-

Indices from Asia-Pacific traded lower during the first trading session of a new week. Nikkei dropped 1.2%, Kospi traded 0.9% lower, Nifty 50 declined 0.2% and indices from China traded up to 1.6% lower. Australian S&P/ASX 200 was an outperformer, gaining 0.6%

-

European index futures point to a slightly lower opening of the cash session on the Old Continent today

-

US index futures trade slightly below Friday's cash closing prices

-

No major statements came after a weekend meeting between US Secretary of State Blinken and Chinese Foreign Minister Qin Gang

-

Fed Goolsbee said that a pause allows Fed to better assess economic developments before

-

Igor Sechin, head of Russian Rosneft, said that it seems appropriate to monitor not only production quotas but also export volumes as Russia is selling around half of its output to the world while some OPEC+ countries sell up to 90% of their output

-

According to Bloomberg report, Iranian oil exports are at almost a 5 year high, reaching the highest level since United States reimposed sanction in 2018, with majority of exports being to China

-

Goldman Sachs cut 2023 GDP growth forecast for China from 6.0 to 5.4%. Forecast for 2024 was lowered from 4.6 to 4.5%. According to Goldman Sachs, stimulus in China won't be enough to generate a strong growth impulse

-

Nomura cut its 2023 GDP growth forecast for China from 5.5 to 5.1%

-

UBS lowered its 2023 GDP growth forecast for China from 5.7 to 5.2%

-

Cryptocurrencies are trading mostly higher at the beginning of a new week. Bitcoin gains 0.1%, Ethereum trades flat while Dogecoin and Ripple gain 0.6% each

-

Energy commodities pull back - Brent and WTI trade around 1.1% lower while US natural gas prices drop 1.3%

-

Precious metals trade mixed - gold and palladium trade around 0.1% higher while silver and platinum drops around 0.1%

-

JPY and CHF are the best performing major currencies while AUD and NZD lag the most

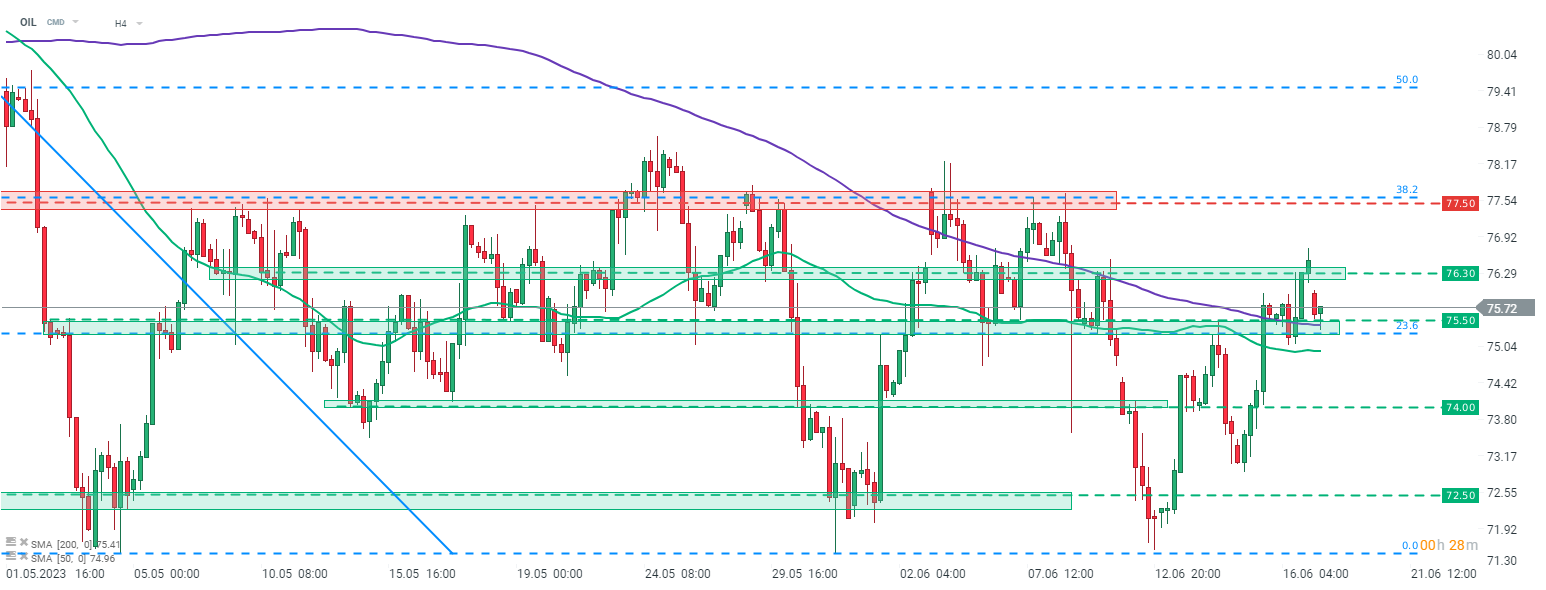

Brent (OIL) launched new week's trading with a bearish price gap as new on rising Iranian exports as well as cuts to Chinese growth forecasts created downward pressure on prices. OIL tested 200-period moving average at H4 interval this morning (purple line) but bulls managed to defend the area. Source: xStation5

Brent (OIL) launched new week's trading with a bearish price gap as new on rising Iranian exports as well as cuts to Chinese growth forecasts created downward pressure on prices. OIL tested 200-period moving average at H4 interval this morning (purple line) but bulls managed to defend the area. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉