- Wall Street indices finished yesterday's trading mixed - S&P 500 dropped 0.19%, Dow Jones gained 0.10%, Nasdaq declined 0.54% and small-cap Russell 2000 added 0.33%

- Indices from Asia-Pacific traded mixed today as well - Nikkei gained 0.5%, S&P/ASX 200 dropped 0.2% while Kospi and Nifty 50 moved 0.8% higher. Indices from China traded 0.5-1.0% lower

- European index futures point to a flat or slightly lower opening of today's cash session on the Old Continent

- UA Zensen, Japan's largest industrial trade union, said that average pay hikes offered by over 230 of its firms this year were the highest since 2013

- Nikkei reports that Bank of Japan plans to discuss whether to end negative rates at next week's meeting

- Mitsubishi UFJ Financial Group (MUFG) expects Bank of Japan to begin tightening policy next week. However, hikes are expected to be gradual following exit from negative interest rates

- US Treasury Secretary Yellen said that it seems unlikely that interest rates will return to pre-pandemic lows

- Fitch expects Fed and ECB to cut rates three times each this year for a total of 75 basis points of easing

- Bitcoin adds 0.8% and is trading near $73,500 mark

- Energy commodities trade slightly higher while precious metals pull back

- NZD and USD are the best performing major currencies, while JPY and CHF lag the most

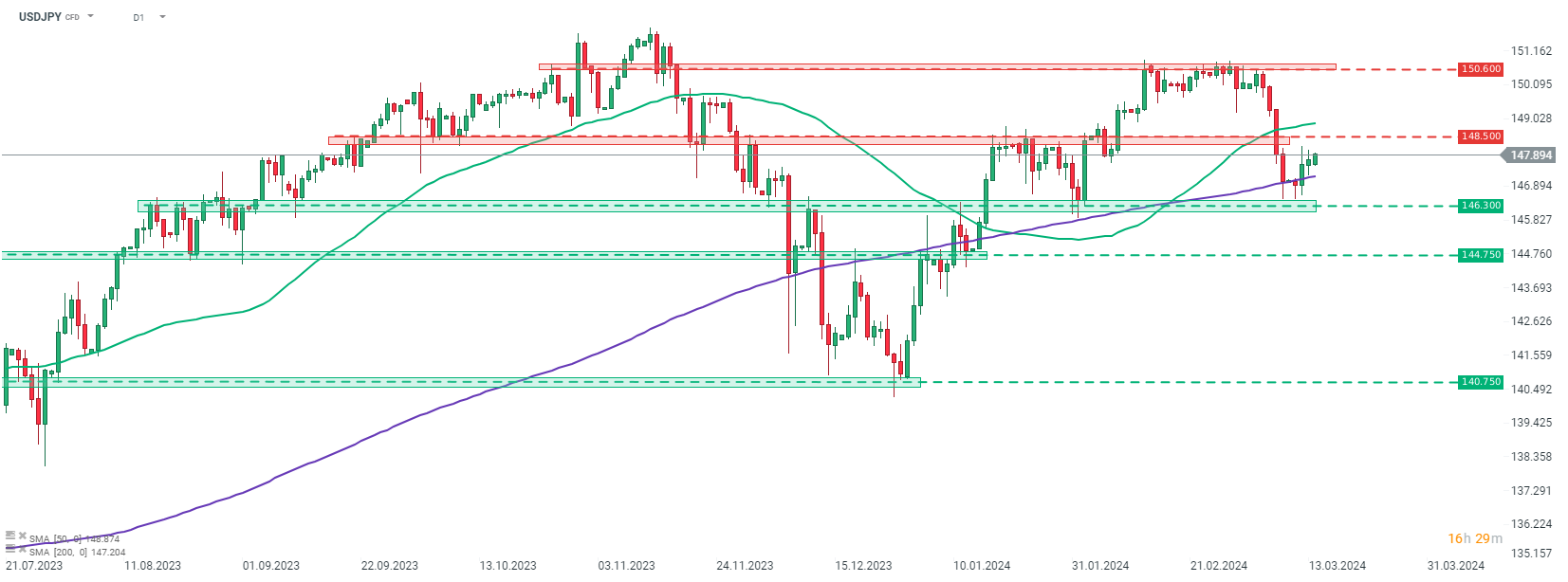

In spite of Japan's largest industrial trade union announcing the biggest wage hikes in a decade, Japanese yen is pulling back today. USDJPY continues a rebound, launched after a failed attempt to break below the 200-session moving average (purple line). Source: xStation5

In spite of Japan's largest industrial trade union announcing the biggest wage hikes in a decade, Japanese yen is pulling back today. USDJPY continues a rebound, launched after a failed attempt to break below the 200-session moving average (purple line). Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸