-

Asian indices launched a new week higher. Nikkei gained 0.7%, S&P/ASX 200 added 0.3% while indices from China traded 0.4-1.5% higher. Kospi was a laggard, dropping over 1% today

-

DAX futures point to a higher opening of the European cash session today

-

Chinese GDP growth reached 1.6% QoQ (exp. 1.1% QoQ) and 4% YoY (exp. 3.6% YoY)

-

Chinese retail sales increased 1.7% YoY in December (exp. 3.7% YoY), industrial production was 4.3% YoY higher (exp. 3.6% YoY) while urban investments were 4.9% YoY higher (exp. 4.8% YoY)

-

People's Bank of China lowered 1-year medium term lending facility and 7-day reverse repo rate by 10 bps

-

First cases of Omicron infection were detected in Beijing, China just 3 weeks ahead of Winter Olympics

-

Goldman Sachs expects US GDP growth to reach 3.4% in 2022, down from 5-6% in 2021

-

ECB Schnabel said that premature rate hike may halt economic recovery

-

According to data from BitPay, share of Bitcoin in cryptocurrency payments dropped from 92% in 2020 to around 65% in 2021

-

USD and CAD are the best performing major currencies while JPY and CHF lag the most

-

Precious metals trade a touch higher in spite of USD strengthening. Brent and WTI trade around 0.5% higher each

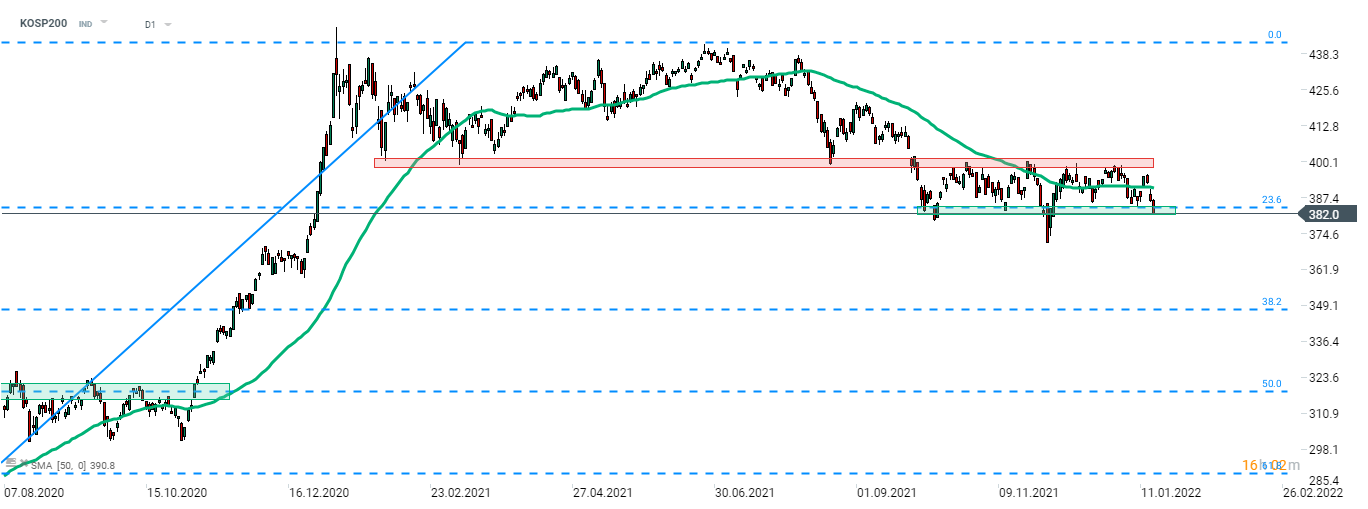

KOSPI (KOSP200) has been top laggard among Asian indices today. The index dropped over 1% and is threatening to break below the support zone at 23.6% retracement of post-pandemic recovery that serves as the lower limit of the current trading range (382 area). Source: xStation5

KOSPI (KOSP200) has been top laggard among Asian indices today. The index dropped over 1% and is threatening to break below the support zone at 23.6% retracement of post-pandemic recovery that serves as the lower limit of the current trading range (382 area). Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals