-

US indices continued sell-off yesterday. S&P 500 dropped 0.97%, Dow Jones moved 0.96% lower and Nasdaq slumped 1.15%. Russell 2000 dropped 1.60%

-

Moods improved during the Asian session after People's Bank of China cut benchmark interest rates. 1-year loan prime rate was lowered from 3.80 to 3.70% while 5-year rate was lowered from 4.65 to 4.60%

-

Nikkei gained 1.1%, S&P/ASX 200 added 0.1% and Kospi moved 0.8% higher. Indices from China gained as well

-

DAX futures point to a flat opening of the European session today

-

White House said that incursion of Russian troops into Ukraine will be met with rapid and severe response from US and its allies.US President Biden also warned Russia that if it invades Ukraine, Russian banks will face severe sanctions

-

Biden said he is not ready to lift tariffs on China yet

-

China warned United States of consequences if US Navy does not stop provocations in Chinese waters

-

New Zealand Prime Minister Ardern said that Covid restrictions will be tightened if a local transmission of Omicron in the country is detected

-

Japanese exports increased 17.5% YoY in December (exp. 16.0% YoY) while imports were 41.1% YoY higher (exp. 42.8% YoY)

-

Australian employment increased by 64.8k jobs in December (exp. 43.5k) with unemployment rate dropping to 4.2% (exp. 4.5%)

-

API report pointed to a 1.4 mb increase in US oil inventories (exp. -1.5 mb)

-

Brent and WTI futures trade around 1% higher

-

Precious metals trade mixed - gold and palladium drop while silver and platinum gain

-

Cryptocurrencies traded flat during the Asian session. Bitcoin trades near $42,000

-

CAD, AUD and GBP are the best major currencies while NZD and JPY lag the most

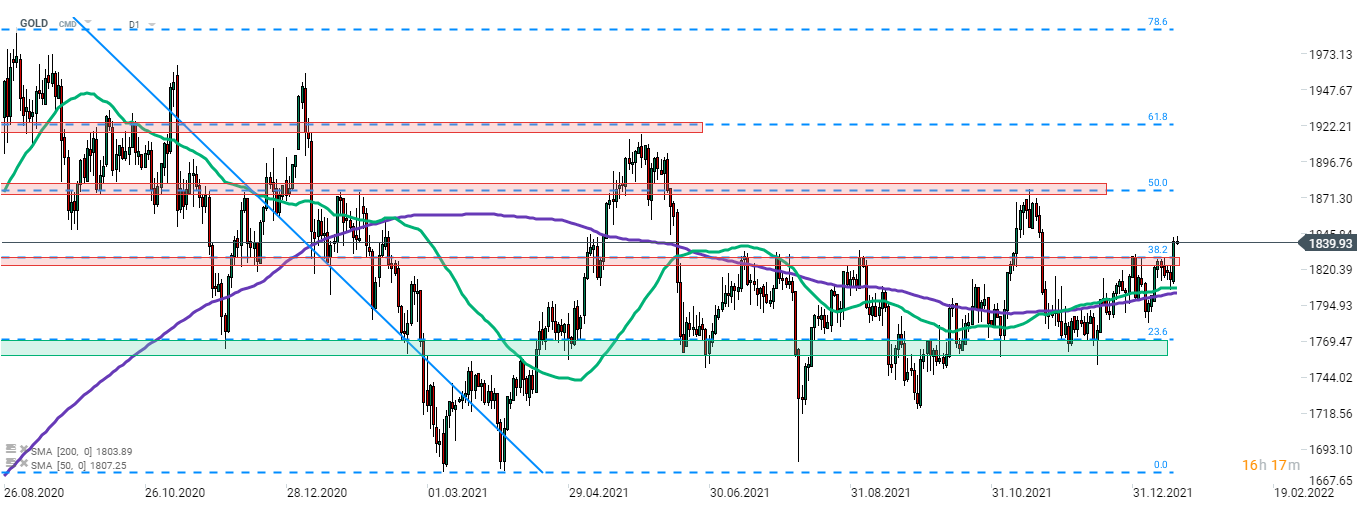

Gold is trading slightly lower today following a massive rally yesterday. Precious metals gained over 1.5% and managed to close above a mid-term resistance zone marked with 38.2% retracement of the downward move launched in August 2020. Next resistance in line can be found at 50% retracement in the $1,875 area. Source: xStation5

Gold is trading slightly lower today following a massive rally yesterday. Precious metals gained over 1.5% and managed to close above a mid-term resistance zone marked with 38.2% retracement of the downward move launched in August 2020. Next resistance in line can be found at 50% retracement in the $1,875 area. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)