-

US indices dropped yesterday but managed to close off the daily lows. S&P 500 dropped 0.75%, Dow Jones moved 0.30% lower and Nasdaq dipped 1.14%

-

Trading in Asia was mixed today - Nikkei gained slightly, S&P/ASX 200 moved lower and Kospi traded flat. Indices from China dropped following miss in monthly activity data

-

Chinese industrial production increased 3.8% YoY in November (exp. 3.6% YoY), retail sales were 3.9% YoY higher (exp. 4.6% YoY) while urban investments jumped 5.2% YoY (exp. 5.4% YoY)

-

DAX futures point to a slightly higher opening of today's European cash session

-

US Congress passed a bill raising debt limit to $2.5 trillion

-

US House passed a legislation banning goods made using forced labour in China

-

Bank of Japan Governor Kuroda said that Japanese economy is not in stagflation and that he sees a chance for price growth to reach a 2% goal

-

UK CPI inflation accelerated from 4.2 to 5.1% YoY in November (exp. 4.7% YoY). Core gauge accelerated from 3.4 to 4.0% YoY

-

API report pointed to 0.81 million barrel draw in US oil inventories (exp. -2.5 mb)

-

Major cryptocurrencies managed to recover slightly yesterday and are trading flat today. Bitcoin trades near $48,000 mark

-

Precious metals, oil and industrial metals move lower

-

USDTRY approaches recent all-time highs above the 14.60 area

-

EUR and AUD are the best performing major currencies while CHF and JPY lag the most

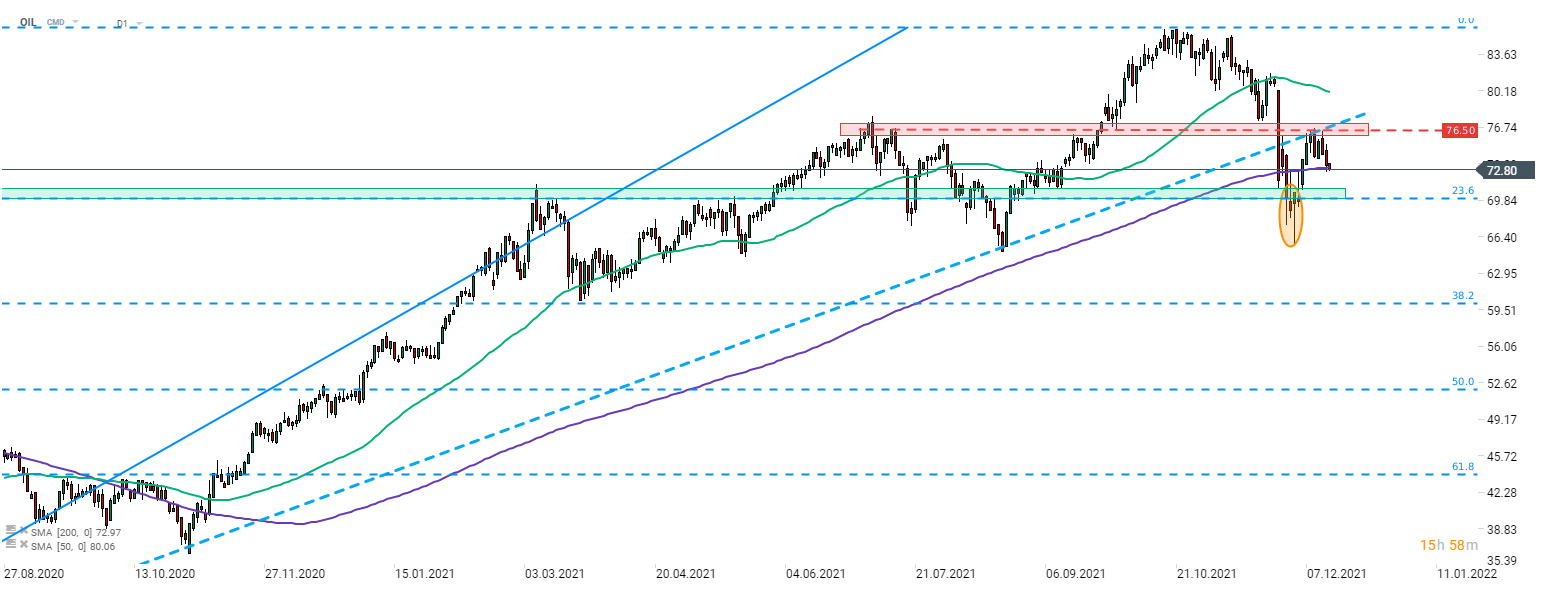

Brent (OIL) attempted to make a break below the $70 handle at the beginning of December but bulls managed to defend the area. However, subsequent upward move was halted at the $76.50 resistance and drop was resumed. Price is currently testing the 200-session moving average - a historically important technical level. Source: xStation5

Brent (OIL) attempted to make a break below the $70 handle at the beginning of December but bulls managed to defend the area. However, subsequent upward move was halted at the $76.50 resistance and drop was resumed. Price is currently testing the 200-session moving average - a historically important technical level. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)