-

US indices rallied yesterday and finished trading significantly higher. S&P 500 added 1.71%, Dow Jones gained 1.56% and Nasdaq jumped 1.73%. Solid earnings from US banks supported upbeat moods

-

Positive moods extended into the Asian session with Nikkei jumping 1.6%, S&P/ASX 200 adding 0.6% and Kospi moving 0.9% higher. Indices from China traded higher

-

DAX futures point to a flat opening of today's cash trading session in Europe

-

US State Department is trying to convince OPEC+ to boost output and stabilize prices

-

Fed's Harker said he does not expect rate to be hiked until late-2022 or early-2023

-

TSMC, world's largest semiconductor manufacturer, will build a new facility in Japan. New factory will commence operations in 2024

-

According to Nikkei report, Toyota will cut global production by 15% in November amid semiconductor shortage

-

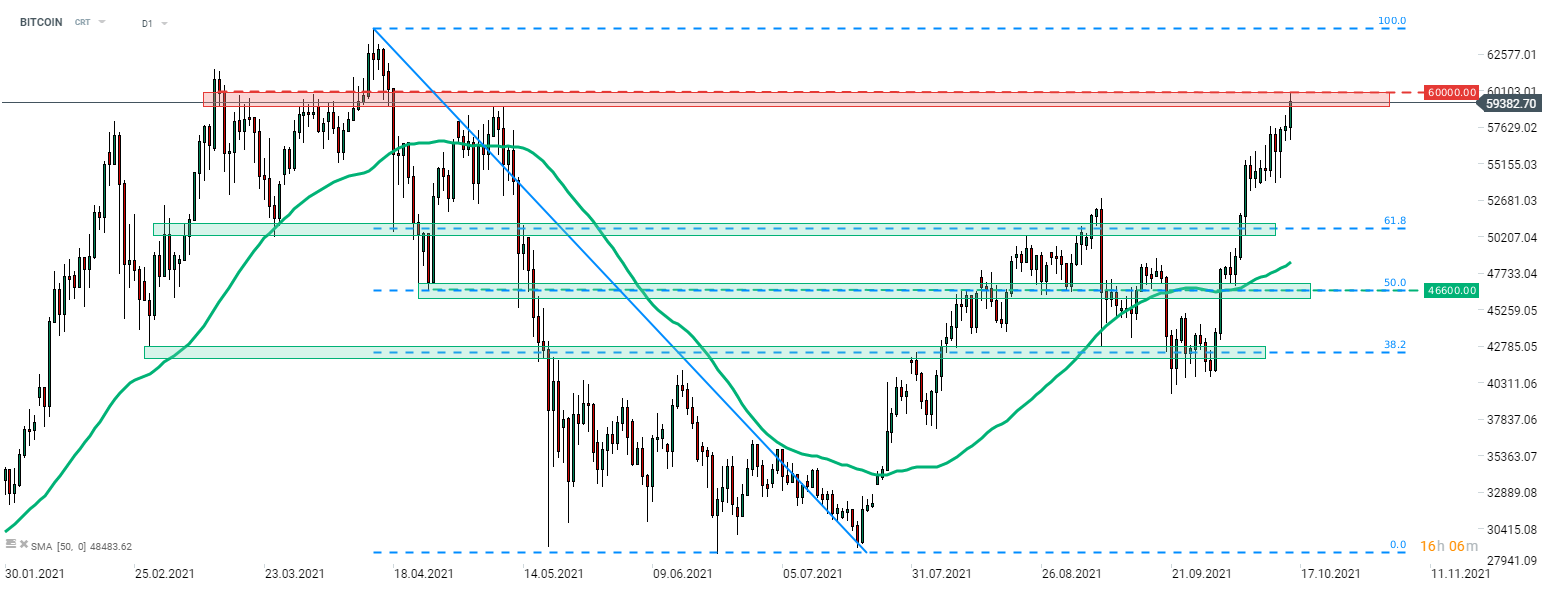

US SEC will reportedly not oppose launch of Bitcoin futures ETF. Cryptocurrencies jumped on the news with Bitcoin testing $60,000 mark for the first time since mid-April 2021

-

Precious metals trade mixed - gold and platinum drop while silver and palladium gain

-

Brent and WTI are trading almost 1% higher on the day. Industrial metals pull back

-

AUD and NZD are the best performing major currencies while safe haven currencies - JPY and CHF - lag the most

Bitcoin rallied on news that SEC will not oppose launch of Bitcoin futures ETF. Coin caught a bid and tested the $60,000 mark. So far, bulls failed to break above but Bitcoin continues to trade within the resistance area ranging below this hurdle. Source: xStation5

Bitcoin rallied on news that SEC will not oppose launch of Bitcoin futures ETF. Coin caught a bid and tested the $60,000 mark. So far, bulls failed to break above but Bitcoin continues to trade within the resistance area ranging below this hurdle. Source: xStation5

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks