Majority of cryptocurrencies is trading slightly higher today. TERRA is an exception as it drops 35% following almost-70% plunge yesterday

-

Oil regained ground and both WTI and Brent are trading around 2.5% higher. WTI climbed back above $100 mark

-

Precious metals benefit from USD weakness. Platinum and silver gain over 1% while gold and palladium trades 0.1% higher

-

AUD and NZD are the best performing major currencies while USD and JPY lag the most

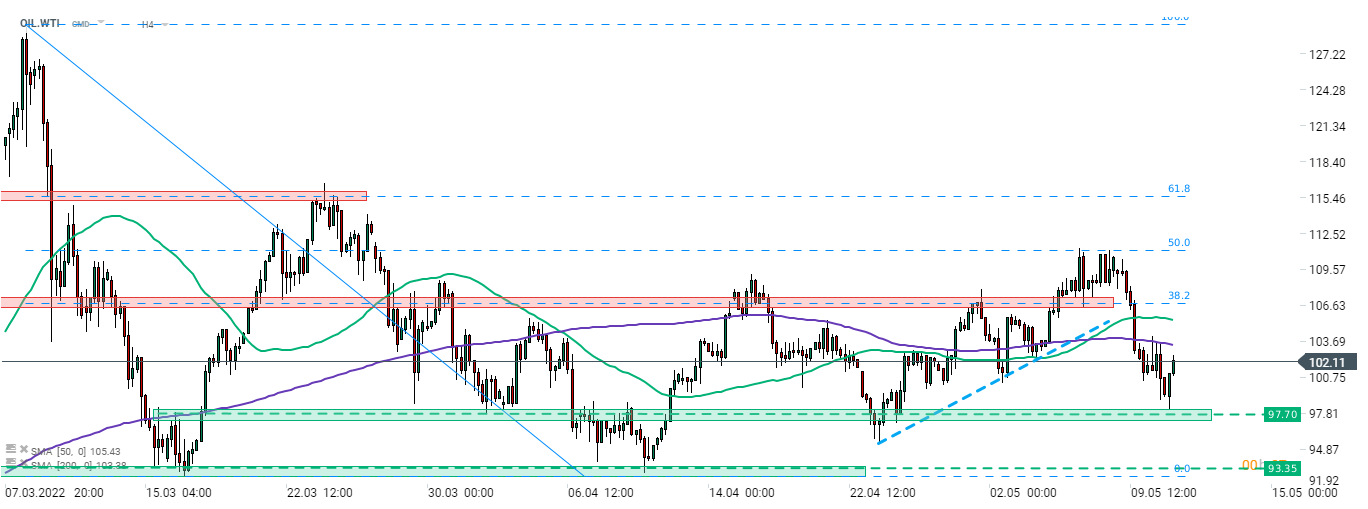

OIL.WTI dipped below $100 per barrel yesterday amid risk asset sell-off. However, bulls managed to regain control and price climbed back above those psychological hurdle. A near-term resistance to watch is marked with 200-period moving average at H4 interval (purple line, $103.40 area). Source: xStation5

OIL.WTI dipped below $100 per barrel yesterday amid risk asset sell-off. However, bulls managed to regain control and price climbed back above those psychological hurdle. A near-term resistance to watch is marked with 200-period moving average at H4 interval (purple line, $103.40 area). Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)