-

Wall Street indices launched yesterday's trading lower and were set for another day of heavy losses. However, indices staged a massive reversal and managed to finish the day higher

-

S&P 500 gained 0.28% (low: -4.01%), Dow Jones added 0.29% (low: -3.25%) and Nasdaq moved 0.63% higher (low: -4.9%)

-

Stocks in Asia failed to benefit from improvement in moods on Wall Street. Nikkei dropped 1.7%, S&P/ASX 200 and Kospi moved 2.5% lower each while indices from China traded 1.3-2.1% lower

-

DAX futures point to a higher opening of today's European cash session

-

US Department of Defense said that 8.5 thousand US soldiers are ready to move to Eastern Europe and aid NATO

-

Virtual meeting between the leaders of the UK, US, Germany, France, Poland and EU was held yesterday. Leaders agreed that Russian incursion into Ukraine must be met with swift response

-

US Secretary of State Blinken said that he prefers to return to Iran nuclear deal but talks with Iran cannot drag for too long

-

Japan will pay subsidies to gasoline wholesalers in order to halt price increases

-

BoJ Governor Kuroda said that increase in commodity prices is a bigger factor in CPI acceleration than weak JPY

-

Bitcoin reached a low slightly below $33,000 yesterday. However, cryptocurrency started to regain ground along with US equities and is now trading slightly below $36,000

-

Precious metals trade mixed - gold trades flat, silver drops while platinum and palladium gain

-

Oil trades higher on the day with Brent recovering back above $86.00 per barrel

-

CAD and JPY are the best performing major currencies while NZD and CHF lag the most

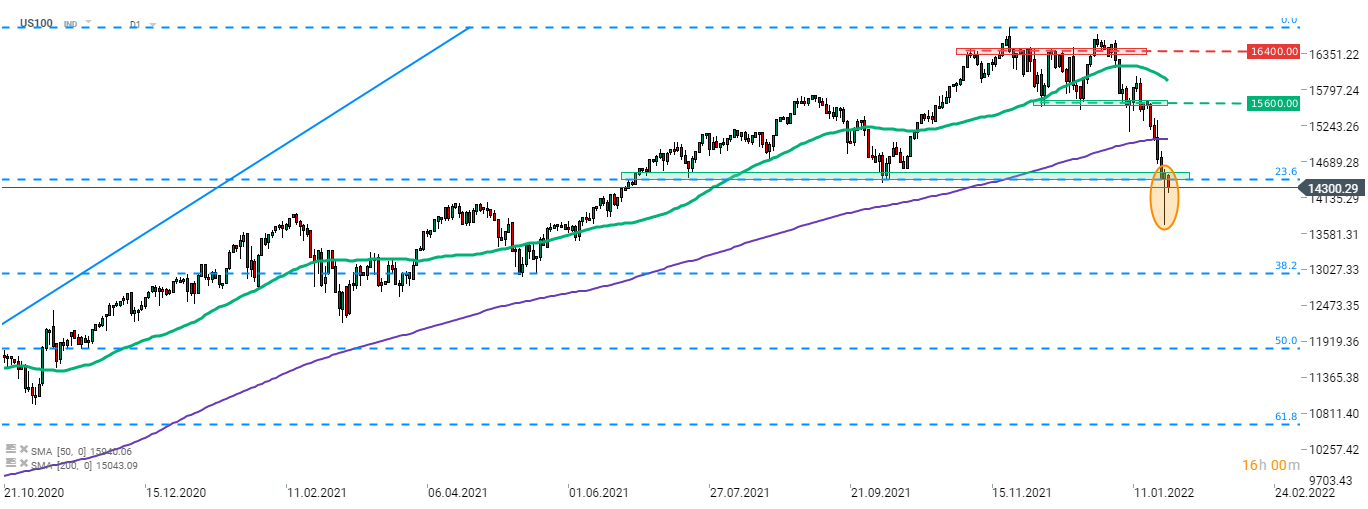

US indices staged a massive reversal yesterday with Nasdaq-100 (US100) recovering over 5% off the daily lows. A bullish candlestick pattern with long, lower wick was painted at 14,400-14,500 pts price zone. Nevertheless, some weakness can be spotted today. Source: xStation5

US indices staged a massive reversal yesterday with Nasdaq-100 (US100) recovering over 5% off the daily lows. A bullish candlestick pattern with long, lower wick was painted at 14,400-14,500 pts price zone. Nevertheless, some weakness can be spotted today. Source: xStation5

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉