-

US indices finished yesterday's trading lower as higher-than-expected US PPI reading for January added to inflation concerns. S&P 500 dropped 1.38%, Dow Jones moved 1.26%, Nasdaq plunged 1.78% and Russell 2000 dropped 0.98%

-

Indices from Asia-Pacific followed into footsteps of US peers and traded lower today. Nikkei dropped 0.7%, S&P/ASX 200 traded 0.9% lower, Kospi declined 1% and Nifty 50 traded 0.3% down. Indices from China traded up to 1% lower

-

DAX futures point to a lower opening of the European cash session

-

US President Biden said that he expects to speak with Chinese counterpart, Xi Jinping, soon. However, relations between China and the United States are strained following the shooting down of a Chinese balloon. Moreover, Financial Times reports that senior Pentagon official will make a trip to Taiwan what is unlikely to brighten up relations between China and the US

-

Fed Mester said that recent data shows demand not softening as expected. She also said that Fed will have to go above 5% and keep rates there for a while

-

RBA Governor Lowe said that if "things go right" rate cuts could come as soon as 2024. However, Lowe also said that rate hike cycle in Australia is not over yet as inflation remains high and damaging

-

Shinichi Uchida, Bank of Japan official, said that BoJ decided to launch a pilot central bank digital currency (CBDC) this April. Program will be aimed at testing technical feasibility of such solutions

-

New Zealand Finance Minister Robertson say that there is evidence suggesting that inflation has peaked already

-

Saudi Energy Minister bin Salman said that the output deal struck in October will remain in place for the full 2023. He also said that he is skeptical about quick pick-up in Chinese demand following economic reopening

-

While decent gains can be spotted on most altcoins, major cryptocurrencies are lagging behind. Bitcoin drops 1.5%, Ethereum trades 0.5% higher, Litecoin declined 0.4% and Ripple trades 0.5% down

-

Energy commodities trade mixed - oil drops around 0.5% while US natural gas rallies 4%

-

Precious metals are pulling back as USD strengthens - gold drops 0.6% and silver trades 0.8% down

-

USD and CAD are the best performing major currencies while JPY and NZD lag the most

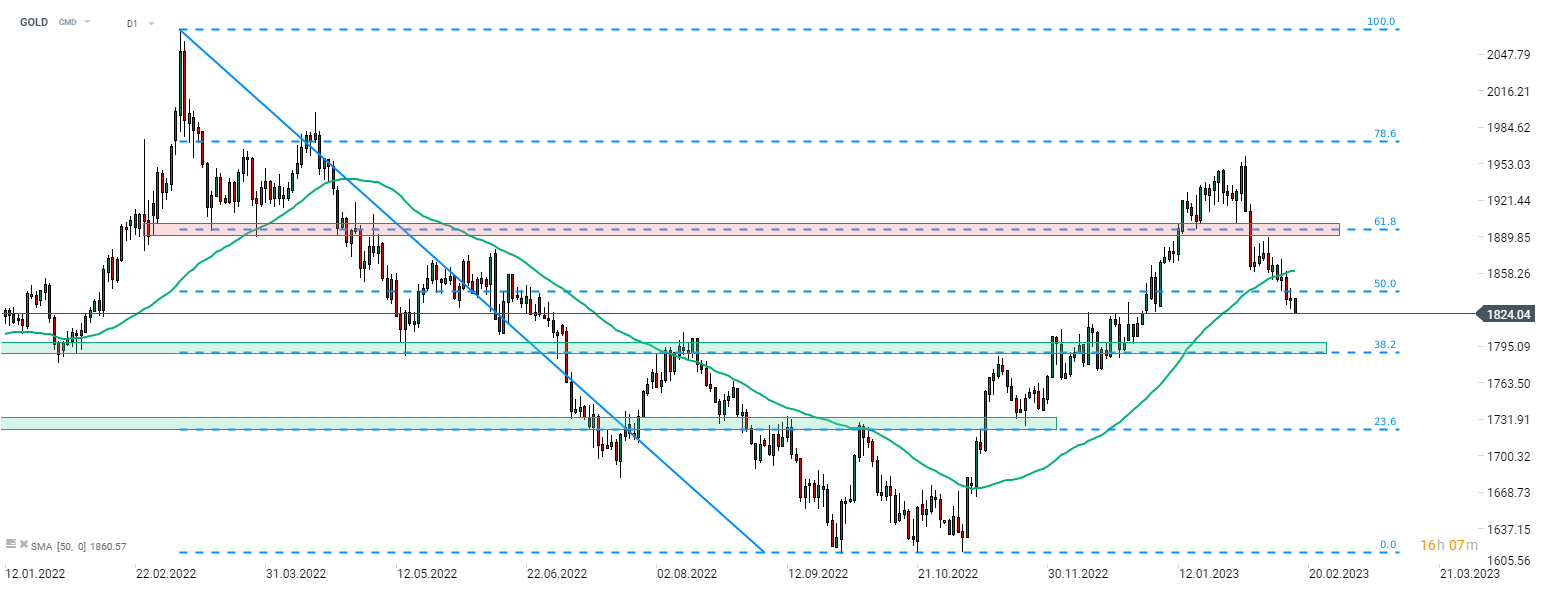

Strong USD, driven by hawkish Fed speakers, is putting a break on the recent gold market rally. GOLD has already pulled back around 7% off a recent high. Source: xStation5

Strong USD, driven by hawkish Fed speakers, is putting a break on the recent gold market rally. GOLD has already pulled back around 7% off a recent high. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30