-

US indices finished yesterday's trading near daily highs. S&P 500 and Dow Jones gained 1.23% each, Nasdaq added 1.33% and Russell 2000 jumped 1.69%

-

Indices from Asia-Pacific also traded higher with Nikkei and S&P/ASX 200 gaining 0.6% and Kospi adding 0.5%. Indices from China traded 0.3-1.4% higher

-

DAX futures point to a more or less flat opening of the European session

-

US President Biden will hold a phone call with Chinese President Xi today at 13:00 pm GMT

-

Western intelligence agencies claim that Russia has made no significant progress in its invasion and resorts to bombing cities and carrying out rocket attacks on military targets

-

S&P lowered the Russian rating to "CC". Russia made coupon payments on its USD bonds due earlier this week but ratings agency sees high chance of default in the coming weeks

-

Bank of Japan left interest rates and other monetary policy settings unchanged at today's meeting, in-line with expectations. Assessment of the economy was downgraded

-

US officials said that talks with Iran are on the finishing line

-

Oil is trading higher this morning with WTI gaining over 2% on the day. Brent trades near $106.30 per barrel while WTI approaches $104.50

-

Precious metals trade mixed - gold and silver drop while palladium and platinum gain

-

Cryptocurrencies are pulling back slightly. Bitcoin trades near $40,700 while Ethereum drops below $2,800

-

AUD and NZD are the best performing major currencies while JPY and EUR lag the most

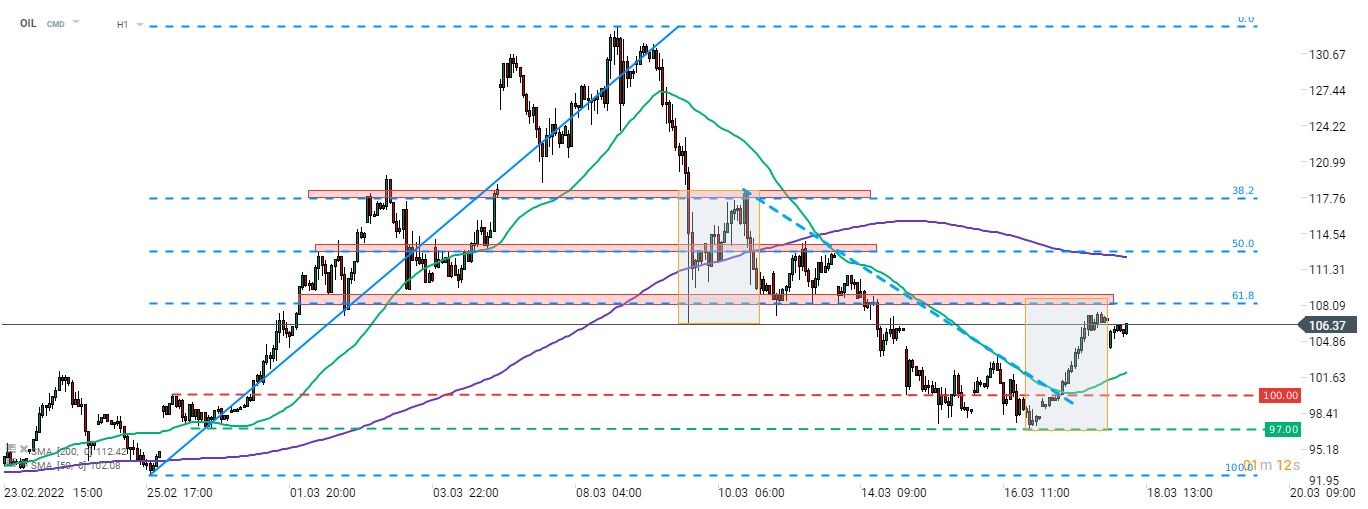

Brent (OIL) broke above the short-term downward trendline and jumped above $106 per barrel. Price is looking towards the resistance zone in the $108 area, marked with 61.8% retracement, previous price reactions and the upper limit of a local market geometry. Source: xStation5

Brent (OIL) broke above the short-term downward trendline and jumped above $106 per barrel. Price is looking towards the resistance zone in the $108 area, marked with 61.8% retracement, previous price reactions and the upper limit of a local market geometry. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉