-

Wall Street dropped hard during the first session after a long weekend. S&P 500 dropped 2.00%, Dow Jones moved 2.06% lower, Nasdaq plunged 2.50% and Russell 2000 slumped 2.70%

-

While US stocks launched the day in bad moods, declines accelerated after solid US data (services PMI coming back above 50) boosted USD and Treasury yields, with 10-year rate climbing above 3.9%

-

Indices from Asia-Pacific traded lower as well but scale of the drop was smaller. Nikkei dropped 1.3%, S&P/ASX 200 traded 0.3% lower, Kospi slumped 1.7% and Nifty 50 declined 1%. Indices from China traded 0.2-0.8% lower

-

DAX futures point to a flat opening of the European cash session today

-

NZD gained after RBNZ delivered a 50 bp rate hike, putting cash rate at 4.75% - the highest level since late-2008. Majority of economists expected such a move but there were some calls for 25 bp hike or even pause following a recent cyclone hit

-

RBNZ signaled need for more rate hikes and confirmed its peak rate forecast at 5.50%

-

AUD weakened following disappointing data for Q4 2022. Wage index increased by 0.8% QoQ (exp. 1.0% QoQ) while construction work completed dropped by 0.4% QoQ (exp. +1.5% QoQ)

-

Cryptocurrencies trade mostly lower - Bitcoin drops 1.6% while Ethereum and Dogecoin decline 1% each. Litecoin bucks the trend and gains 1%

-

Energy commodities are pulling back amid overall increase in risk aversion - Brent drops 0.3%, WTI trades 0.4% lower and US natural gas prices plunged 2.5%

-

Gold and silver trade little change while platinum and palladium jump around 0.8% each

-

NZD and JPY are the best performing major currencies while AUD, CAD and USD lag the most

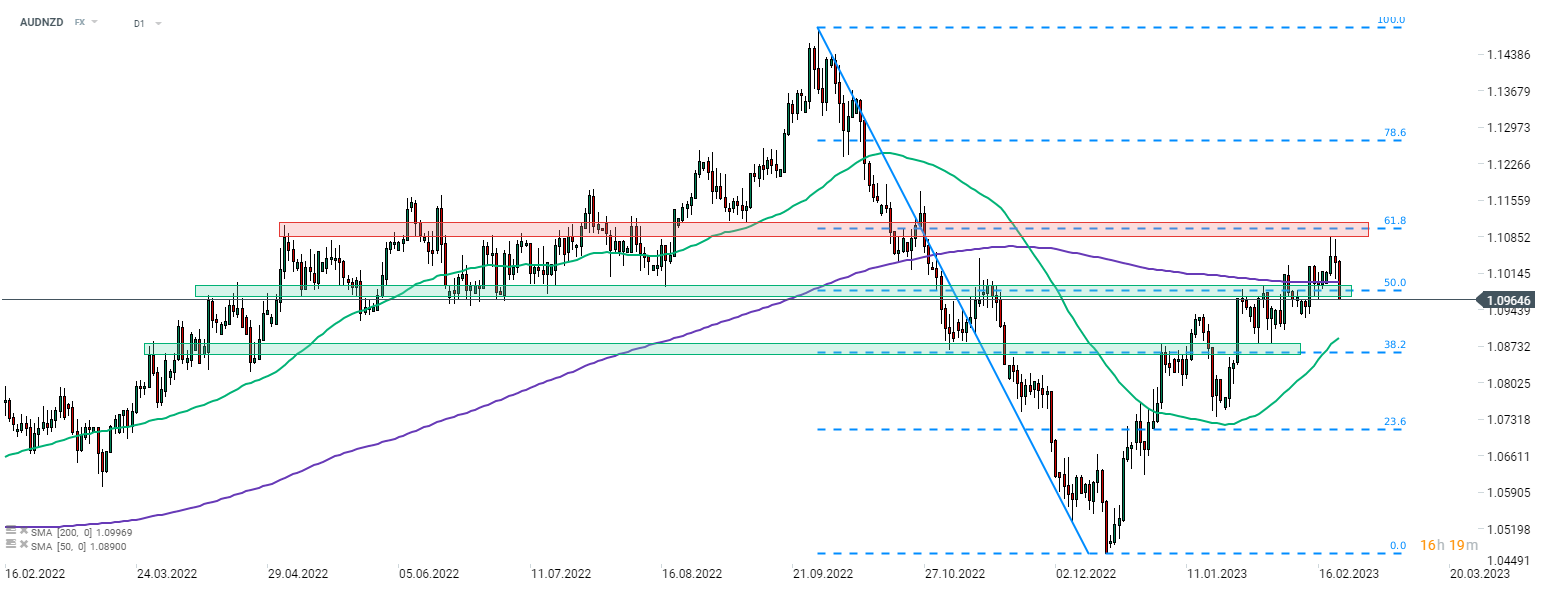

AUDNZD is plunging today amid a mix of NZD-positive and AUD-negative news. The pair pulled back from the resistance zone marked with 61.8% retracement and plunged back below recently-broken 200-session moving average (purple line). AUDNZD is attempting to make a break below the zone marked with 50% retracement, which would pave the way for a test of 1.0870 area, marked with 38.2% retracement. Source: xStation5

AUDNZD is plunging today amid a mix of NZD-positive and AUD-negative news. The pair pulled back from the resistance zone marked with 61.8% retracement and plunged back below recently-broken 200-session moving average (purple line). AUDNZD is attempting to make a break below the zone marked with 50% retracement, which would pave the way for a test of 1.0870 area, marked with 38.2% retracement. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)