-

Stock market indices from Asia-Pacific region traded higher at the beginning of a new week. Nikkei gained 0.5%, S&P/ASX 200 jumped 1% and Kospi rallied 1.8%. Indices from China traded 0.8-2.7% higher

-

European and US index futures trade higher

-

Joe Biden's visit to Saudi Arabia did not result in any announcement of oil output increase by Saudis

-

Amos Hochstein, senior energy security adviser to US State Department, said, however, that he is confident OPEC will increase output based on what he heard during Middle East trip

-

China reported the highest new daily Covid-19 case count in almost 3 months. However, no new cases outside quarantine were reported in Shanghai. Mass testing will be carried out in 9 districts of Shanghai on July 19-21

-

New Zealand CPI inflation jumped from 6.9% to 7.3% YoY in Q2 2022 (exp. 7.1% YoY)

-

Cryptocurrencies rally with Bitcoin trading 3.5% higher and Ethereum gaining 5%. Polygon (+15%) and Avalanche (+10%) lead

-

Oil benefits from risk-on moods and lack of output increase announcement from Saudi Arabia. Brent gains 1.7% while WTI trades 1.4% higher

-

Precious metals advance - gold gains 0.6% while platinum and silver jump 1.3%

-

GBP and CAD are the best performing major currencies while USD and NZD lag the most

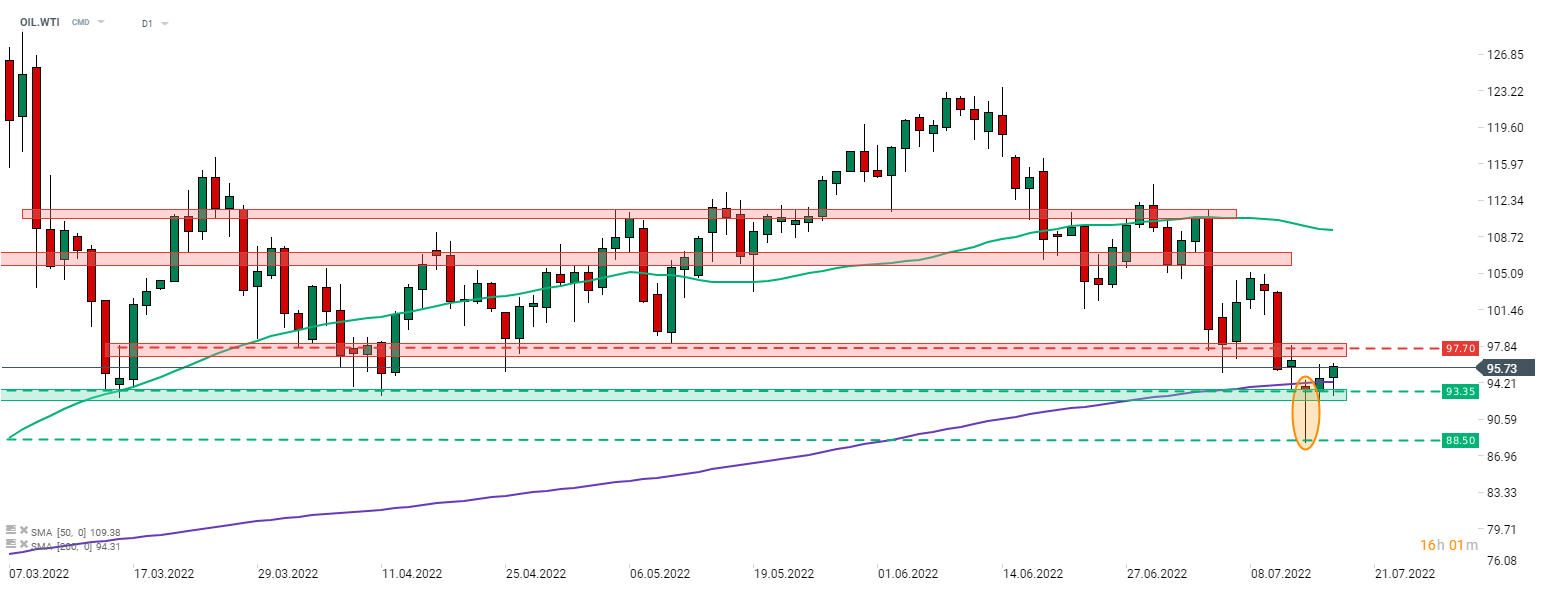

Joe Biden failed to reach an agreement on oil output increase with Saudi Arabia. This coupled with improvement in risk moods fuels today's gains on the oil market. WTI (OIL.WTI) gains 1.4% and continues recovery after painting a bullish hammer pattern. Source: xStation5

Joe Biden failed to reach an agreement on oil output increase with Saudi Arabia. This coupled with improvement in risk moods fuels today's gains on the oil market. WTI (OIL.WTI) gains 1.4% and continues recovery after painting a bullish hammer pattern. Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!