-

US indices slumped yesterday as Treasury yields jumped. S&P 500 dropped 1.83%, Dow Jones moved 1.51% lower and Nasdaq slumped 2.60%. Russell 2000 plunged 3.06%

-

Indices from Asia-Pacific followed into footsteps of their US peers and also moved lower. Nikkei slumped 2.8%, S&P/ASX 200 moved 1% lower and Kospi dropped 0.7%. Indices from China traded lower

-

DAX futures point to a lower opening of the European cash session

-

Oil prices jumped after an oil pipeline between Iraq and Turkey was shut down following an explosion. Brent reached overnight high near $89 per barrel

-

Members of Conservative Party want to trigger a confidence vote in Prime Minister Boris Johnson and oust him from the post

-

White House spokesperson said that US administration has tools to combat rising oil prices and that it can engage with OPEC if needed

-

According to OPEC monthly report, cartel does not expect Omicron or tighter monetary policy to derail oil demand

-

According to Telegraph report, UK authorities will lift Covid restrictions today

-

Precious metals trade mixed - gold trades flat, silver gains while platinum and palladium drop

-

JPY and NZD are the best performing major currencies while USD and CAD lag the most

-

Cryptocurrencies trade slightly lower. Bitcoin dropped below $42,000 while Ethereum tests $3,100 area

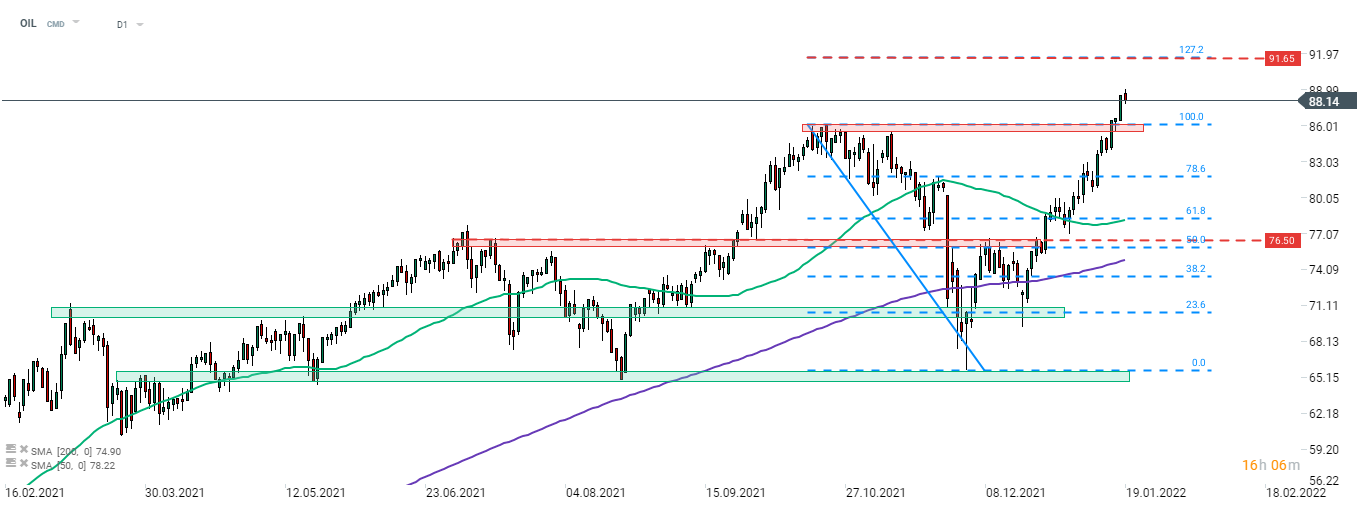

Oil prices leaped higher on the news that the largest Iraqi oil pipeline has been shut down due to an explosion. Brent (OIL) reached a daily high near $89 per barrel. However, part of the gains was erased already and oil is trading slightly lower on the day. Source: xStation5

Oil prices leaped higher on the news that the largest Iraqi oil pipeline has been shut down due to an explosion. Brent (OIL) reached a daily high near $89 per barrel. However, part of the gains was erased already and oil is trading slightly lower on the day. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)