-

US indices finished yesterday's trading lower. S&P 500 dropped 1.01%, Dow Jones moved 1.42% lower and Nasdaq finished 1.23% lower. Russell 2000 dropped 1.45%

-

More positive moods could have been spotted during the Asian trading hours. S&P/ASX 200 gained 0.6%, Kospi added 0.5% and indices from China traded 0.3-1.8% higher

-

DAX futures point to a higher flat opening of the European cash session

-

United States and Germany agreed that Nord Stream 2 cannot be launched following recent Russian aggression towards Ukraine

-

Joe Biden said that it is beginning of the Russian invasion on Ukraine

-

United States, United Kingdom and Canada decided to move more troops to the eastern NATO countries, like Poland or Latvia

-

Meeting between US Secretary of State Blinken and Russian Foreign Affairs Minister Lavrov was called off

-

Satellite data showed increase in presence of Russian troops and equipment in Belarus

-

Reserve Bank of New Zealand delivered a 25 basis point rate hike, in-line with expectations. NZD moved higher following the announcement even as some market participants expected a 50 bp hike

-

Cryptocurrencies are trading slightly higher today. Bitcoin trades more or less flat near $38,000

-

Oil trades a touch higher - Brent trades near $93.50 while WTI trades in the $91.70 area

-

Precious metals trade mixed - gold drops, silver trades flat while platinum and palladium gain

-

NZD and AUD are the best performing major currencies while USD and JPY are top laggards

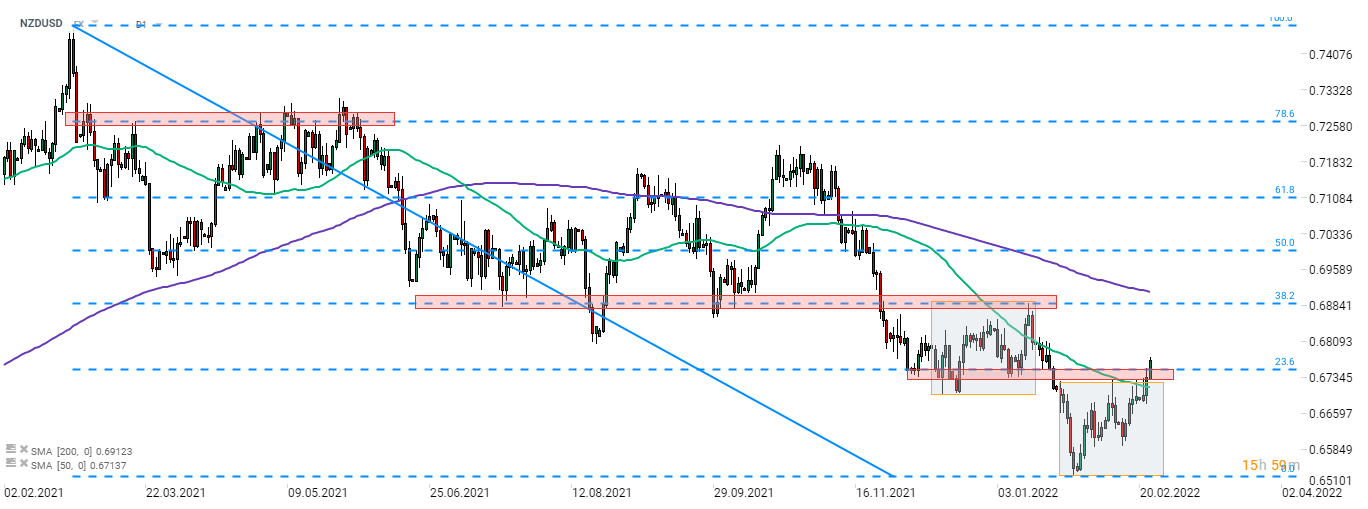

NZDUSD is trading higher following a RBNZ rate hike. The pair has managed to break above the upper limit of a local market geometry and is making a break above the resistance zone ranging below the 23.6% retracement of the downward move started a year ago. Source: xStation5

NZDUSD is trading higher following a RBNZ rate hike. The pair has managed to break above the upper limit of a local market geometry and is making a break above the resistance zone ranging below the 23.6% retracement of the downward move started a year ago. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)