-

US indices finished yesterday's trading mixed - S&P 500 gained 0.37%, Nasdaq rallied 0.95%, Dow Jones finished flat and Russell 2000 declined 0.80%

-

Fed Chair Powell repeated a few times during testimony before US Senate committee that two more rates hike this year seem appropriate and his own forecasts are similar to FOMC forecasts

-

Powell also said that Fed does not see any rate cuts anytime soon

-

Indices from Asia-Pacific traded lower today, reacting to a hawkish actions by central banks in Europe yesterday. Nikkei dropped 1.9%, S&P/ASX 200 declined 1.4%, Kospi traded 0.8% down and Nifty 50 moved 0.3% lower

-

DAX futures point to a lower opening of the European cash session today

-

US Treasury Secretary Yellen said that chance of a recession has eased but it remains a risk as Fed continues to tighten policy

-

Fed Barkin said that the US central bank is still a good way away from a 2% inflation target. However, Barkin refused to prejudge what Fed will do at July meeting

-

Australian manufacturing PMI ticked higher from 48.4 to 48.6 in June while services gauge dropped from 52.1 to 50.7

-

Japanese manufacturing PMI dropped from 50.6 to 49.8 in June (exp. 50.2)

-

Japanese core CPI inflation (excluding food) decelerated from 3.4 to 3.2% YoY in May (exp. 3.1% YoY). Headline measure decelerated from 3.5 to 3.2% YoY

-

However, the so-called core-core Japanese CPI measure, that excludes food & energy and is closely watched by the Bank of Japan, accelerated from 4.1 to 4.3% YoY (exp. 4.4% YoY). This is the highest reading in over 40 years!

-

Deutsche Bank expects Bank of England to deliver three 25 basis point rate hikes at meeting in August, September and November for a peak rate of 5.75%

-

Major cryptocurrencies are trading little changed today - Bitcoin trades flat while Ripple and Ethereum gain around 0.2% each

-

Energy commodities trade mixed. Oil drops around 1% while NATGAS trades around 3% higher following a contract rollover

-

Precious metals are trading slightly higher - gold gains 0.1% while silver and palladium add 0.4%. Platinum drops 0.5%

-

USD and EUR are the best performing major currencies while AUD and NZD lag the most

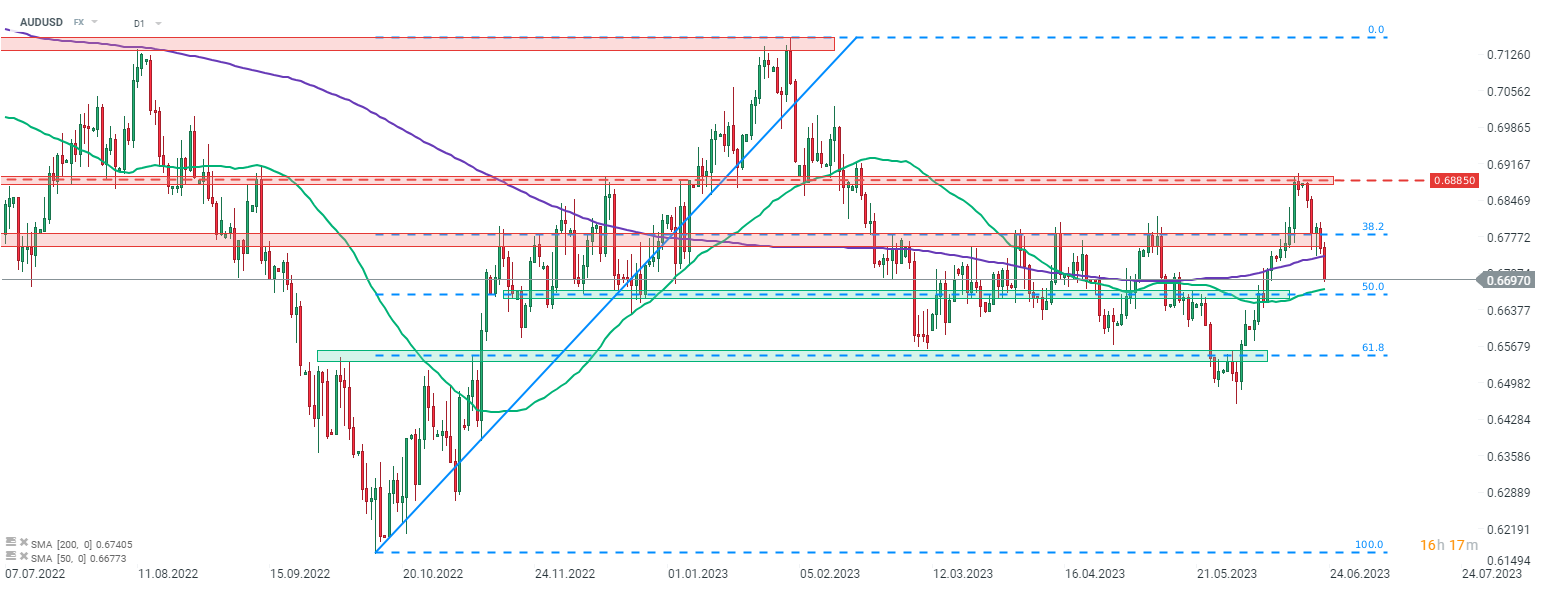

AUDUSD deepens downward move and breaks below the 200-session moving average today. The pair trades at the lowest level since early-June following drop in Australian services PMI. Source: xStation5

AUDUSD deepens downward move and breaks below the 200-session moving average today. The pair trades at the lowest level since early-June following drop in Australian services PMI. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)