-

US indices dropped yesterday and erased all of the post-FOMC jump. S&P 500 dropped 0.87%, Nasdaq slumped 2.47%, Russell declined 1.95% while Dow Jones finished 0.08% lower

-

Major indices from Japan and China dropped over 1% today, following into footsteps of their US peers. S&P/ASX 200 gained 0.1% while Kospi added almost 0.4%

-

DAX futures point to a lower opening of today's European cash session

-

The Bank of Japan decided to leave interest rates and yield targets unchanged. BoJ may start slowing purchases under its pandemic relief programmes early next year

-

China revised 2020 GDP growth data down from 2.3 to 2.2%

-

According to Politico report, White House acknowledged that 'Build Back Better' infrastructure bill is not going to get through the Congress this year

-

United Kingdom and Australia signed post-Brexit trade deal. Deal includes removal of most of the tariffs on goods

-

According to Goldman Sachs, impact of Omicron on oil demand and mobility has been small so far

-

Turkish lira dropped to a fresh record lows with USDTRY jumping past 16.00 and EURTRY moving above 18.00

-

CHF and JPY are the best performing major currencies while commodity currencies (AUD, CAD, NZD) lag the most

-

Precious metals gain, oil drops and industrial metals trade mixed

-

Cryptocurrencies are trading slightly lower. Bitcoin trades near $47,500 while Ethereum tests $3,950 area

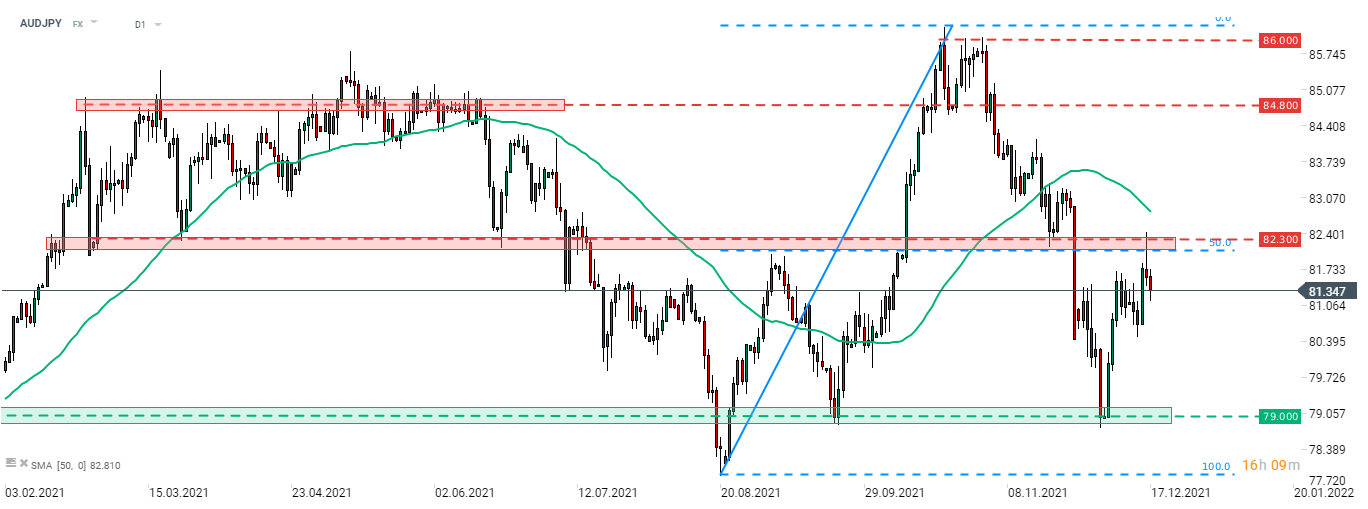

AUDJPY experienced a big reversal yesterday and halted upward correction at the resistance zone marked with 50% retracement of the upward move started in August 2021. Pullback is deepening today, thanks to the strength of the Japanese currency. Near-term support zone can be found in the 79.00 area. Source: xStation5

AUDJPY experienced a big reversal yesterday and halted upward correction at the resistance zone marked with 50% retracement of the upward move started in August 2021. Pullback is deepening today, thanks to the strength of the Japanese currency. Near-term support zone can be found in the 79.00 area. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)