-

Stocks in Asia are trading higher at the beginning of a new week. S&P/ASX 200 gained around 0.2%, Kospi moved 0.3% higher and indices from China gained over 1%. Nikkei dropped slightly

-

DAX futures point to a higher opening of the European session

-

Axios claims that President Biden is reportedly ready to accept corporate tax hike to 25%, instead of 28%

-

Total coronavirus death toll exceeded 3 million over the weekend. There were 142 million confirmed cases so far and 120.5 million recoveries

-

The United Kingdom will move part of its navy fleet into the Black Sea in May amid rising Russia-Ukraine tensions. Russia is also boosting presence of its warships

-

Japanese industrial production declined 1.3% MoM in February (exp. -2.1% MoM)

-

Japanese exports increased 16.1% YoY in March (exp. 11.6% YoY) while imports increased 5.7% YoY (exp. 4.7% YoY)

-

CME rejected rumours saying that it plans to launch Dogecoin futures

-

Bitcoin plunged over 10% during the weekend and trades near $56,000 mark

-

Precious metals trade mixed while oil trades lower

-

GBP and NZD are the best performing major currencies while CHF and EUR lag the most

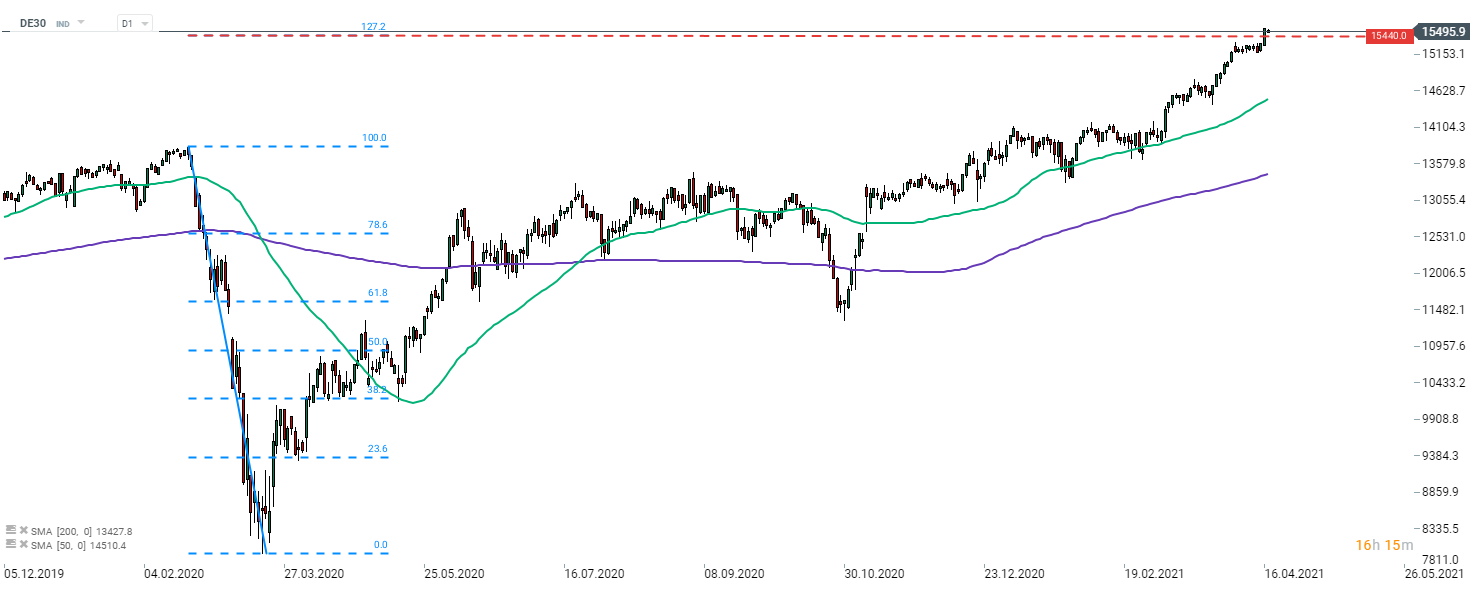

DE30 jumped above 127.2% retracement of the 2020 pandemic shock last week. Index is seen launching today's cash session near 15,500 pts - the highest cash opening in history. Source: xStation5

DE30 jumped above 127.2% retracement of the 2020 pandemic shock last week. Index is seen launching today's cash session near 15,500 pts - the highest cash opening in history. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments