-

Indices from Asia-Pacific traded mostly lower today - Japanese Nikkei is up 1.50%, S&P/ASX 200 moved 0.12% lower, Kospi is down 0.55%, indices from China traded 1.40% lower

-

Asian equities had a sluggish performance on Tuesday due to China's slow economic recovery, leading to reduced growth estimates and a warning from US Treasury Secretary Yellen about its global impact.

-

US bank regulators are expected to propose new capital regulations next week, with stricter rules for mortgage capital compared to the Basel standard.

-

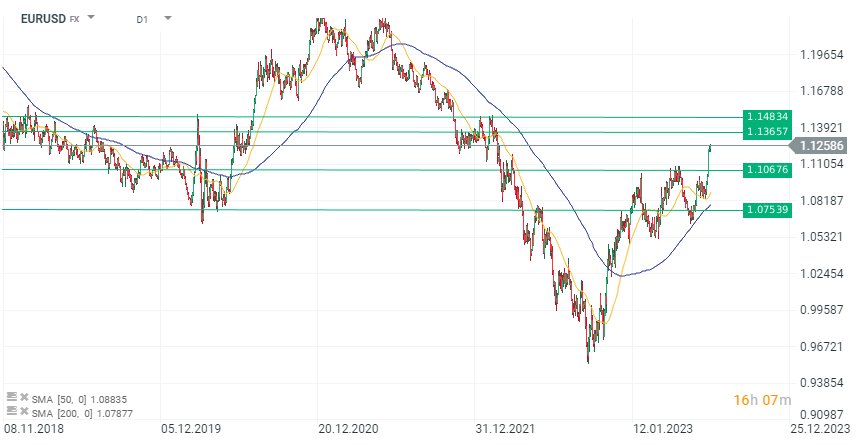

The dollar experienced a slight decline against major currencies with EURUSD trading 0.2% higher.

-

Yellen expressed optimism about the US path to reducing inflation without significantly affecting the labor market.

-

Concern is growing in Asia after China's weak economic data led to lowered growth forecasts by major institutions. This situation puts Beijing's official GDP target at risk.

-

Australia's Treasurer Chalmers expressed ongoing concern about inflation but expects moderation in future data.

-

The Reserve Bank of Australia (RBA) minutes highlighted their commitment to reducing inflation, particularly in service sectors like rents, energy, and food.

-

The RBA minutes also noted a tight labor market and low productivity contributing to labor expenses, and the need for additional monetary tightening may be considered in the future.

EURUSD - the dollar continues to remain weak against other currencies, particularly against the euro. The EURUSD pair continues its upward movement, gaining 0.23% today to reach 1.126.

EURUSD - the dollar continues to remain weak against other currencies, particularly against the euro. The EURUSD pair continues its upward movement, gaining 0.23% today to reach 1.126.

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸