-

Indices from Wall Street built onto earlier gains and once again moved higher. S&P 500 gained 0.74%, Nasdaq moved 0.71% higher and Dow Jones added 0.56%

-

Stocks in Asia traded mixed - Nikkei and S&P/ASX 200 posted small gains, Kospi dropped and indices from China struggled to find common direction

-

DAX futures point to a lower opening of the European cash session today

-

Biden said he believes $1.75-1.90 trillion tax and spending deal is within reach

-

People's Bank of China left 1- and 5-year loan prime rates unchanged. Main interest rates in China were left unchanged for the past 18 months already

-

Chinese authorities met with coal producers and agreed to work to bring down prices to a "reasonable range"

-

Morgan Stanley expects Brent at $95 per barrel in Q1 2022. Bank boosted its long-term Brent price forecast to $70 per barrel ($60 previously)

-

Netflix reported Q3 revenue at $7.48 billion (exp. $7.48 billion) and EPS of $3.19 (exp. $2.56). Company reported an addition of 4.4 million subscribers, much better than 3.84 million expected. Stock jumped in the after-hours trading

-

Japanese exports increased 13% YoY in September (exp. 11% YoY) while imports were 38.6% YoY higher (exp. 34.4% YoY). Trade balance stood at -622.8 billion JPY (exp. -591 billion JPY)

-

API report pointed to a 3.3 million barrel build in oil inventories (exp. 1.9 mb)

-

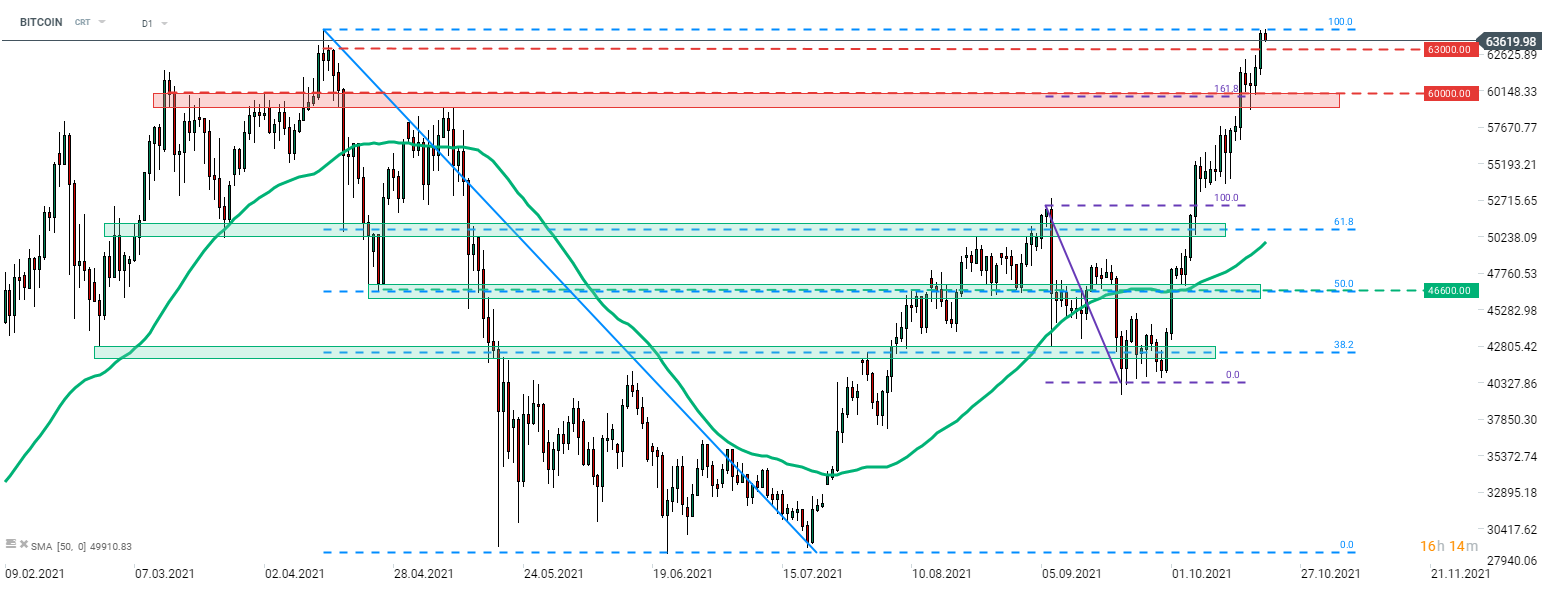

Bitcoin tested all-time highs overnight but has pulled back slightly since

-

Precious metals trade lower with gold being an exception

-

Oil and industrial metals drop

-

CHF and JPY are the worst performing major currencies while AUD and NZD lead gains

Bitcoin tested all-time highs from April during today's Asian session. However, bulls were unable to break above and paint a fresh record, and the coin has pulled back slightly since. Source: xStation5

Bitcoin tested all-time highs from April during today's Asian session. However, bulls were unable to break above and paint a fresh record, and the coin has pulled back slightly since. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf