-

US indices finished yesterday's trading mostly higher. S&P 500 gained 0.10%, Dow Jones added 0.46% and Russell 2000 moved 0.20% higher. Nasdaq dropped 0.49%

-

Mixed moods could have been spotted during the Asian session. Nikkei and S&P/ASX 200 gained, Kospi dropped and indices from China traded mixed

-

DAX futures point to a lower opening of the European session

-

US Senate approved $1 trillion infrastructure bill with bipartisan support. House of Representatives will work on the bill now

-

South Korean exports increased 46.4% YoY during the first 10 days of August. Imports were 63.1% YoY higher

-

Singapore Q2 GDP increased 14.7% YoY (exp. 14.2%). On quarter-over-quarter basis Q2 GDP dropped -1.8%

-

API report pointed to a 0.82 million barrel draw in the oil inventories (exp. -1.1 mb)

-

Coinbase reported Q2 revenue at $2.23 billion (exp. $1.77 billion) and EPS at $6.42 (exp. $2.24). Ethereum trading volume on Coinbase exceeded Bitcoin trading volume in Q2 2021

-

Bitcoin trades in the $45,500 area

-

Precious metals trade mixed - gold and platinum gain while silver and palladium drop

-

Oil and industrial metals pull back slightly

-

USD and EUR are the best performing major currencies while JPY and GBP lag the most

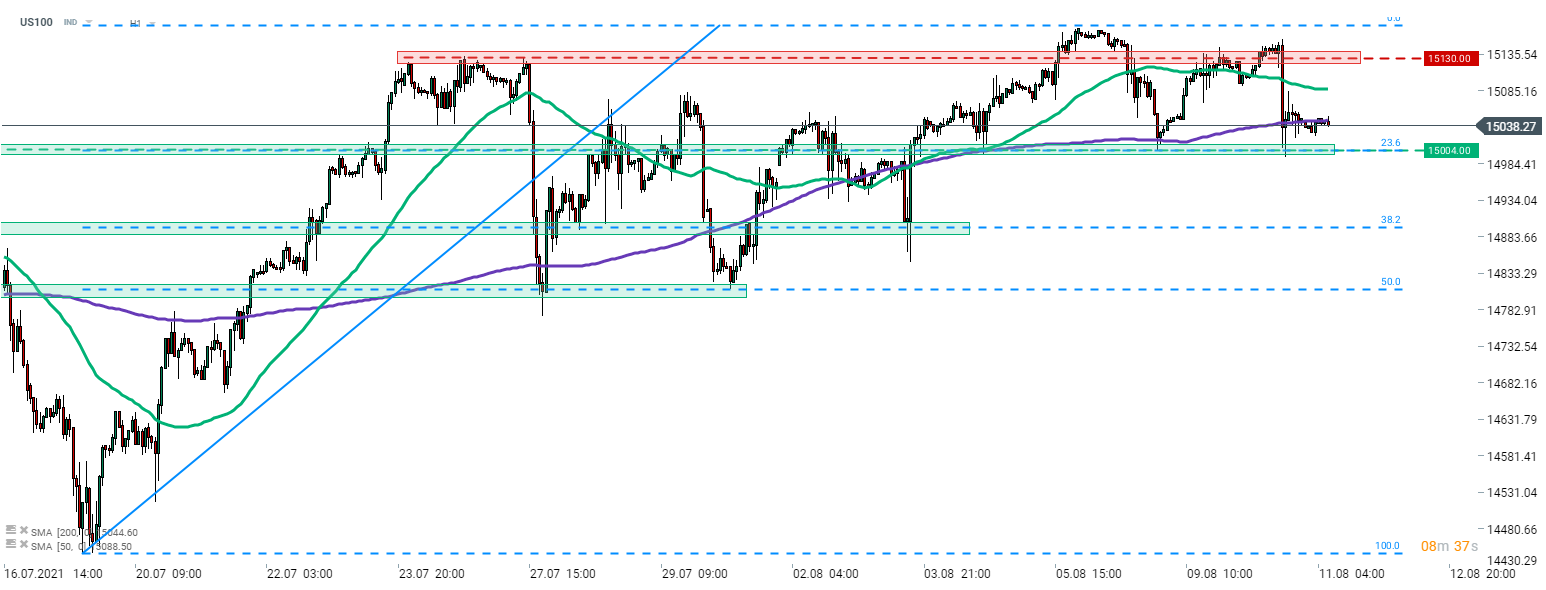

US100 was a laggard among US indices yesterday. Tech index dropped but decline was halted by the 23.6% retracement of the upward move launched in mid-July. The index climbed back towards the 200-hour moving average and has traded sideways since. Source: xStation5

US100 was a laggard among US indices yesterday. Tech index dropped but decline was halted by the 23.6% retracement of the upward move launched in mid-July. The index climbed back towards the 200-hour moving average and has traded sideways since. Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals