-

Stocks in Asia traded lower at the beginning of a new week. Nikkei dropped over 2%, Kospi plunged 1.8%, S&P/ASX 200 finished 0.1% lower and indices from China declined

-

US and European equity futures launched new week lower

-

US Senator Manchin changed his position and said that he cannot support Biden's 'Build Back Better' infrastructure deal. This made situation more complex and will cause any talks to drag in 2022

-

Goldman Sachs lowered US real GDP forecasts for 2022 amid struggles with infrastructure deal. GS expects Q1 real GDP growth to reach 2% (3% earlier), Q2 growth to reach 3% (3.5% earlier) and Q3 growth to reach 2.75% (3% earlier)

-

Fed's Waller said late on Friday that goal of accelerating QE taper is to make conditions for a first rate hike as soon as March 2022

-

Netherlands imposed a 3-week lockdown over the Christmas period due to Omicron concerns

-

Australian authorities ruled out new Covid restrictions for now. The German health minister said that a lockdown during Christmas is not an option. Similar comments were made by the UK authorities

-

People's Bank of China lowered 1-year loan prime rate from 3.85 to 3.80% while 5-year rate was left unchanged at 4.65%

-

Oil is trading lower following news of Dutch Christmas lockdown. Industrial metals also drop

-

Gold is trading slightly higher while other precious metals drop

-

EUR and JPY are the best performing major currencies while AUD and NZD lag the most. Turkish lira continues to drop with USDTRY reaching daily high at around 17.60

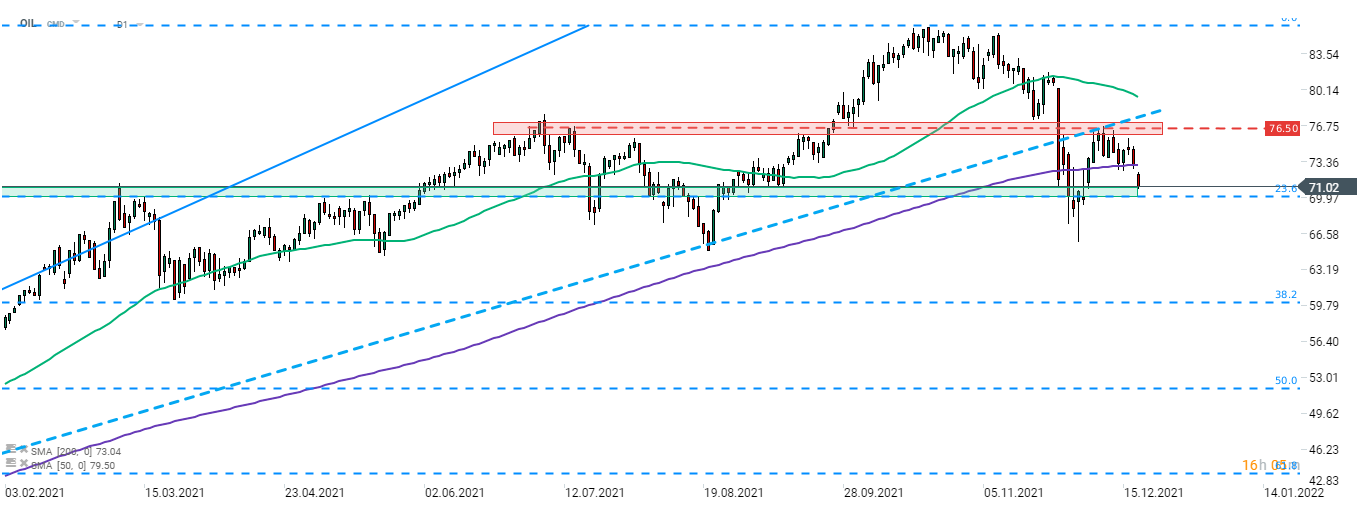

OIL (Brent) launched a new week with a big bearish price gap and dropped to a 2-week low. The Netherlands decide to impose a 3-week lockdown over Christmas and crude price moves lower as traders fear other countries may do the same. Nevertheless, UK and Germany have ruled out similar measures for now. Source: xStation5

OIL (Brent) launched a new week with a big bearish price gap and dropped to a 2-week low. The Netherlands decide to impose a 3-week lockdown over Christmas and crude price moves lower as traders fear other countries may do the same. Nevertheless, UK and Germany have ruled out similar measures for now. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)