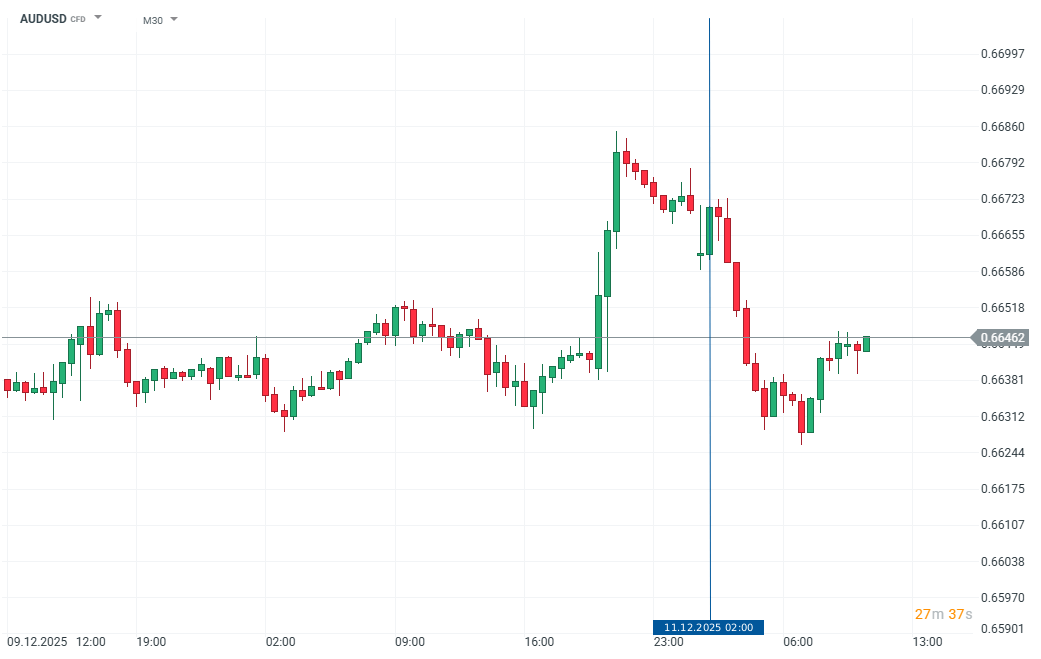

The Australian labor-market report for November came in weaker than expected. As a result, the FX market saw a significant selloff in the Australian dollar, which is currently down between 0.30–0.60% against other G10 currencies.

Employment unexpectedly fell by 21.3K — the largest monthly decline in nine months. The stabilization of the unemployment rate at 4.3% did not calm the market, because the data composition was weak: full-time employment collapsed by 56.5K, participation dropped to 66.7%, and underemployment rose to 6.2%, the highest level in more than a year. The simultaneous decline in both the employed and unemployed populations suggested that some people are leaving the labor force, reinforcing the narrative of a cooling — though not collapsing — labor market. These factors left the AUD under moderate pressure despite a weaker USD following yesterday’s 25 bp Fed rate cut.

Despite this weakness, the downside potential for AUD remains partly limited by the still-hawkish stance of the RBA. Governor Michele Bullock reminded this week that the Board actively discussed scenarios requiring a rate hike, stressing that “it is wrong to assume” the RBA is unwilling to tighten policy if inflation remains sticky. Economists broadly agree that the labor market is loosening gradually, while labor costs, rebounding inflation, and persistently high capacity utilization remain areas of concern for the Bank. As a result, the market does not expect rate cuts, and part of the market even sees a risk of a hike in 2026 if inflation accelerates again. For now, the mixed labor-market data complicate the short-term outlook but do not fundamentally alter the RBA’s stance.

AUDUSD has fallen 0.40% to 0.6645, erasing part of Wednesday’s gains triggered by the Fed decision.

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment