-

US indices finished yesterday's trading mixed. S&P 500 dropped 0.11%, Dow Jones moved 0.21% lower while Nasdaq gained 0.13% and closed at record high. Russell 2000 added 0.33%

-

Stocks in Asia traded mixed. Nikkei and S&P/ASX 200 dropped, Kospi gained while indices from China traded without a common direction

-

DAX futures point to a slightly higher opening of the European session

-

US Senator Romney said that Democrats and Republicans reached a framework agreement on the infrastructure bill. Politicians from both parties will head to White House today to meet with President Biden

-

Fed's Rosengren said that market is not behaving and pricing assets as if it expects inflation at or above 3%

-

Chinese media reported that TSMC, major semiconductor manufacturer, plans to rise prices by 10-20% next year

-

Chinese banking official said that PPI may reach 10% MoM and pressure consumption

-

Negotiators from the US are preparing to resume Iran nuclear talks

-

Bitcoin trades near $32,500

-

Precious and industrial metals trade lower. Oil trades slightly higher. Agricultural commodities drop

-

NZD and JPY are the best performing major currencies while CHF and EUR lag the most

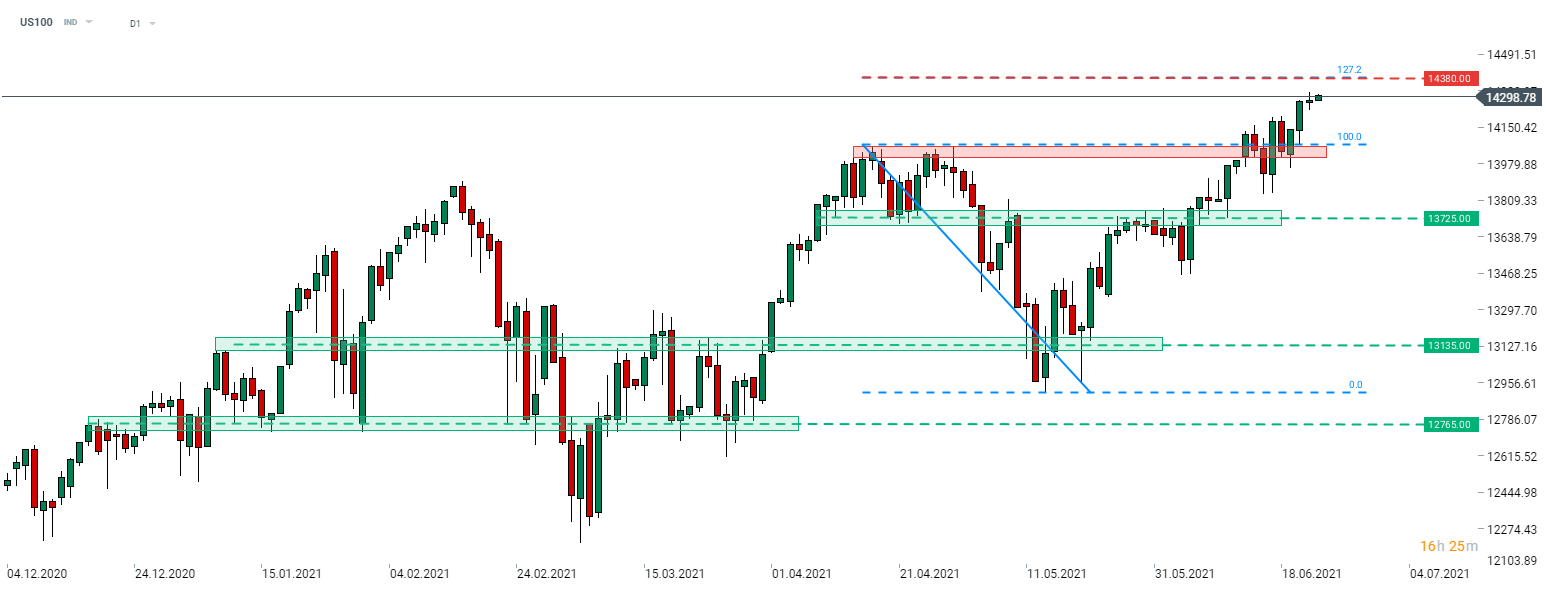

US100 finished yesterday's trading at a record level but off the daily highs. Index is trading higher today and is testing 14,300 pts area. Source: xStation5

US100 finished yesterday's trading at a record level but off the daily highs. Index is trading higher today and is testing 14,300 pts area. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

📈Wall Street rebounds, VIX slips 5% 🗽What does US earnings season show us?